- United States

- /

- Banks

- /

- NYSE:HOMB

Home Bancshares (HOMB) Net Profit Margin Surges, Reinforcing Bullish Narratives on Profitability

Reviewed by Simply Wall St

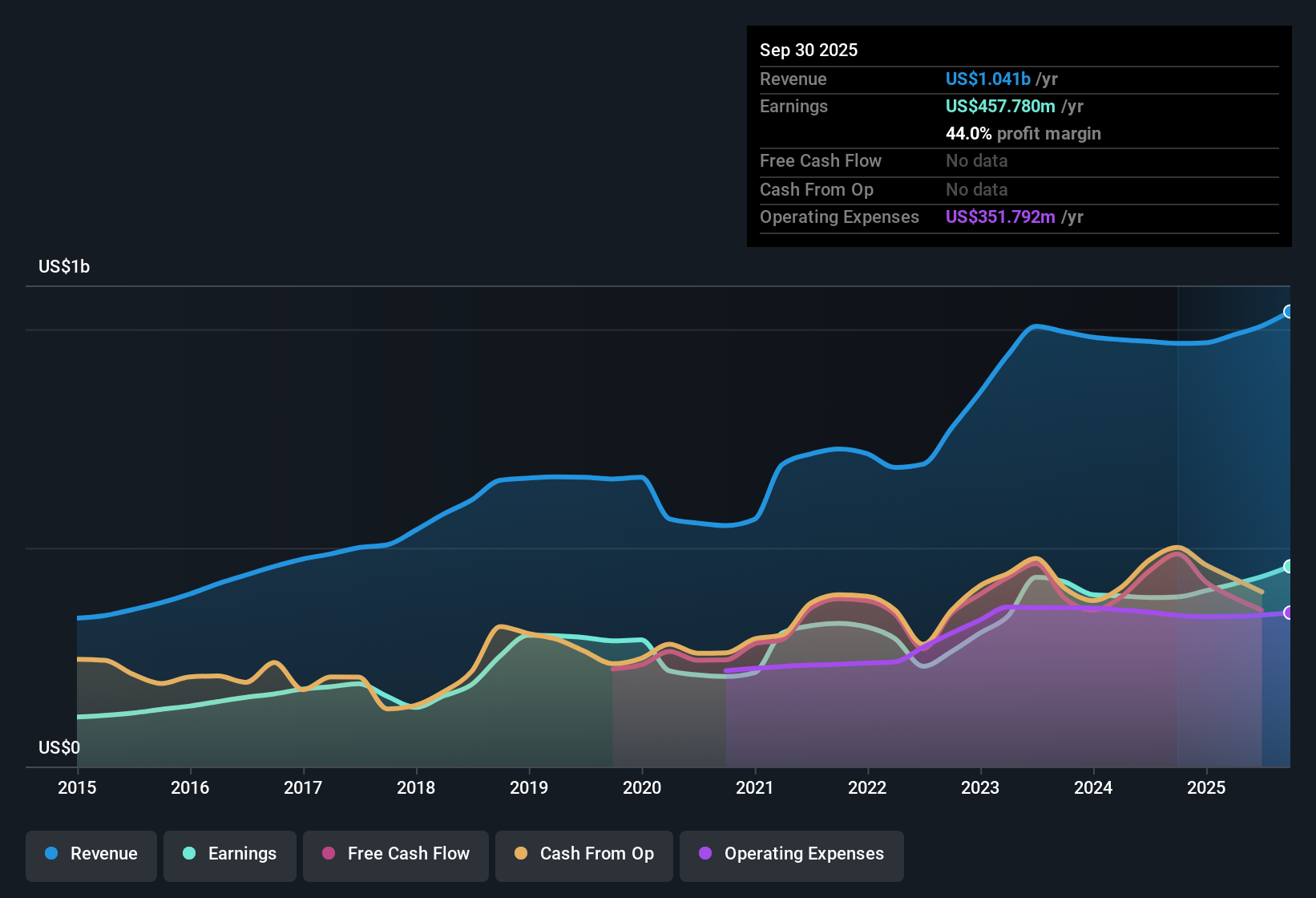

Home Bancshares (HOMB) delivered earnings growth of 12.4% over the past year, ahead of its five-year average annual growth rate of 12%. Net profit margin jumped to 43.1% from last year’s 39.7%, reflecting strong profitability trends. Shares trade at 12 times earnings, which is below the peer average but above the broader banks industry. Analysts see fair value at $48.07 per share, which is well above current levels. With continued profit growth, attractive margins, and a favorable valuation, investors are likely to take a constructive view of these results.

See our full analysis for Home Bancshares (Conway AR).The next step is to put these results head-to-head with the key narratives driving sentiment in the market. Let’s see which stories hold up and which ones face new questions after this quarter’s release.

See what the community is saying about Home Bancshares (Conway AR)

Margin Expansion Outpaces Industry Norms

- Net profit margin rose to 43.1%, up from 39.7% last year. Analysts now expect profit margins to grow further to 44.2% within three years. This level of sustained profitability sets Home Bancshares apart from many regional peers.

- According to the analysts' consensus view, this above-average margin performance is being driven by a focus on specialized lending and higher-return segments.

- Income diversity is increasing due to investments in areas like marine finance and wealth management, helping smooth out earnings even if core lending faces headwinds.

- Operational efficiency improvements from digital initiatives and disciplined acquisitions are supporting stable margins compared to banks that are still reliant on branch-heavy models.

Acquisition Track Record Versus Concentrated Loan Risks

- Consistent growth comes partly from management’s ongoing push for strategic bank acquisitions, which remain a central part of the company’s approach to expanding its asset and deposit base.

- Analysts' consensus narrative notes that reliance on acquisition-led expansion and concentrated loan growth in certain segments (such as multifamily construction and marine lending) introduces integration risks and exposes earnings to downturns in those specific markets.

- If future deals become scarce or costly, or if integration challenges arise, the company may struggle to match its historical rate of margin and earnings growth.

- Heavy loan exposure in high-growth Sun Belt markets can rapidly boost top-line results, but may amplify losses if those sectors or regions face unexpected shocks.

Discounted Valuation and Analyst Gap Remain

- Home Bancshares trades at a price-to-earnings ratio of 12x, undercutting the peer group average of 13.8x. The current share price of $26.52 is 13.3% below the analyst price target of $33.38, leaving a notable valuation gap for investors watching the stock.

- Analysts' consensus view points out that even with below-market revenue and earnings growth forecasts, the stock’s combination of solid margins, proven M&A capability, and a forward dividend provides a level of value not widely available across the sector.

- Persistent analyst disagreement over future fair value and growth assumptions, including a DCF fair value of $48.07, means investors have room to run their own numbers and stress-test the consensus.

- Compared to the broader US banks industry, Home Bancshares’ premium to sector multiples appears justified by its quality fundamentals and expansion track record. However, upward rerating would require continued execution on both growth and risk management.

If you want to dive deeper into how analysts are weighing these drivers and risks in their forecasts, you can see the full consensus narrative for this stock. 📊 Read the full Home Bancshares (Conway AR) Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Home Bancshares (Conway AR) on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the latest results? Put your own view together in just minutes and shape the story your way. Do it your way

A great starting point for your Home Bancshares (Conway AR) research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Home Bancshares’ reliance on acquisition-driven growth and concentrated loan exposure in select markets leaves it vulnerable to integration challenges and regional downturns.

If you want to steer clear of those uncertainties, use our stable growth stocks screener (2097 results) to uncover companies that consistently deliver steady revenue and earnings through all market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Home Bancshares (Conway AR) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HOMB

Home Bancshares (Conway AR)

Operates as the bank holding company for Centennial Bank that provides commercial and retail banking, and related financial services to businesses, real estate developers and investors, individuals, and municipalities in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives