- United States

- /

- Banks

- /

- NYSE:FCF

Should First Commonwealth Financial’s (FCF) Earnings Miss Prompt Rethinking of Its Investment Case?

Reviewed by Sasha Jovanovic

- Earlier this month, First Commonwealth Financial reported quarterly revenues of US$136 million, reflecting an 11.9% year-on-year increase but missing analysts’ EPS and net interest income estimates.

- Despite management highlighting strength in core banking operations, the mixed financial results shaped investor sentiment and prompted a reassessment of company fundamentals.

- We’ll explore how missing key earnings estimates could influence First Commonwealth Financial’s investment thesis moving forward.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

First Commonwealth Financial Investment Narrative Recap

Owning First Commonwealth Financial means believing in its ability to drive consistent growth through diversified lending, gradual digital advancements, and stable core banking revenues. The latest revenue increase showed underlying business strength but missing key earnings estimates, alongside a small drop in the share price, could put renewed focus on near-term margin pressures, the most important short-term catalyst, and heighten attention on rising credit costs, which remain a significant risk for the bank. However, for now, the impact of this earnings shortfall on the company's long-term fundamentals does not appear material.

The Q3 increase in net charge-offs, reported at US$12.2 million versus US$2.8 million in the previous quarter, stands out as highly relevant since it exacerbates concerns about credit quality and loan loss exposure, an area investors should keep a close watch on as overall earnings performance comes under scrutiny.

In contrast, investors would do well to consider the potential for further spikes in loan loss provisions that could...

Read the full narrative on First Commonwealth Financial (it's free!)

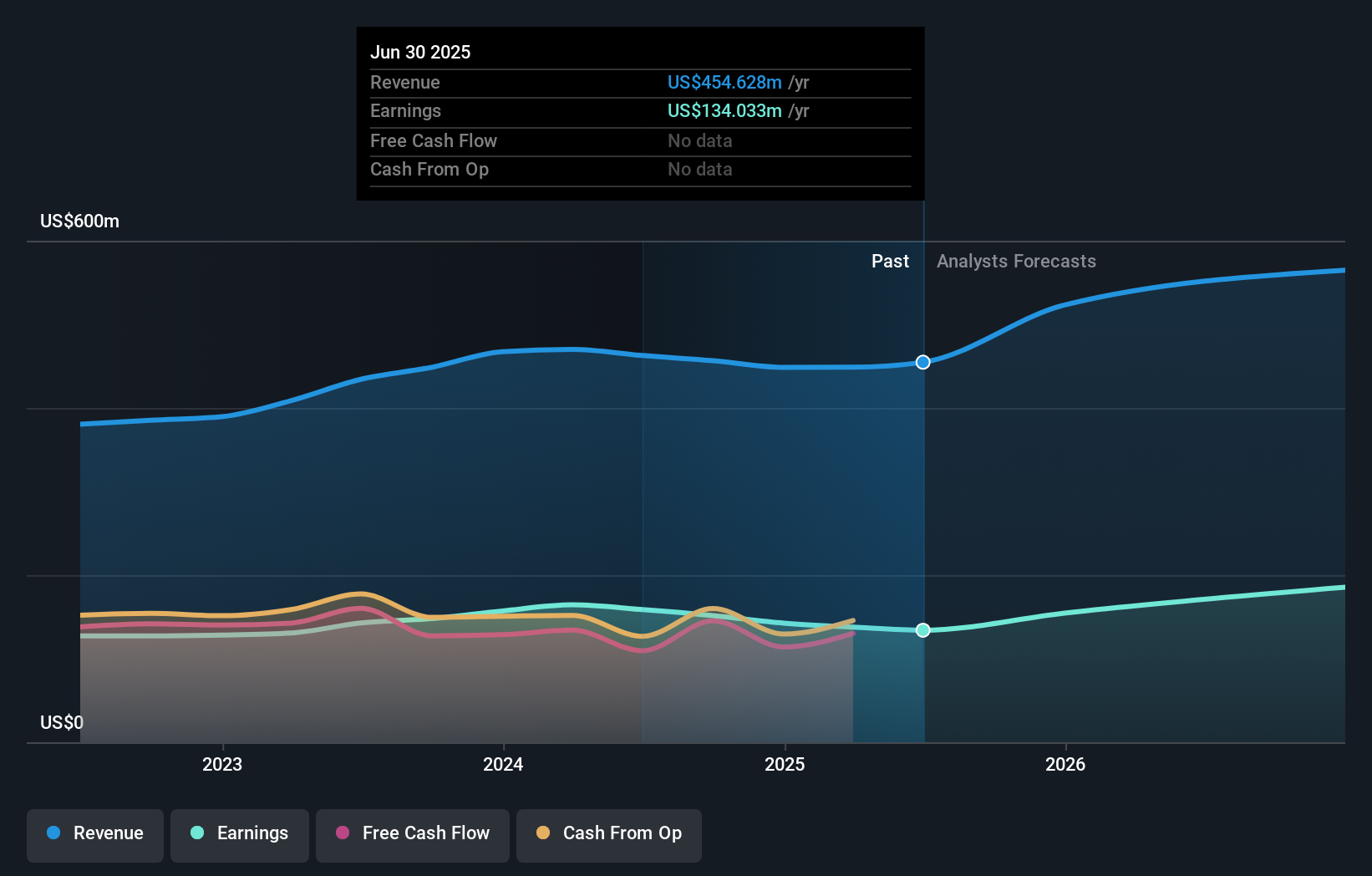

First Commonwealth Financial's narrative projects $698.8 million revenue and $250.5 million earnings by 2028. This requires 15.4% yearly revenue growth and an $116.5 million earnings increase from $134.0 million today.

Uncover how First Commonwealth Financial's forecasts yield a $19.20 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered three distinct fair value views for First Commonwealth, ranging from US$19.20 to US$12,644.96. Margin compression risk remains a key consideration for anyone assessing the company amid these varied outlooks, so take time to examine multiple viewpoints before deciding on your own position.

Explore 3 other fair value estimates on First Commonwealth Financial - why the stock might be worth just $19.20!

Build Your Own First Commonwealth Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Commonwealth Financial research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free First Commonwealth Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Commonwealth Financial's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCF

First Commonwealth Financial

A financial holding company, provides various consumer and commercial banking products and services in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives