- United States

- /

- Banks

- /

- NYSE:FNB

F.N.B (FNB): Evaluating the Stock’s Valuation Following Recent Growth Momentum

Reviewed by Simply Wall St

See our latest analysis for F.N.B.

F.N.B’s recent upward momentum reflects investor optimism, as its share price has delivered a solid 14.4% gain so far this year. In addition, the longer view is notable, with total shareholder return topping 31.9% over three years and more than doubling over five years. This suggests sustained value creation and a backdrop of growing confidence in its growth story.

If consistent growth like F.N.B’s has you thinking bigger, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With such solid returns and double-digit growth in both revenue and net income, the question now is whether F.N.B shares still offer an attractive entry point or if the market has already factored in their future prospects.

Most Popular Narrative: 10.4% Undervalued

With F.N.B shares closing at $16.64 and the most widely followed narrative placing fair value at $18.56, there is a visible gap between where the market trades and current analyst consensus. A closer look at what is driving this view reveals some key catalysts for the company's future performance.

F.N.B's major investments in digital channels, AI, data science, and omnichannel onboarding (for example, eStore Common App, integrated in-branch and online originations) are expected to enhance customer acquisition, cross-sell rates, and operational efficiency. These factors may support higher revenue growth and potentially improved long-term net margins.

Curious which future growth levers justify a premium over today’s price? There is a bold play on tech-driven expansion and a margin story tied to F.N.B’s digital bets. Want to understand what ambitious projections are included in that fair value? The surprising upside case is just a click away.

Result: Fair Value of $18.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the heavy regional focus and ongoing technology costs could limit growth if economic conditions shift or if digital initiatives underperform.

Find out about the key risks to this F.N.B narrative.

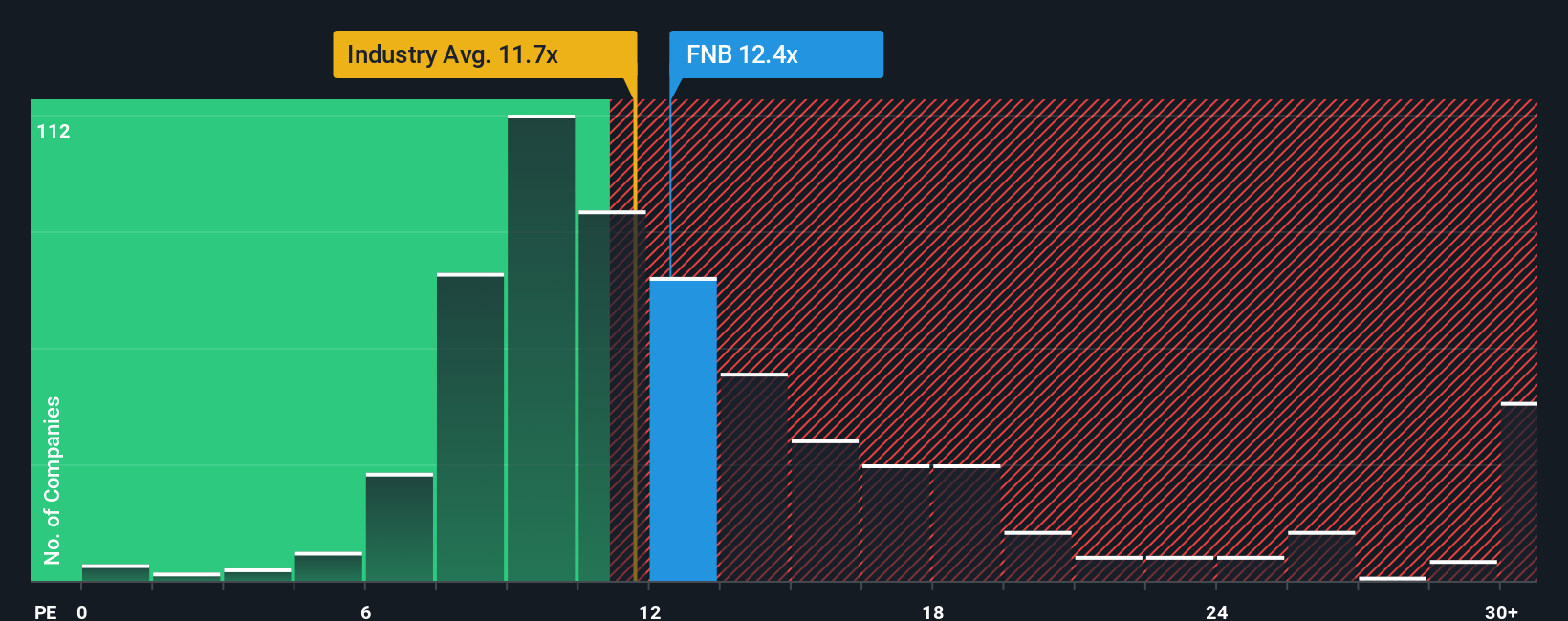

Another View: Multiple-Based Valuation

Taking a step back from analyst projections, let's see what F.N.B's current price-to-earnings ratio of 11.8x tells us. This stands slightly above the US Banks industry average of 11.4x, yet remains below the peer group at 13.5x and the fair ratio estimate of 12.8x. This mix signals the market may be pricing F.N.B near a reasonable level, but not at a clear bargain. Could this hint at limited upside, or is the fair ratio still within reach if the company delivers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own F.N.B Narrative

If you see things differently or want your research to take center stage, you can build your own F.N.B narrative in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding F.N.B.

Looking for More Smart Investment Ideas?

Opportunities like F.N.B are just the beginning. Don’t let other market movers pass you by. Now is the moment to expand your watchlist and seize new possibilities with these hand-picked ideas:

- Tap into rapid sector growth by starting with these 25 AI penny stocks powering automation, big data, and tomorrow's intelligent applications.

- Unlock resilient income streams and financial strength as you browse these 15 dividend stocks with yields > 3% with attractive yields and strong fundamentals.

- Position yourself for value with these 913 undervalued stocks based on cash flows, where robust companies trade below their intrinsic worth and signal long-term upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FNB

F.N.B

A bank and financial holding company, provides a range of financial products and services primarily to consumers, corporations, governments, and small- to medium-sized businesses in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026