- United States

- /

- Banks

- /

- NYSE:HOMB

Assessing Home Bancshares (HOMB) Valuation After Record Q3 Earnings Beat and Strong Outlook

Reviewed by Kshitija Bhandaru

Home Bancshares (Conway AR) just delivered its third-quarter results, catching many investors' attention. The company reported higher sales and profits than Wall Street expected, including record net income and strong performance on key financial measures.

See our latest analysis for Home Bancshares (Conway AR).

Home Bancshares’ latest earnings news helped fuel a quick rebound in its share price, which climbed 2.38% on the day results were released. Still, shares remain down 6.8% over the past month amid a broader sector pullback and ongoing industry concerns. Looking at the bigger picture, a 4.4% total shareholder return over the past year highlights the stock’s steady performance, while a 76.6% total return over five years shows consistent long-term value for investors, even as near-term momentum has wavered.

If you’re weighing your next move, it could be the right time to expand your search and discover fast growing stocks with high insider ownership.

After an impressive earnings beat and a long-term track record of outperformance, the real question now is whether Home Bancshares is trading below its true value, or if markets are already accounting for all future growth potential.

Most Popular Narrative: 19.5% Undervalued

With a fair value set at $33.71 versus the last close of $27.15, the most popular narrative sees Home Bancshares as having room to run. The gap points toward bold growth assumptions and hints at catalysts backing the bullish case.

The company's strong presence and loan growth in high-growth markets such as Texas, Florida, and Arkansas positions it to capture outsized revenue and deposit growth as economic and population expansion in these Sun Belt states continues, supporting sustained top-line growth. Management is actively seeking bank acquisition targets in its core footprint, leveraging its historical track record of disciplined, accretive M&A to drive asset growth and EPS expansion. Any successful deals would be directly additive to earnings and tangible book value.

Curious what’s fueling that sizable valuation gap? The narrative relies on more than simple growth trends; it’s anchored to future expansion, earnings upgrades, and a surprisingly optimistic margin outlook. Want to see which projections are doing the heavy lifting behind the target price? Dive in to get the numbers and assumptions the narrative is betting on.

Result: Fair Value of $33.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on acquisitions and concentrated loan growth in select markets could present real challenges to sustaining the company’s growth trajectory.

Find out about the key risks to this Home Bancshares (Conway AR) narrative.

Another View: Earnings Ratio Sends a Different Signal

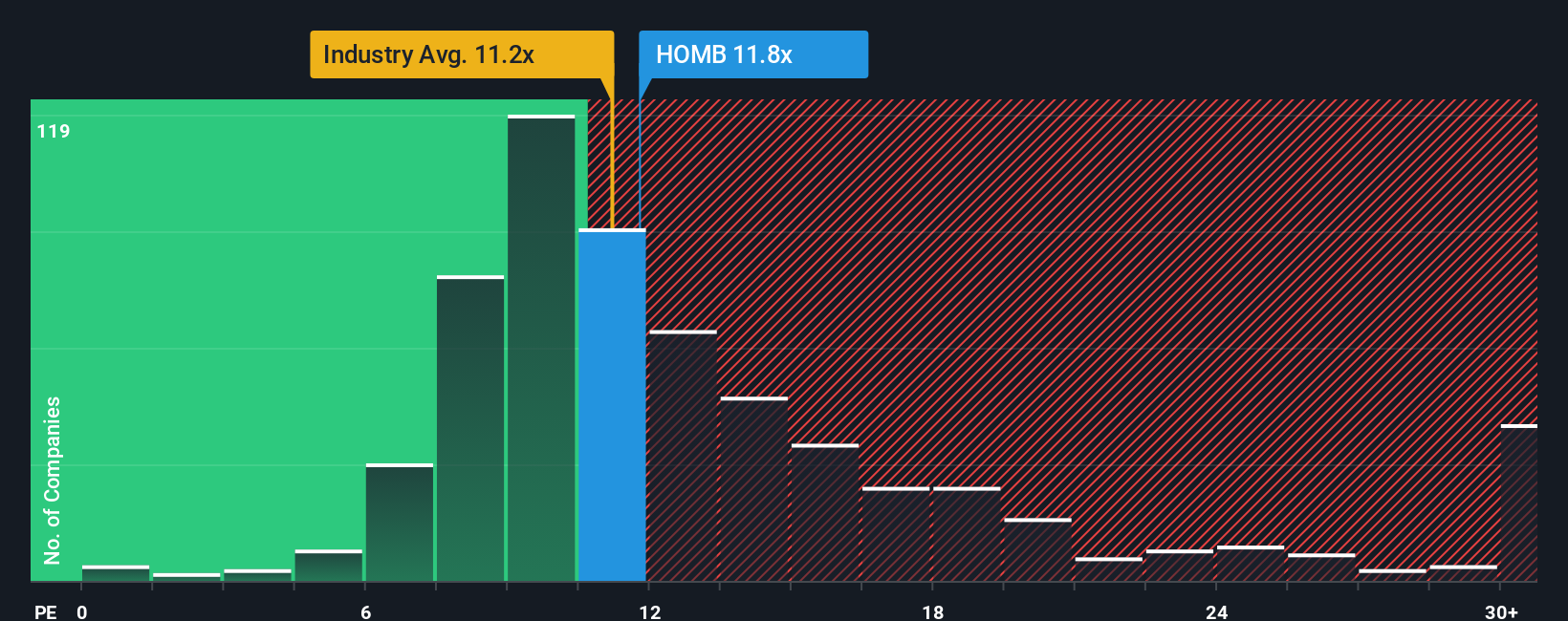

Looking at valuation through the price-to-earnings ratio, a different picture emerges. Home Bancshares trades at 11.7 times earnings, which is about in line with its fair ratio, just above the U.S. banks industry at 11.2, and below its peer group at 13.9. This suggests the stock is attractively valued versus similar banks, but less of an outright bargain according to this measure. Does this signal limited upside, or is the market underappreciating future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Home Bancshares (Conway AR) Narrative

Want to dig into the numbers for yourself or challenge the consensus? You can analyze the data independently and shape your own view in just a few minutes. Do it your way.

A great starting point for your Home Bancshares (Conway AR) research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you want a real edge, the best investors always keep their radar open for game-changing opportunities across the market. Don’t let these potential winners pass you by.

- Uncover higher yields and potential stability by tapping into these 18 dividend stocks with yields > 3% for stocks offering impressive dividend payouts above 3%.

- Catch the next technology wave by targeting these 24 AI penny stocks, where innovative companies are shaping smarter industries with artificial intelligence.

- Secure bargains that could be hiding in plain sight by zeroing in on these 878 undervalued stocks based on cash flows built on robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Home Bancshares (Conway AR) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HOMB

Home Bancshares (Conway AR)

Operates as the bank holding company for Centennial Bank that provides commercial and retail banking, and related financial services to businesses, real estate developers and investors, individuals, and municipalities in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives