- United States

- /

- Banks

- /

- NYSE:FNB

Could F.N.B’s New Payment Switch Reveal a Deeper Shift in Its Digital Strategy (FNB)?

Reviewed by Sasha Jovanovic

- Earlier this week, F.N.B. Corporation announced Payment Switch, a mobile banking feature that lets customers automatically move recurring ACH and debit card payments to FNB, alongside new instant payments capabilities for faster fund transfers.

- By combining Payment Switch with its existing Direct Deposit Switch and eStore onboarding platform, F.N.B. is aiming to remove friction when customers change banks and deepen its role as their primary financial institution.

- Next, we’ll explore how F.N.B.’s expanded instant and recurring payment tools could influence its digital-led growth and fee-income narrative.

We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

F.N.B Investment Narrative Recap

To own F.N.B., you need to believe its steady, regional bank model can be enhanced by digital tools that deepen primary banking relationships and support fee-income growth. The new Payment Switch and instant payments features appear incrementally positive for near term customer acquisition and deposit retention, but they do not meaningfully change the key short term swing factor of funding costs or the ongoing risk that elevated tech spend could pressure margins if adoption lags.

Among recent updates, the continued US$0.12 per share quarterly dividend through 2024 and 2025 stands out alongside these digital launches, signaling management’s focus on pairing technology investment with returning cash to shareholders. For investors watching the digital-led growth story, that combination of recurring dividends and new payment capabilities connects directly to the catalyst of scaling eStore-driven onboarding and cross-sell, while still leaving open questions about whether higher noninterest expenses will be fully offset by future efficiencies.

But investors should also be aware that if these new payment tools fail to reach scale, the impact of persistent technology spend on...

Read the full narrative on F.N.B (it's free!)

F.N.B's narrative projects $2.2 billion revenue and $775.6 million earnings by 2028. This requires 13.0% yearly revenue growth and a $308.6 million earnings increase from $467.0 million today.

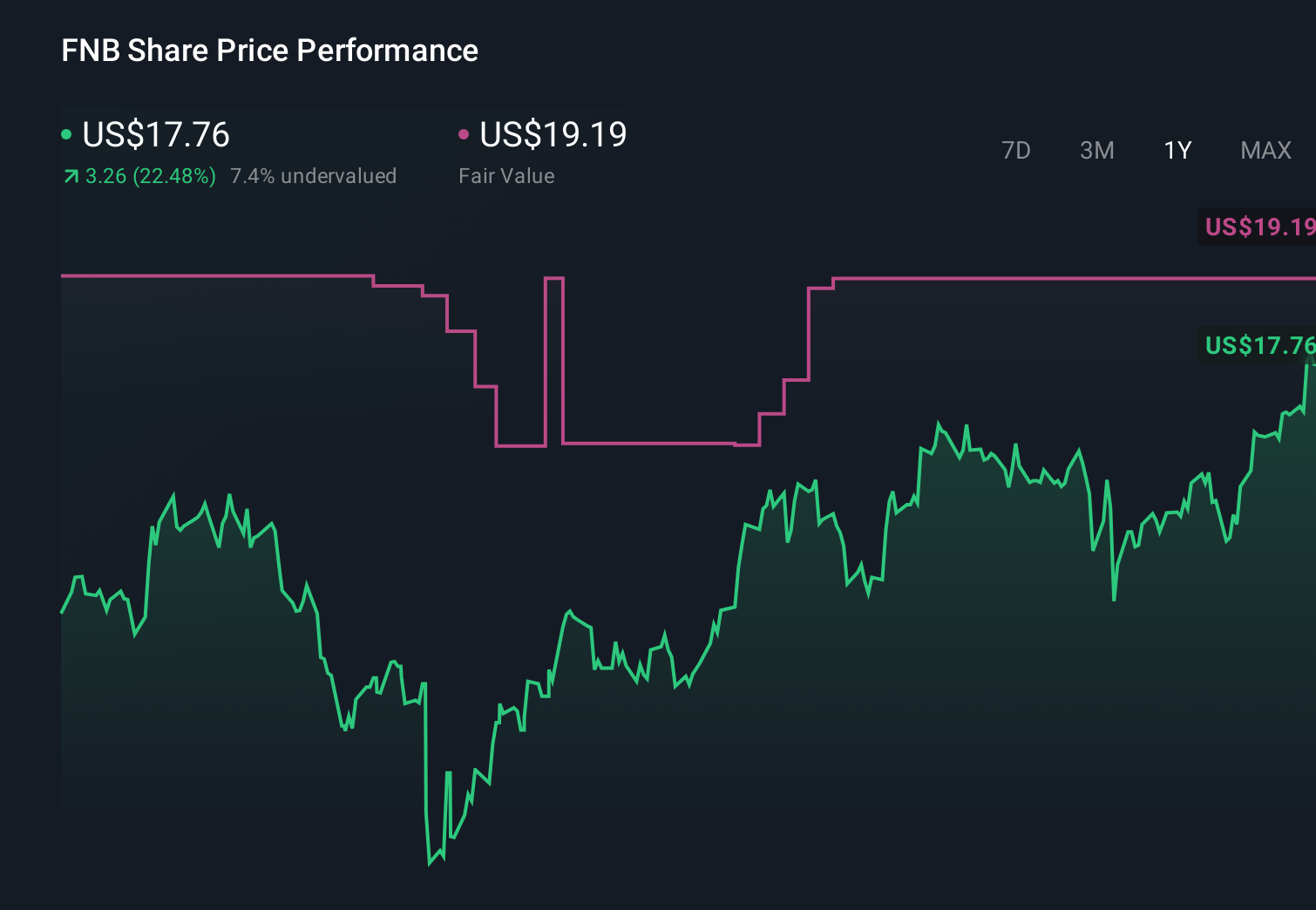

Uncover how F.N.B's forecasts yield a $19.19 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community see F.N.B.’s fair value anywhere from US$19.19 up to US$63.31, underscoring how far opinions can stretch. Set against that wide range, the central catalyst remains whether F.N.B.’s expanding digital onboarding and payments ecosystem can meaningfully support earnings while its regional footprint and cost base stay in check, so it is worth examining several viewpoints before you decide where you stand.

Explore 4 other fair value estimates on F.N.B - why the stock might be worth just $19.19!

Build Your Own F.N.B Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your F.N.B research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free F.N.B research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate F.N.B's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FNB

F.N.B

A bank and financial holding company, provides a range of financial products and services primarily to consumers, corporations, governments, and small- to medium-sized businesses in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion