- United States

- /

- Banks

- /

- NYSE:CUBI

Customers Bancorp (CUBI): Assessing Valuation After a Recent Uptrend in Share Price

Reviewed by Simply Wall St

See our latest analysis for Customers Bancorp.

After a robust run so far this year, Customers Bancorp’s share price has climbed 38% year-to-date, with the latest uptick suggesting that sentiment is picking up. Looking further out, the company boasts a 44% total shareholder return over the past 12 months and has more than quadrupled investors’ money over five years. This reflects both its growth story and shifting risk outlook.

If you’re interested in spotting the next surge, now is a smart moment to widen your perspective and discover fast growing stocks with high insider ownership

But with shares near their recent highs and analysts still forecasting upside, is Customers Bancorp still undervalued at current levels, or has the market already factored in all of its future growth potential?

Most Popular Narrative: 15.2% Undervalued

According to the most widely followed narrative, Customers Bancorp’s fair value sits comfortably above the latest closing price of $65.55. This suggests the market has not yet caught up to the company's anticipated growth and profitability improvements.

The rapid digitization of commercial banking and payments is driving institutional clients to seek tech-focused, 24/7 banking solutions. Customers Bancorp capitalizes on this trend through its proprietary cubiX platform. With payments volume of $1.5 trillion in 2024 and accelerating growth, ongoing regulatory clarity around digital assets and stablecoins positions Customers as the leading provider, supporting significant potential for deposit and fee income growth.

Want to know what propels such a bold valuation? The secret sauce blends aggressive digital expansion, industry-defying profit margin goals, and a fundamental shift in how the bank earns and grows. Crack open the full narrative to see the numbers and strategic pivots that could make or break this story.

Result: Fair Value of $77.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on digital asset deposits and rising regulatory scrutiny could spark volatility. This may challenge the bullish trajectory projected for Customers Bancorp.

Find out about the key risks to this Customers Bancorp narrative.

Another View: The Market’s Multiple

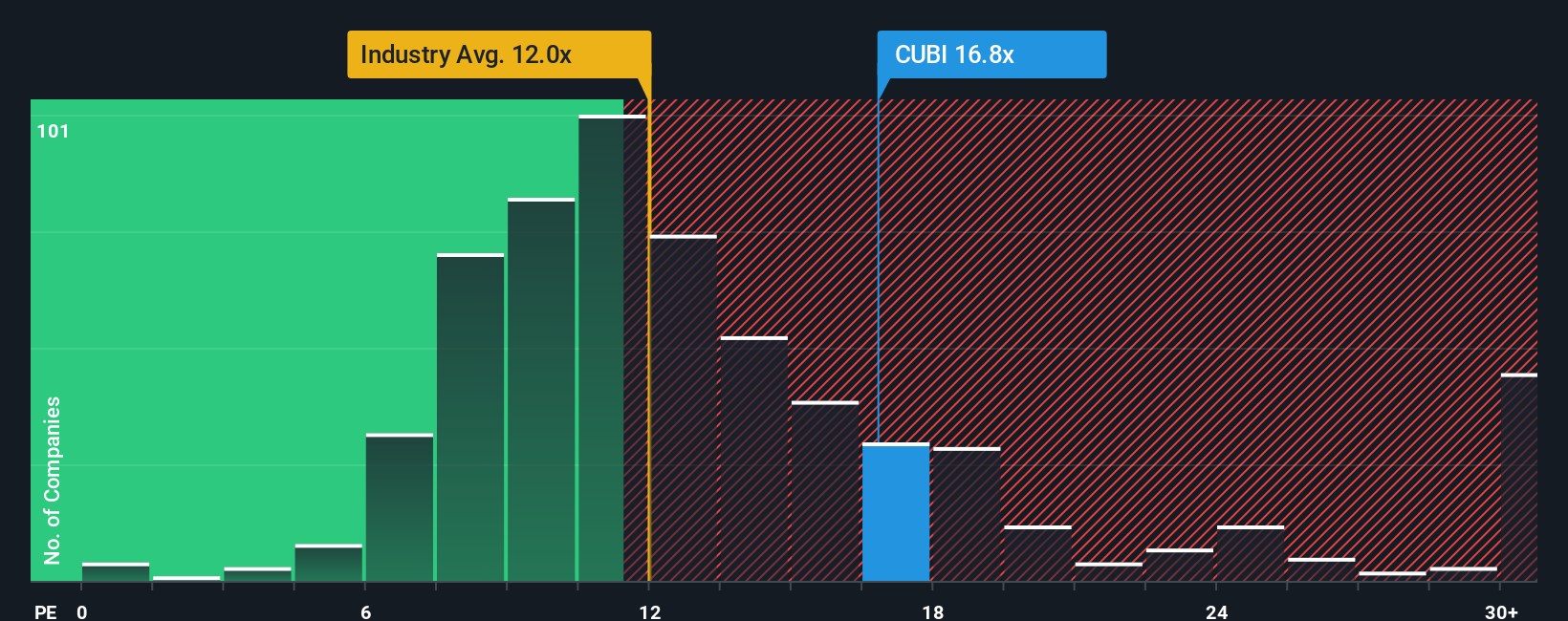

While analysts see Customers Bancorp as undervalued, the current market ratio paints a less optimistic picture. Shares trade at 16.9 times earnings, notably higher than both industry (11.3x) and peer averages (14.8x), and even above the ratio the market might move toward, the fair ratio of 18.3x. This premium suggests investors expect robust growth, but it also raises questions about potential valuation risk if growth falls short. Could this optimism persist, or is there a correction ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Customers Bancorp Narrative

If these perspectives do not align with your own, or you prefer to dive into the details yourself, you can craft a fresh take in just a few minutes: Do it your way.

A great starting point for your Customers Bancorp research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Move beyond the obvious and tap into tomorrow’s standout opportunities with Simply Wall Street’s powerful screener tools. Missing these could mean missing your next big win.

- Capitalize on the market’s potential by checking out these 868 undervalued stocks based on cash flows, which may be trading at prices well below their true worth.

- Fuel your portfolio with future-focused performance by targeting these 27 AI penny stocks, as these companies are harnessing artificial intelligence to redefine industry standards.

- Boost your income strategy by targeting these 17 dividend stocks with yields > 3%, which offer reliable yields above 3% for steady, long-term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CUBI

Customers Bancorp

Operates as the bank holding company for Customers Bank that provides banking products and services.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives