- United States

- /

- Banks

- /

- NYSE:FBK

FB Financial (FBK): Exploring Valuation as Momentum Shifts After Recent Performance Trends

Reviewed by Simply Wall St

FB Financial (FBK) shares have shown resilience lately, despite a mix of returns over the past month. Investors are paying close attention to recent performance shifts, looking for clues about future prospects and valuation trends.

See our latest analysis for FB Financial.

FB Financial’s share price momentum has shifted gears this year, with a solid 90-day price return of 16.7% signaling renewed confidence, even after a recent dip. While its 1-year total shareholder return is flat, long-term holders have enjoyed impressive gains, including a 34.9% total return over three years and 86.1% over five years. This suggests that the stock’s potential remains intact as sentiment cycles between risk and optimism.

If you’re wondering what other interesting names might be building momentum, now’s a smart time to explore fast growing stocks with high insider ownership.

But with shares still trading below analyst targets and significant revenue and earnings growth over the past year, the main question is whether FB Financial is undervalued or if the market has fully accounted for its future growth.

Most Popular Narrative: 15.5% Undervalued

FB Financial's narrative-based fair value estimate sits comfortably above the recent close, challenging whether the latest price fully captures its underlying earnings potential and momentum shifts.

“The planned combination with Southern States Bank is expected to enhance scale and market opportunities, potentially benefiting revenue growth through expanded market presence and improved margin stabilization. FB Financial's ability to adjust cost structures, such as repricing certificates of deposit at lower rates, indicates management's focus on improving net margins by reducing the cost of funds.”

Want a peek into the math driving this target price? The real intrigue lies in bold forecasts for future earnings growth and expanding margins, along with a future price multiple that could surprise you. Curious what financial leaps underpin this narrative? The details just might upend your expectations.

Result: Fair Value of $65.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, integration challenges from the Southern States Bank merger or unexpected shifts in economic policy could still disrupt FB Financial’s growth trajectory and outlook.

Find out about the key risks to this FB Financial narrative.

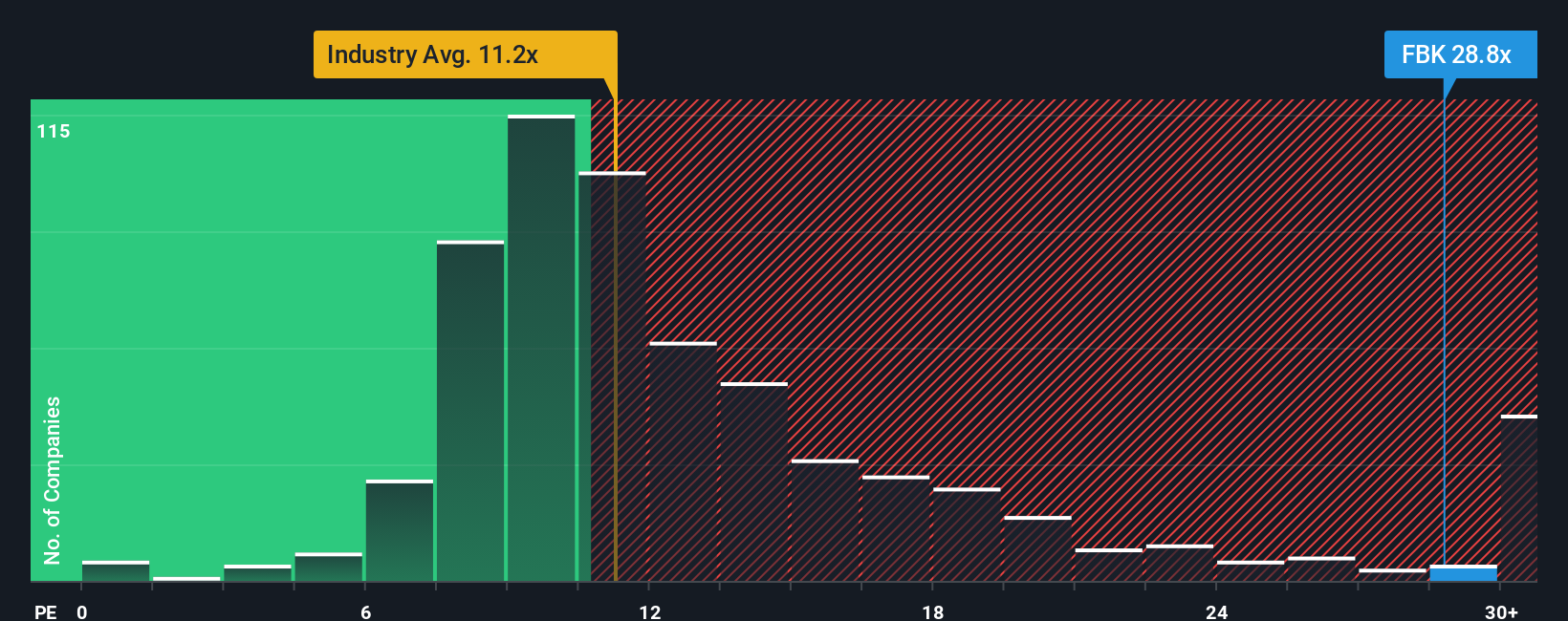

Another View: Expensive on Earnings Ratios

Looking at earnings multiples, FB Financial’s current price-to-earnings ratio of 28.4x stands well above both the US Banks industry average of 11x and the peer group average of 10.7x. Even compared to a fair ratio of 19.4x, the stock appears pricey. This raises questions about how much optimism is already priced in, as well as whether faster earnings growth will materialize quickly enough.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own FB Financial Narrative

If you’re thinking differently or want to dive into the numbers yourself, shaping your own view is quick and easy. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding FB Financial.

Looking for More Investment Ideas?

Don't let opportunities pass you by. Take charge and spot the most exciting stocks waiting to be found using Simply Wall Street’s powerful tools.

- Unlock growth potential with these 27 quantum computing stocks, a leader in computing innovation and tech breakthroughs.

- Boost your passive income by checking out these 16 dividend stocks with yields > 3%, which offers generous yields and steady payout histories.

- Get ahead of the curve with these 24 AI penny stocks as it fuels tomorrow’s digital intelligence and redefines entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FBK

FB Financial

Operates as a bank holding company for FirstBank that provides a suite of commercial and consumer banking services.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives