- United States

- /

- Banks

- /

- NYSE:FCF

First Commonwealth Financial (FCF): Margin Decline Challenges Bullish Sentiment Despite Strong Growth Outlook

Reviewed by Simply Wall St

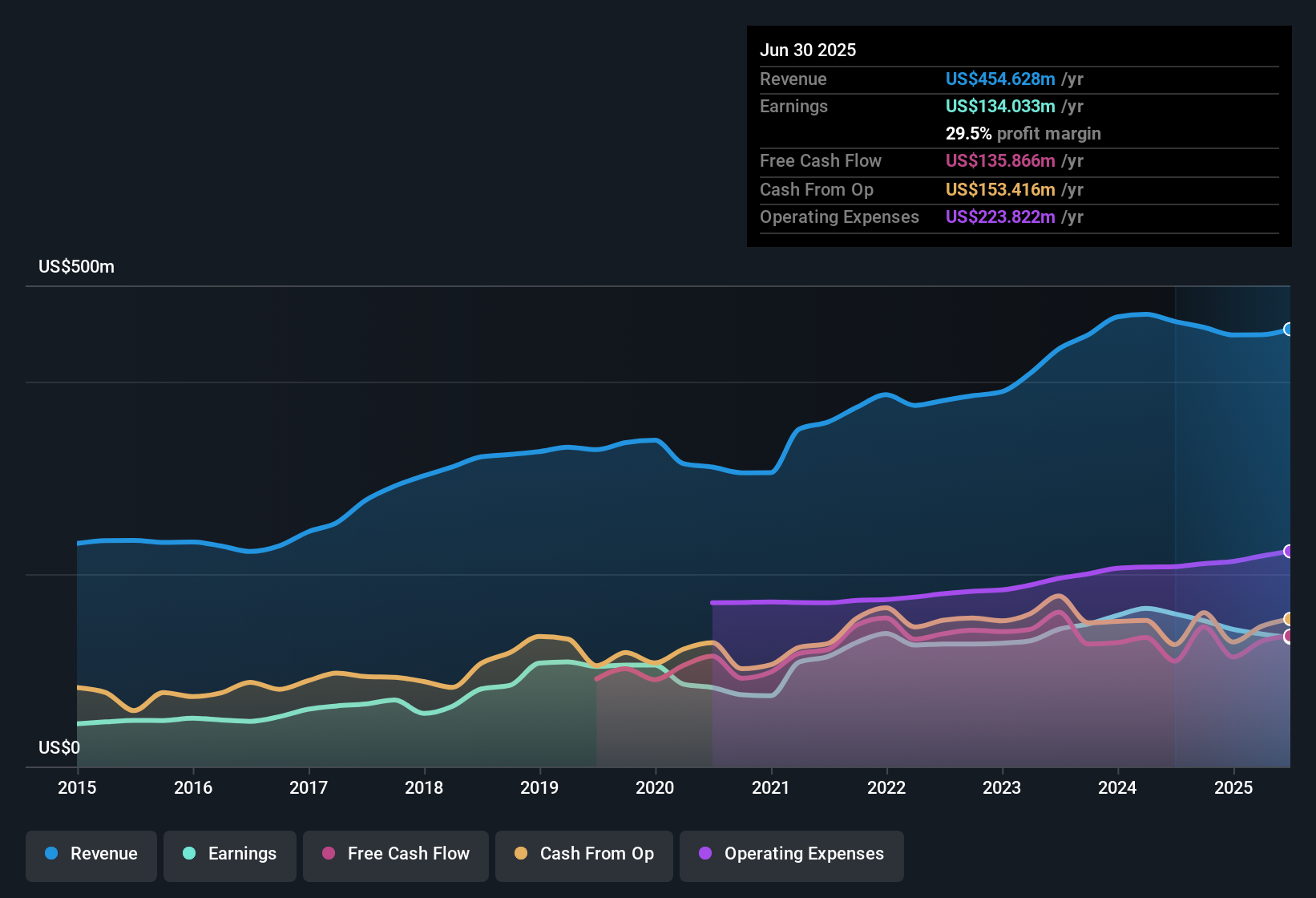

First Commonwealth Financial (FCF) reported net profit margins of 30.6%, down from 33.2% a year earlier, with five-year earnings growing at an annual rate of 8.7%. Looking ahead, revenue is forecast to grow 13.6% annually, above the US market's 10.2% pace. EPS is expected to increase by 19.7% per year, outpacing the broader market but just shy of the 20% threshold considered highly significant. With shares trading well below estimated fair value and no notable risks highlighted, the setup for investors is a mix of strong growth expectations and attractive valuation, tempered by recent margin compression.

See our full analysis for First Commonwealth Financial.The next step is putting these numbers side by side with the current narratives to see which stories hold up and which ones might get a reality check.

See what the community is saying about First Commonwealth Financial

Margin Expansion Back on the Table as Analysts Model 35.8% by 2028

- Consensus expects profit margins to climb from 29.5% today to 35.8% within three years, reversing the recent dip from 33.2% a year ago.

- Analysts' consensus view notes that digital banking investments and fee-based revenue streams are positioned as key drivers for this projected margin recovery.

- Recent technology upgrades and expansion into secondary markets are expected to improve operational efficiency and help offset competitive pressures from larger banks and fintech firms.

- Success in growing noninterest income, such as wealth management, SBA lending, and insurance, should lessen reliance on traditional lending and could help smooth out earnings volatility during economic cycles.

- To see if this margin rebound and diversification story stacks up in detail, check why consensus is leaning constructive in the full breakdown. 📊 Read the full First Commonwealth Financial Consensus Narrative.

Analysts Eye $250.5 Million Earnings by 2028

- Projected earnings are set to rise from $134.0 million today to $250.5 million by September 2028, with annual revenue growth assumptions of 15.4% over the next three years.

- Analysts' consensus view points out that these ambitious growth figures hinge on expanding into new business lines and maintaining low-cost deposit growth.

- Acquisitions like CenterBank and a focus on scalable digital platforms are expected to fuel both revenue and balance sheet expansion, building resilience even as competition intensifies.

- Still, reliance on traditional banking and measured technology upgrades means the company must execute carefully or risk falling short of the expected trajectory.

Share Price Trades at a Steep Discount to DCF Fair Value

- With shares recently at $15.49 and a DCF fair value of $34.76, the current market price sits at less than half of intrinsic value estimates, while the analyst price target ($18.75) is only a modest 21% premium to today's price.

- Analysts' consensus view calls this valuation gap a sign that the market may not yet be pricing in forecasted profit and margin gains.

- This disconnect can create an opportunity for long-term investors who believe in the growth narrative, provided that the company achieves the projected margin recovery and revenue targets.

- If competitive and regulatory headwinds persist, however, the gap may simply reflect skepticism about management's ability to deliver on expectations.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for First Commonwealth Financial on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something unique in the numbers? Take just a few minutes to put your own spin on the story and define what you think matters most. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding First Commonwealth Financial.

See What Else Is Out There

While First Commonwealth Financial boasts ambitious growth targets, its recent margin compression and reliance on traditional banking raise questions about future consistency.

If you want investments with a steadier track record, focus on stable growth stocks screener (2125 results) that have delivered consistent revenue and earnings expansion, regardless of the phase of the economic cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCF

First Commonwealth Financial

A financial holding company, provides various consumer and commercial banking products and services in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives