- United States

- /

- Banks

- /

- NYSE:FHN

Should Investors Reassess First Horizon After Recent 12.8% Year-to-Date Surge?

Reviewed by Bailey Pemberton

Thinking about what to do with First Horizon stock? You are not alone. After all, this financial services name has delivered some eye-catching moves recently, and its journey this year has given plenty of investors reason to lean in. While it dipped a modest 0.4% over the last week, First Horizon has managed to push up 1.4% in the past month, and it is up 12.8% year to date. If you glance further back, the stock's 1-year return stands at an impressive 48.6%. For those patient enough to stick around since 2019, First Horizon has soared by nearly 148% over five years.

So, what is pushing this momentum? Much of it hinges on the evolving landscape for regional banks and shifting perceptions of risk in the sector. Changing interest rates, consolidation rumors, and renewed focus on regional franchises have all played a part in the market's re-evaluation of banks like First Horizon. While the news cycle is always swirling, the core story is one of a company increasingly on investors' radars.

Now, when it comes to value, it is not all sunshine. First Horizon's valuation score clocks in at 2 out of 6. That means it checked just 2 boxes as undervalued by typical metrics. That is a signal to dig a little deeper before making any bold calls. Up next, I will walk through the valuation approaches that analysts use most frequently, but stick around because I have a perspective at the end that might frame those numbers in a whole new way.

First Horizon scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: First Horizon Excess Returns Analysis

The Excess Returns model evaluates whether a bank generates returns on equity above its cost of capital. Unlike other methods, it focuses on how much value the company creates for shareholders after accounting for the cost of equity financing. This makes it especially useful for analyzing financial institutions like First Horizon.

For First Horizon, analysts estimate a Book Value of $16.78 per share and a Stable EPS of $1.95 per share, reflecting the expected earnings that will persist into the future based on projections from ten analysts. The company’s Cost of Equity is estimated at $1.27 per share, resulting in an Excess Return of $0.68 per share. This suggests that, on average, First Horizon is generating returns that outpace its required cost of capital, with an Average Return on Equity of 10.57%. Looking ahead, the Stable Book Value is projected to rise to $18.47 per share according to a consensus of twelve analyst estimates.

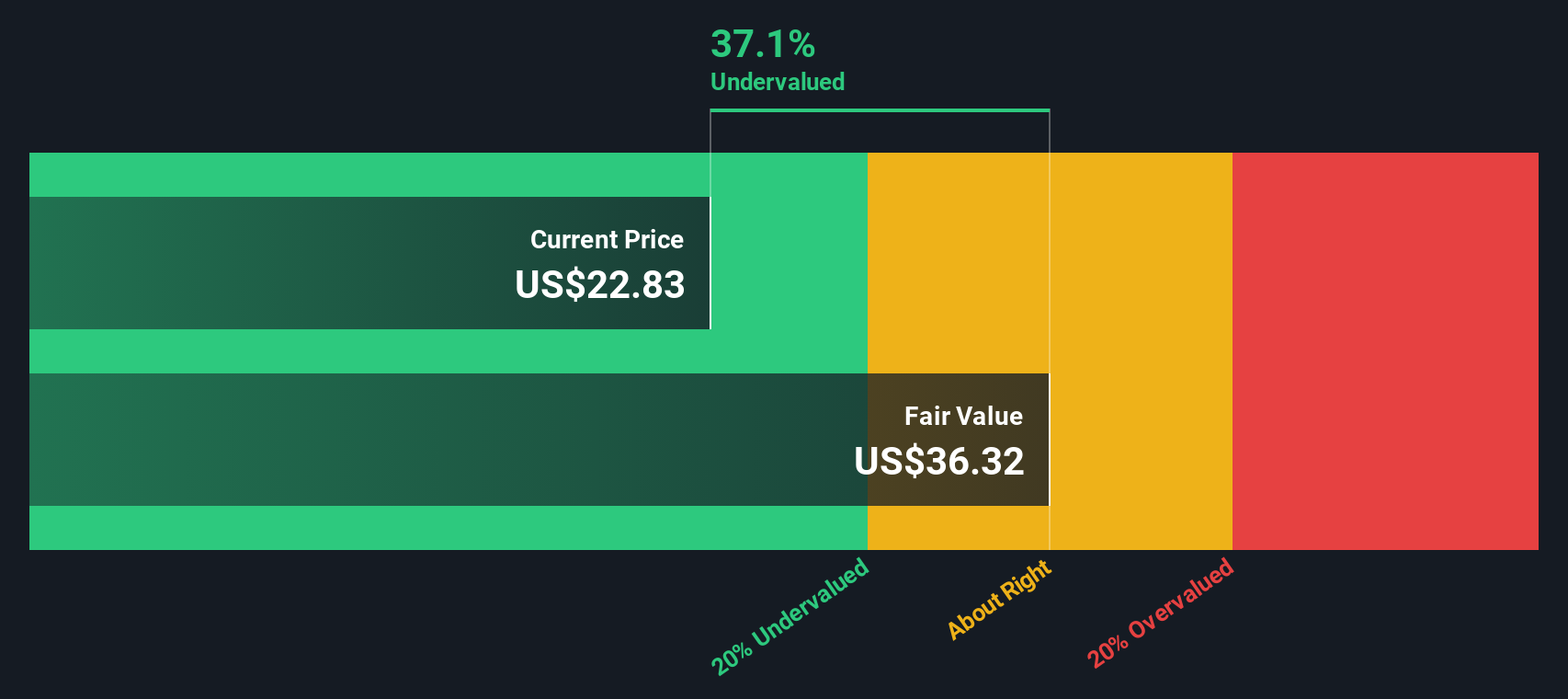

By synthesizing these factors, the Excess Returns valuation model arrives at an intrinsic fair value estimate of $36.28 per share. This is a notable 37.8% discount compared to the current share price, suggesting the stock is substantially undervalued at current levels.

Result: UNDERVALUED

Our Excess Returns analysis suggests First Horizon is undervalued by 37.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: First Horizon Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most widely used valuation multiples for profitable companies like First Horizon because it links a company’s stock price directly to its underlying earnings. It is a quick way for investors to gauge how much they are paying for each dollar of profit the business generates. Generally, higher expected earnings growth or lower perceived risk support a higher PE ratio. In contrast, slower growth or greater risk warrant a lower multiple.

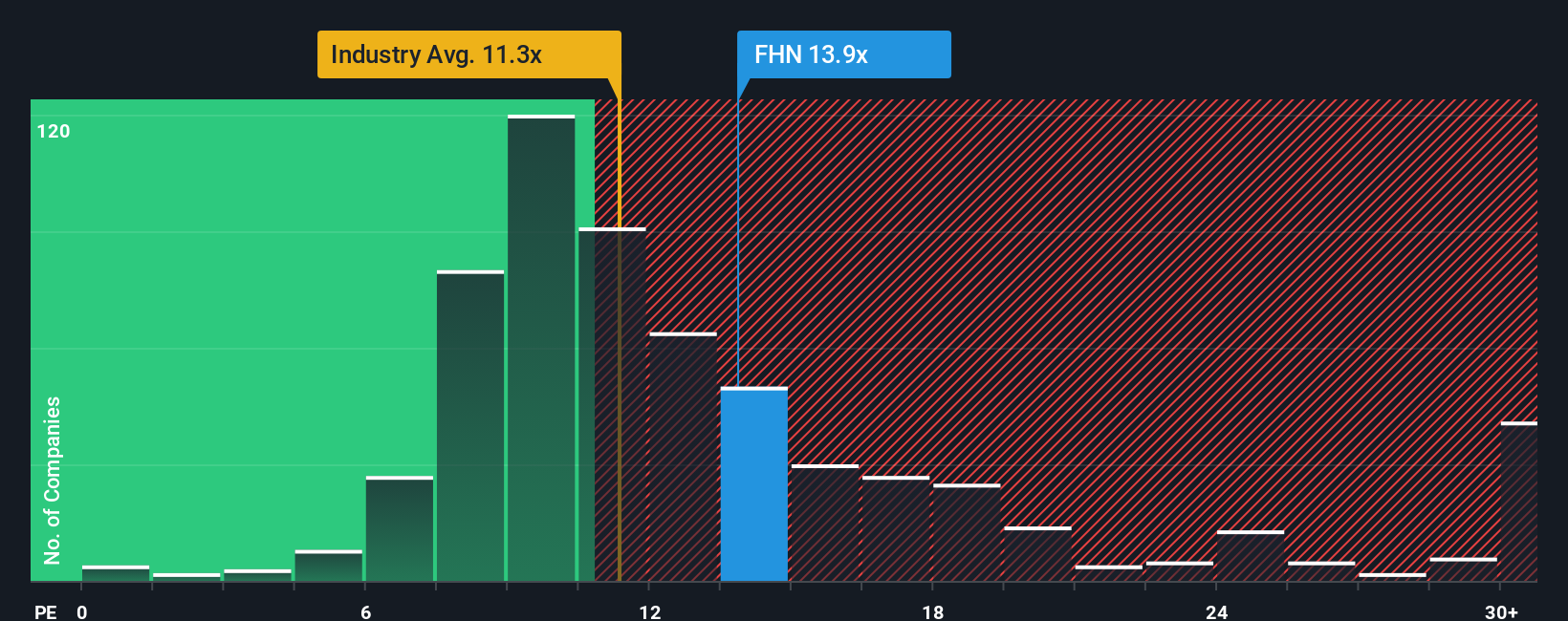

First Horizon is currently trading on a PE ratio of 14.0x. That compares to the average PE ratio of 11.8x for the broader Banks industry and 12.8x for its peer group. This indicates the stock is priced at a slight premium to its closest competitors. However, not all banks are created equal, and different growth and risk profiles can justify significant variance in multiples.

That is where Simply Wall St’s Fair Ratio comes in. This proprietary metric refines the idea of a “normal” PE ratio by factoring in dynamics such as First Horizon’s earnings growth prospects, profit margin, relative risks, market cap, and its industry context. Rather than a blunt comparison to industry averages, the Fair Ratio provides a more tailored benchmark for what the company actually deserves. For First Horizon, the Fair Ratio is calculated at 13.2x, just below its current multiple of 14.0x. The difference is less than 0.10, indicating the current valuation is in line with where it should be using a more nuanced approach.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your First Horizon Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your own story about a company, connecting what matters to you, such as fair value, future revenue, and profit margin estimates, into a forecast that makes sense for your investment style. Narratives help you tie the company’s bigger picture to a specific forecast and resulting fair value, making your analysis personal rather than generic.

On Simply Wall St’s Community page, Narratives are a popular, easy-to-use tool that let millions of investors craft and share their perspectives on what drives a company’s value. By linking the story to numbers, you can quickly see if First Horizon’s fair value, based on your assumptions, is above or below the current price, supporting more confident decisions on when to buy or sell. When news or earnings updates are published, Narratives update in real time so your view always fits the latest facts.

For example, some investors see cost discipline and mortgage growth supporting a fair value as high as $27.00, while others, concerned about credit risks and economic uncertainty, set their valuation closer to $22.00. This shows that Narratives make it simple to find your own conviction amid analyst disagreement.

Do you think there's more to the story for First Horizon? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FHN

First Horizon

Operates as the bank holding company for First Horizon Bank that provides various financial services.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives