- United States

- /

- Banks

- /

- NYSE:HOMB

Is Now The Time To Put Home Bancshares (Conway AR) (NYSE:HOMB) On Your Watchlist?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like Home Bancshares (Conway AR) (NYSE:HOMB). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Home Bancshares (Conway AR)

How Fast Is Home Bancshares (Conway AR) Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That makes EPS growth an attractive quality for any company. We can see that in the last three years Home Bancshares (Conway AR) grew its EPS by 11% per year. That's a pretty good rate, if the company can sustain it.

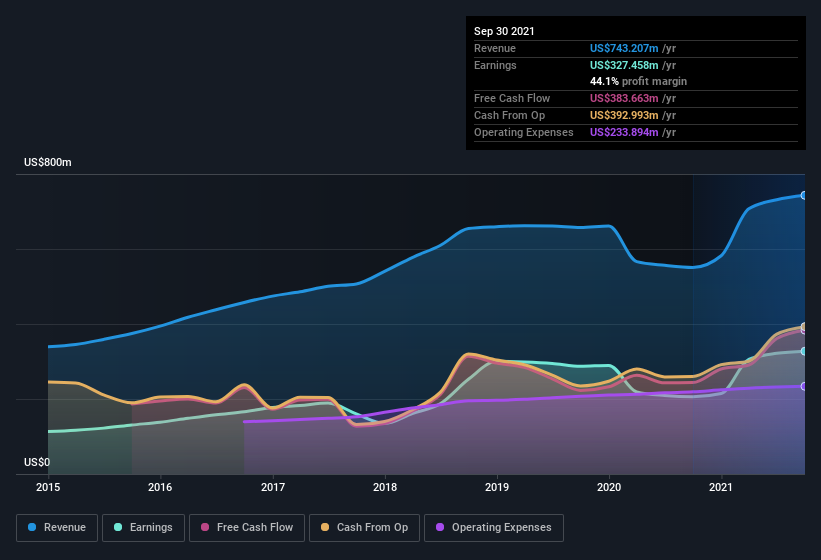

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Not all of Home Bancshares (Conway AR)'s revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. While we note Home Bancshares (Conway AR)'s EBIT margins were flat over the last year, revenue grew by a solid 35% to US$743m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for Home Bancshares (Conway AR)?

Are Home Bancshares (Conway AR) Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

While Home Bancshares (Conway AR) insiders did net -US$350k selling stock over the last year, they invested US$646k, a much higher figure. You could argue that level of buying implies genuine confidence in the business. It is also worth noting that it was Co-Founder John Allison who made the biggest single purchase, worth US$240k, paying US$23.98 per share.

The good news, alongside the insider buying, for Home Bancshares (Conway AR) bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they have a glittering mountain of wealth invested in it, currently valued at US$316m. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Johnny Allison, is paid less than the median for similar sized companies. For companies with market capitalizations between US$2.0b and US$6.4b, like Home Bancshares (Conway AR), the median CEO pay is around US$5.2m.

The Home Bancshares (Conway AR) CEO received US$4.6m in compensation for the year ending . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Home Bancshares (Conway AR) Deserve A Spot On Your Watchlist?

One important encouraging feature of Home Bancshares (Conway AR) is that it is growing profits. On top of that, we've seen insiders buying shares even though they already own plenty. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. Of course, just because Home Bancshares (Conway AR) is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Home Bancshares (Conway AR), you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Home Bancshares (Conway AR), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Home Bancshares (Conway AR) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:HOMB

Home Bancshares (Conway AR)

Operates as the bank holding company for Centennial Bank that provides commercial and retail banking, and related financial services to businesses, real estate developers and investors, individuals, and municipalities in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives