- United States

- /

- Banks

- /

- NYSE:JPM

Does JPMorgan’s AI Payoff Signal More Upside Ahead for the Stock in 2025?

Reviewed by Bailey Pemberton

If you are holding JPMorgan Chase or considering jumping in, you are not alone. The stock has had a wild ride worth watching. Over the past year, JPMorgan has climbed an impressive 35.8% and posted a stellar 24.4% return year-to-date. In fact, if you zoom out even more, the last five years have seen the stock soar over 230%. These are the kind of numbers that make you double-check if you are missing something. Does the rocket still have fuel, or is turbulence ahead?

Recent headlines have added plenty of color to the story. JPMorgan's push into artificial intelligence is already paying for itself, with CEO Jamie Dimon claiming $2B in direct benefits that match the company's massive investment. It is not just tech moves either. JPMorgan is right at the center of the dealmaking world, whether it is helping lead potential blockbuster IPOs or being swept up in broader banking sector shifts. This kind of visibility, paired with its historical outperformance, keeps the stock on the radar for anyone following financial markets closely.

Yet, with big growth often comes questions about value. While JPMorgan is sometimes painted as a stock that always delivers, our valuation checklists suggest it is undervalued in just 2 out of 6 common metrics, giving it a value score of 2. That is not a home run, but it opens the door for a deeper look. Next up, let’s break down how JPMorgan stacks up under different valuation lenses and why one approach might outshine the rest in helping you decide what to do next.

JPMorgan Chase scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: JPMorgan Chase Excess Returns Analysis

The Excess Returns model measures how much profit JPMorgan Chase generates above the minimum return required by investors. Essentially, it evaluates the company’s ability to create value from its shareholders’ equity over time. A high excess return points to consistent value creation, an important trait for a bank of JPMorgan’s scale.

Key figures from the latest analysis include a Book Value of $124.96 per share and a projected Stable EPS of $21.97 per share, based on future Return on Equity estimates from 13 analysts. The Cost of Equity stands at $11.01 per share, which means JPMorgan is expected to generate an Excess Return of $10.95 per share each year after accounting for the required investor return. The company’s average Return on Equity is an impressive 16.38%, with analysts projecting a Stable Book Value moving toward $134.07 per share in the future.

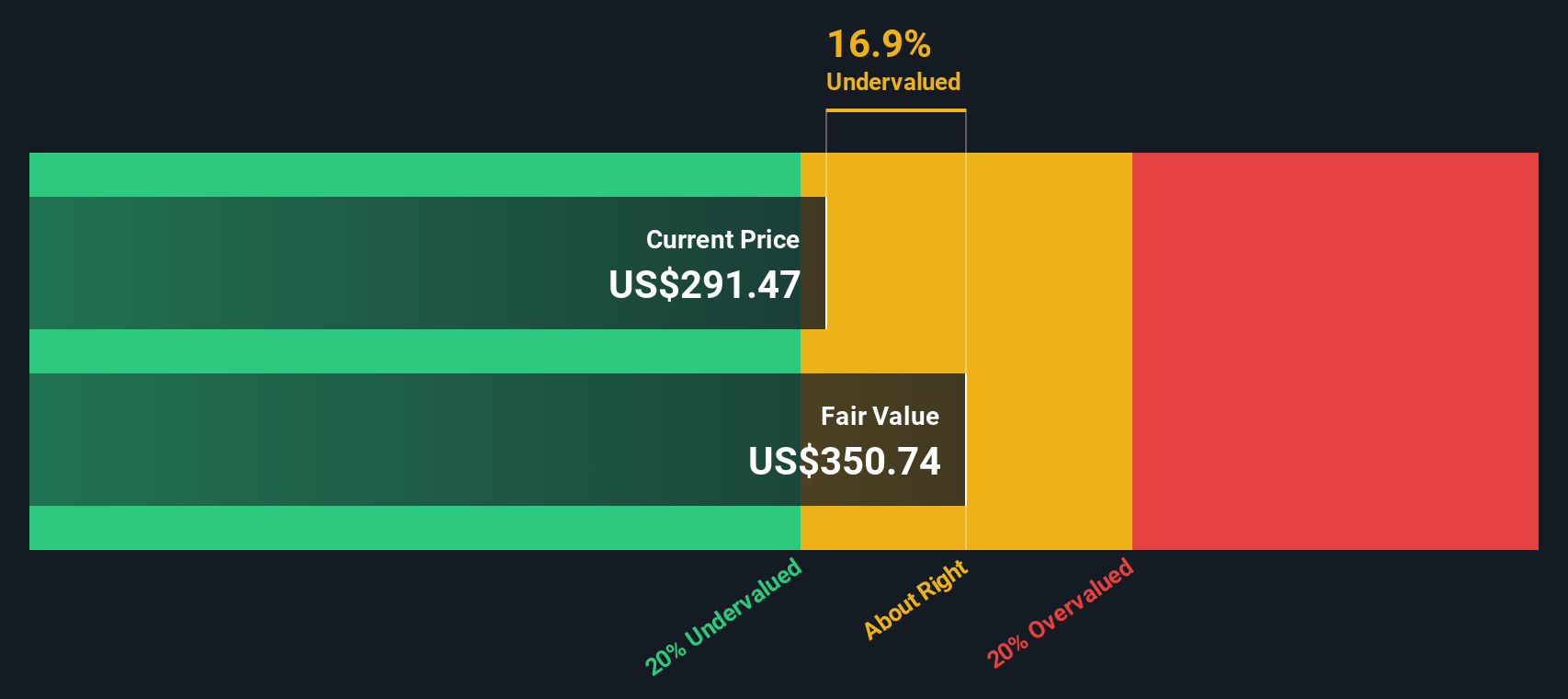

Based on this model, the implied intrinsic value for JPMorgan is $347.41 per share, which represents a 14.1% discount compared to the current share price. This indicates the stock may be meaningfully undervalued using this method.

Result: UNDERVALUED

Our Excess Returns analysis suggests JPMorgan Chase is undervalued by 14.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: JPMorgan Chase Price vs Earnings

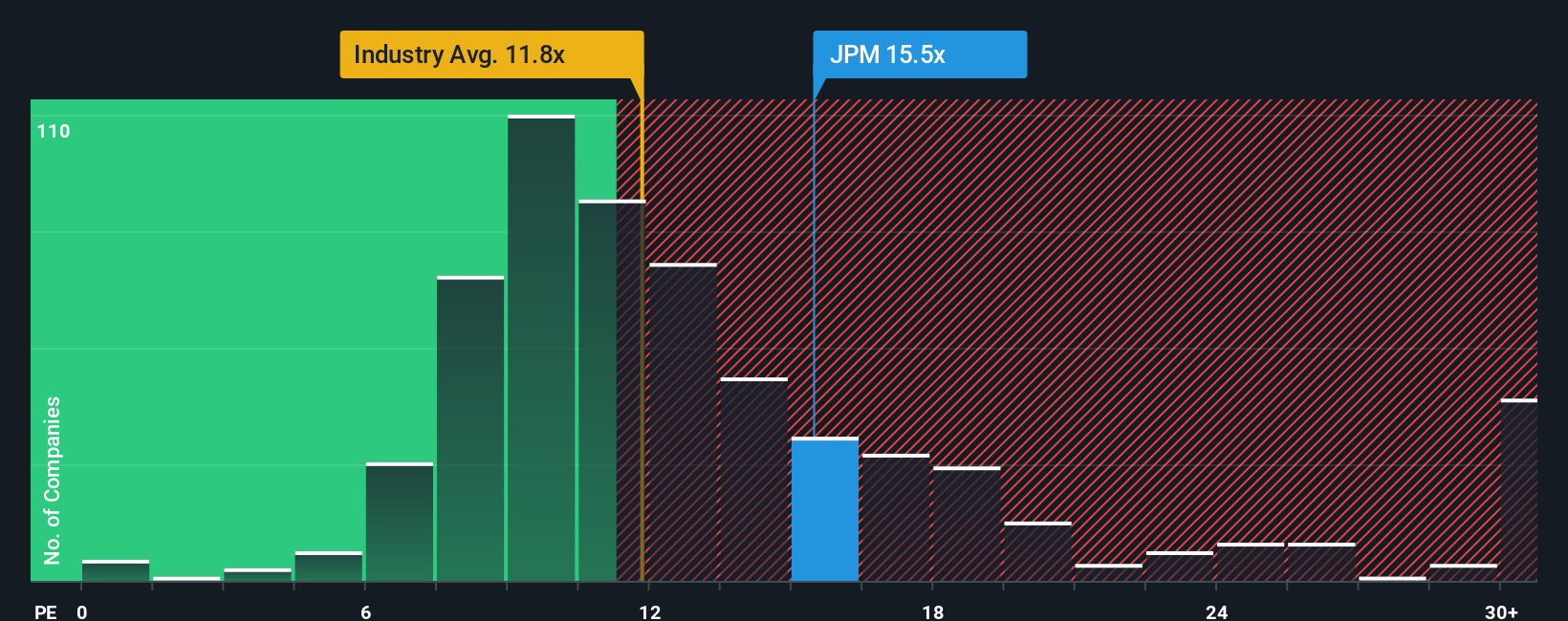

For consistently profitable companies like JPMorgan Chase, the Price-to-Earnings (PE) ratio is one of the most widely used and reliable valuation tools. It helps investors understand how much they are paying for each dollar of current earnings. Growth expectations and business risks can have a big impact on what’s considered a typical or “fair” PE ratio. Faster growing or more stable firms generally deserve a higher PE, while slower-growing or riskier companies trade at lower multiples.

JPMorgan’s current PE ratio sits at 14.3x. That is comfortably above the bank industry average of 11.2x and also higher than the average for its listed peers at 12.5x. This may suggest a market premium for JPMorgan's size, profitability and reputation, but it can also raise the question of whether investors are overpaying.

This is where Simply Wall St's “Fair Ratio” comes in. This proprietary valuation factors in more than just the average, adjusting for JPMorgan’s future earnings growth, industry differences, profit margins, market cap and specific risks. For JPMorgan, the Fair Ratio is calculated at 15.4x. Because this is quite close to the current multiple, the analysis suggests investors are valuing JPMorgan almost perfectly in line with its true prospects, which is something few stocks achieve.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your JPMorgan Chase Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story or perspective about a company’s future. It reflects what you believe about its growth, risks, margins, and where its fair value should be, connecting your view of the business with real financial forecasts and a target price.

Unlike traditional valuation models that focus only on the numbers, Narratives let you make investment decisions by linking JPMorgan Chase’s actual business drivers to your projections and then allow you to see how your view compares to other investors. Narratives are easy to build and share on the Simply Wall St Community page, trusted by millions of investors, with tools that help you compare your Fair Value against the current Price and update automatically whenever important news or results are announced.

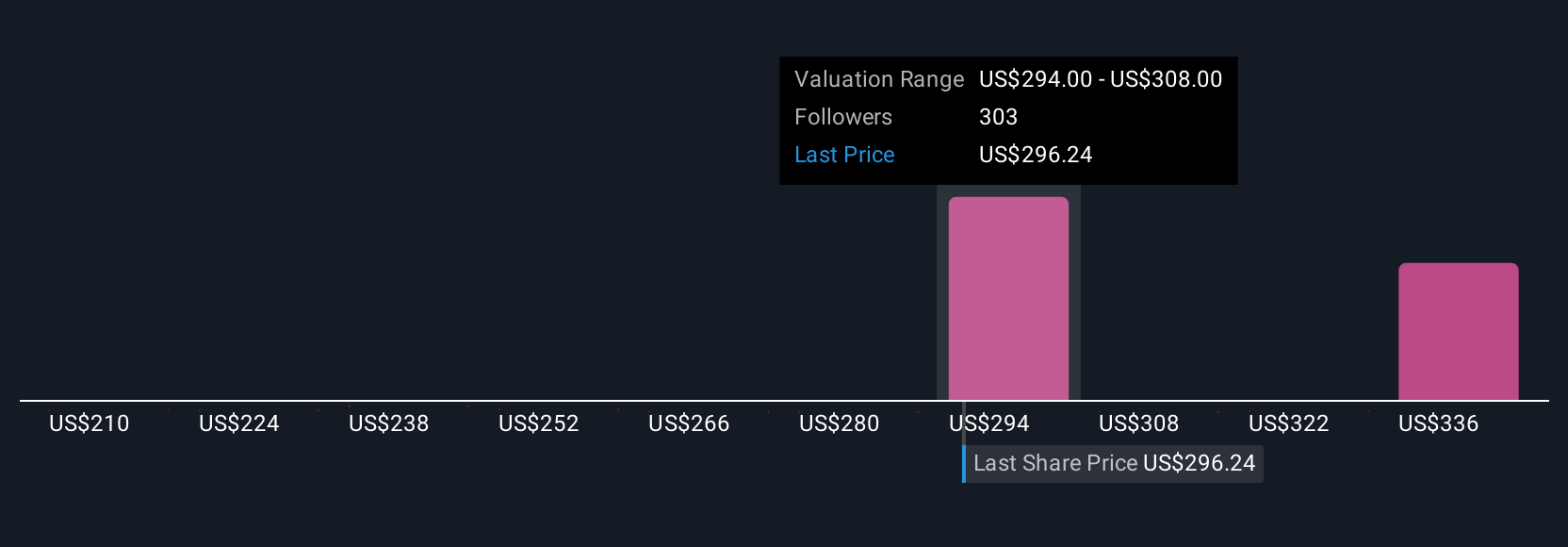

For example, with JPMorgan Chase, one Narrative might see digital banking and tokenization unlocking future value, resulting in a Fair Value of $350 per share. Another may focus on regulatory risks and credit losses, arriving at a more cautious Fair Value of $247. Whatever your view, Narratives let you invest with clarity and keep your thinking up to date as new information emerges.

For JPMorgan Chase, we will make it really easy for you with previews of two leading JPMorgan Chase Narratives:

Fair Value: $320.96

Undervalued by: 7% (calculated as (($320.96 - $298.54) / $320.96))

Expected Revenue Growth Rate: 4.8%

- Growth in digital banking, payments, and wealth management is set to drive higher revenue, improved margins, and strong customer acquisition for JPMorgan.

- Investments in financial technology and tokenization position the company for resilience and market share gains even as business cycles evolve.

- Risks include intensifying fintech competition and regulatory changes, but a diversified business model and confident management support a platform for sustained long-term earnings growth.

Fair Value: $247.02

Overvalued by: 21% (calculated as (($298.54 - $247.02) / $247.02))

Expected Revenue Growth Rate: 4.1%

- Rising credit loss allowances and a 4% increase in expenses point to potential margin compression and challenges for future profitability.

- Expected rate cuts and a cautious investment banking outlook could weigh on net interest income and advisory revenue, making strong growth harder to sustain.

- Recent revenue momentum may not be enough to offset concerns over costs, reserve builds, and industry pressures, suggesting downside risk to today's valuation.

Do you think there's more to the story for JPMorgan Chase? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives