- United States

- /

- Banks

- /

- NYSE:GBCI

Glacier Bancorp (GBCI): Heading Into Earnings With Limited Public Financial Data

Reviewed by Simply Wall St

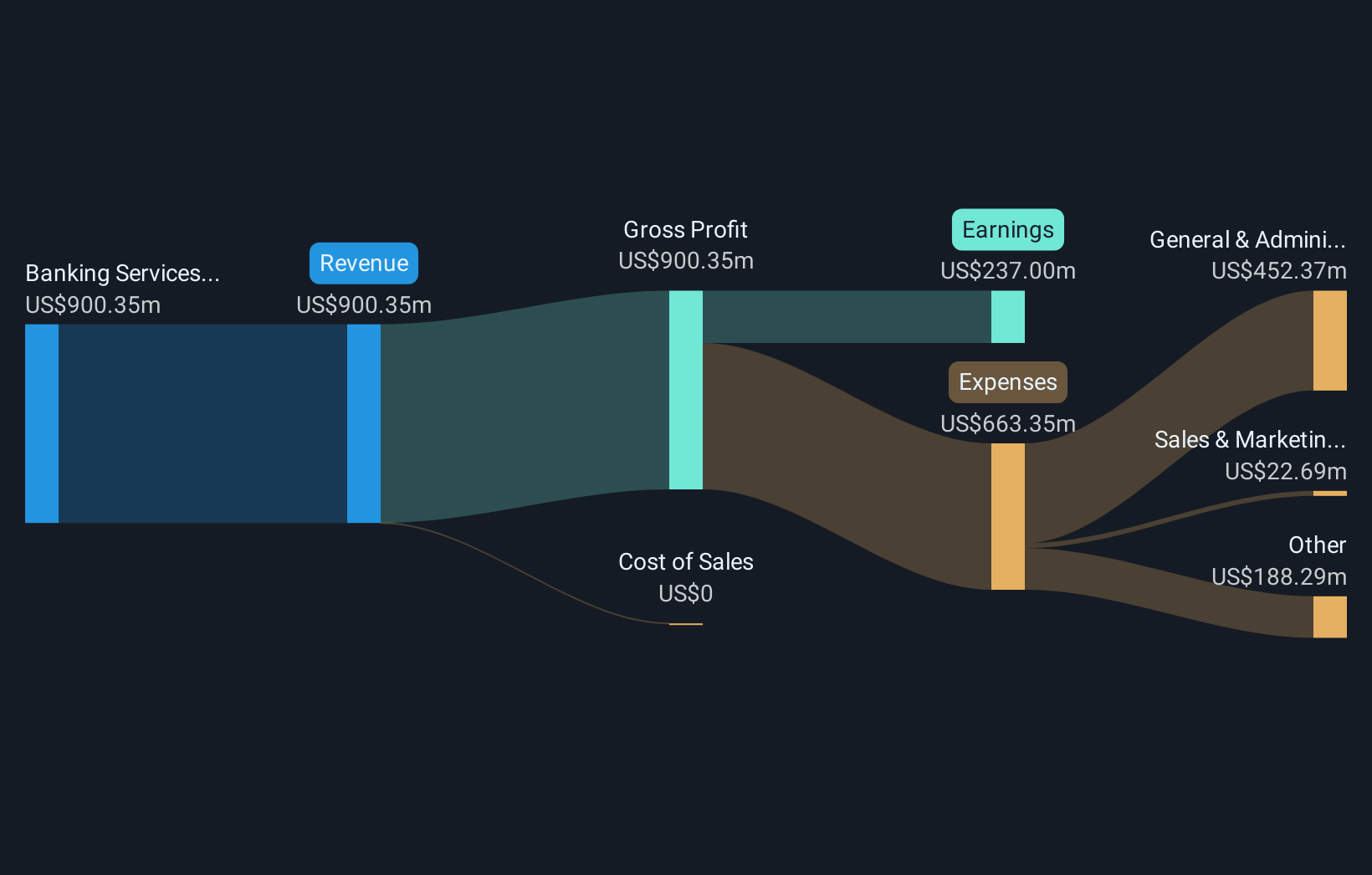

Glacier Bancorp (GBCI) operates as a bank, and its latest filings indicate limited financial info was made publicly available. There are no disclosed trends for revenue, earnings, or margins in the recent statement data, leaving investors without a clear read on the bank’s performance drivers this quarter.

See our full analysis for Glacier Bancorp.The next section will put these results in perspective by comparing them to the leading market narratives so we can see where the stories align, and where they diverge.

See what the community is saying about Glacier Bancorp

Loan Growth Projections Anchor Long-Term Upside

- Analysts expect Glacier Bancorp’s revenue to grow by 23.5% per year for the next three years, with projected earnings of $581.0 million by September 2028.

- According to the analysts' consensus view, this growth is grounded in demographic expansion and strong deposit momentum in Western regions,

- migration to core markets is fueling sustainable gains in loans and deposits,

- digital upgrades in commercial lending and treasury functions are set to boost operational efficiency and retention among younger customers.

Analysts note how these projections set the stage for sustained earnings momentum driven by robust regional trends and tech investment. 📊 Read the full Glacier Bancorp Consensus Narrative.

Margin Expansion: 25.7% Today, 36.1% Targeted

- Consensus expects a notable rise in profit margins, from 25.7% currently to 36.1% in three years. This would be a sizable gain if realized.

- Analysts' consensus view sees this margin trend as a direct result of Glacier's investments in digital platforms and conservative asset management,

- upgraded systems are already lowering cost-to-income ratios and attracting a more tech-savvy customer base,

- a greater share of noninterest-bearing deposits enables the bank to benefit more from stabilizing or rising interest rates.

Profit Target Implies Valuation Premium to Peers

- To align with analyst expectations, Glacier would need to achieve a PE ratio of 14.5x on 2028 earnings. This is above today’s industry average of 11.9x and the current share price of $43.94, against a set analyst price target of $54.00.

- The consensus view underscores a tension: delivering projected growth and defending a premium valuation depend on smooth integration of acquisitions and capturing efficiency gains,

- if integration risk or cost savings fall short, persistent expense growth could limit margin improvement,

- facing demographic headwinds in rural core markets makes maintaining long-term loan growth less certain than the forecast suggests.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Glacier Bancorp on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a different take on the figures? It only takes a few minutes to turn that unique outlook into your own narrative. Why not share your view? Do it your way

See What Else Is Out There

Glacier Bancorp’s growth story relies on optimistic projections, but integration risks, uncertain long-term loan demand, and the need to justify a high valuation create vulnerability.

If you want to sidestep those valuation headwinds and target companies trading below their intrinsic worth, discover hidden gems through these 869 undervalued stocks based on cash flows now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GBCI

Glacier Bancorp

Operates as the bank holding company for Glacier Bank that provides commercial banking services to individuals, small to medium-sized businesses, community organizations, and public entities in the United States.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives