- United States

- /

- Banks

- /

- NYSE:JPM

Assessing JPMorgan Chase (JPM) Valuation After Recent Steady Share Price Performance

Reviewed by Kshitija Bhandaru

See our latest analysis for JPMorgan Chase.

While JPMorgan Chase’s 1-year total shareholder return has climbed nearly 49%, it is the steady upward momentum reflected in a 29% year-to-date share price return that has investors’ confidence building. After a solid stretch, the stock’s combination of resilience and growth points to strong fundamentals and an improving market outlook for the banking sector.

If banking’s recent momentum has you exploring broader opportunities, now is a good time to broaden your search and discover fast growing stocks with high insider ownership

With shares pushing toward analyst targets and fundamentals strong, investors face a key question: Is JPMorgan Chase still undervalued, or is the market already factoring in future growth and potential upside?

Most Popular Narrative: 10% Undervalued

The latest narrative points to a fair value well above the most recent closing price, suggesting the market has yet to fully price in JPMorgan Chase's future growth prospects.

Ongoing investment and active participation in tokenization, stablecoins, and payment innovations (as detailed in the deposit token discussion) positions JPMorgan to benefit competitively from the next wave of technology adoption in banking and payments. This is likely to support both future revenue resilience and margin improvement.

Want to know what is fueling this optimism? Find out the eye-opening driver underpinning JPMorgan's premium. Hint: it’s a blend of future margins and earnings projections that you don't expect from a big US bank. Dive in to discover how ambitious forecasts are shaping this surprising valuation.

Result: Fair Value of $310.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory changes or an upswing in digital competition could quickly challenge JPMorgan's current momentum and put pressure on future earnings growth.

Find out about the key risks to this JPMorgan Chase narrative.

Another View: Looking at Valuation Multiples

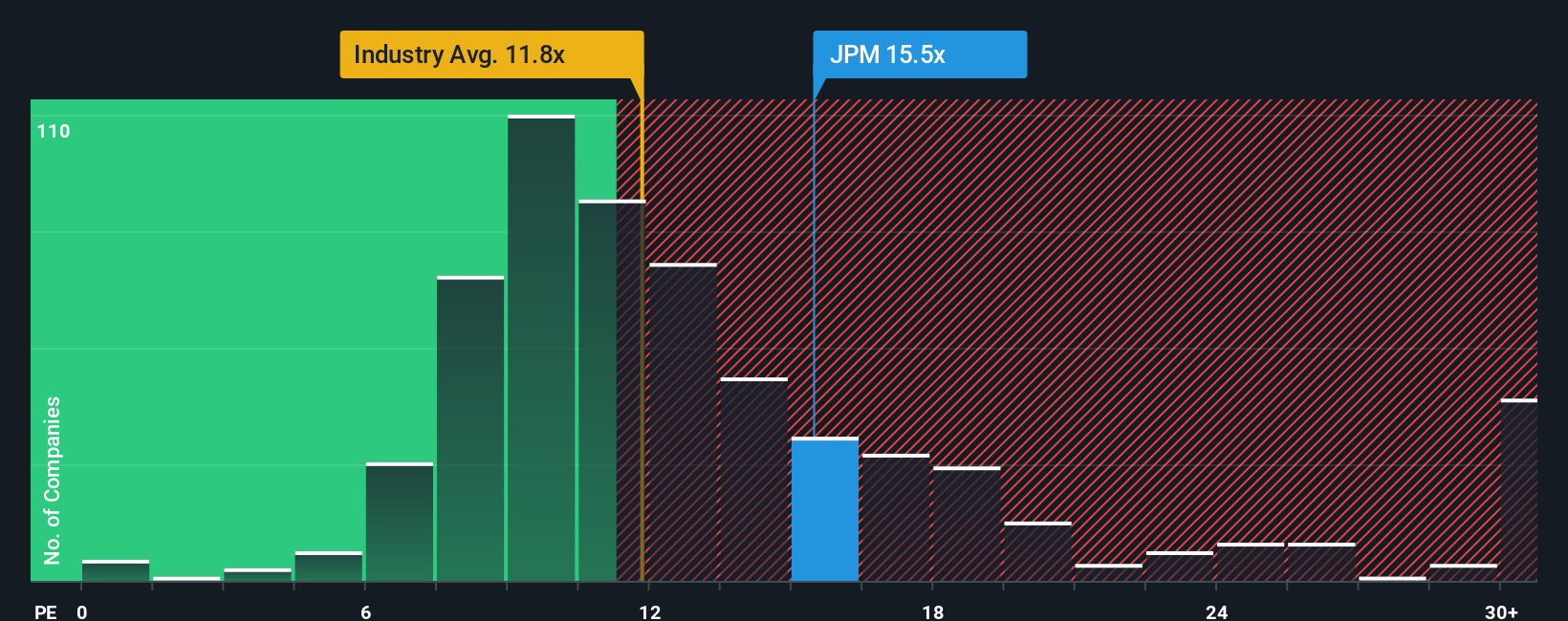

Taking a different approach, let's compare JPMorgan Chase's price-to-earnings ratio of 15.5x to the industry average of 11.8x and a fair ratio estimate of 15.4x. This higher ratio suggests the market is pricing in premium expectations. But does that leave enough upside for cautious investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own JPMorgan Chase Narrative

If you have your own perspective or want to dig deeper into the numbers, it only takes a few minutes to craft your own view. Do it your way

A great starting point for your JPMorgan Chase research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Level up your strategy by targeting opportunities that only the savviest investors spot. Put yourself ahead of the crowd with just a few clicks below.

- Capitalize on surging market trends and uncover hidden gems with these 901 undervalued stocks based on cash flows that stand out based on real cash flow analysis.

- Boost your potential for reliable income by focusing on these 19 dividend stocks with yields > 3% offering attractive yields above 3%.

- Seize growth from emerging technologies and pinpoint tomorrow’s leaders among these 24 AI penny stocks who are pushing boundaries in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives