- United States

- /

- Banks

- /

- NYSE:CMA

Is Comerica’s 30% Rally Justified After Dividend News and Digital Banking Push?

Reviewed by Bailey Pemberton

- Wondering if Comerica is truly a bargain or trading at a premium? You are definitely not alone, and there is a lot to unpack about the real value behind this stock.

- After a strong run, Comerica’s shares have climbed 30.4% year to date and 16.1% in the past year. This hints at renewed investor optimism and possibly shifting risk perceptions.

- Recent headlines have highlighted robust loan growth and management’s efforts to strengthen the balance sheet. This provides much-needed context to the latest upward moves. News about increasing dividends and a focus on digital banking initiatives have also caught the market’s attention and fueled further speculation.

- Right now, Comerica scores a 1 out of 6 on our valuation checks, so the numbers are raising some eyebrows. Let’s break down what really drives its value. Then stick around, because we have an even smarter way to judge whether it’s undervalued or not.

Comerica scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Comerica Excess Returns Analysis

The Excess Returns valuation model measures a company's intrinsic value by assessing how much profit it can generate over and above its cost of equity. This method is especially relevant for financial stocks, as it highlights how efficiently a bank like Comerica turns shareholders' equity into real economic value.

For Comerica, analysts estimate a stable Return on Equity at 10.08%, based on a weighted forecast from 15 experts. The current Book Value is $55.15 per share. Projections suggest it could rise to $58.97 per share in the coming years. Earnings power also appears solid, with a stable EPS (earnings per share) forecast of $5.95. The cost of equity, or the minimum return investors expect, is $4.84 per share. This results in a notable excess return of $1.11 per share, indicating that Comerica is expected to generate profits beyond the demands of its capital providers.

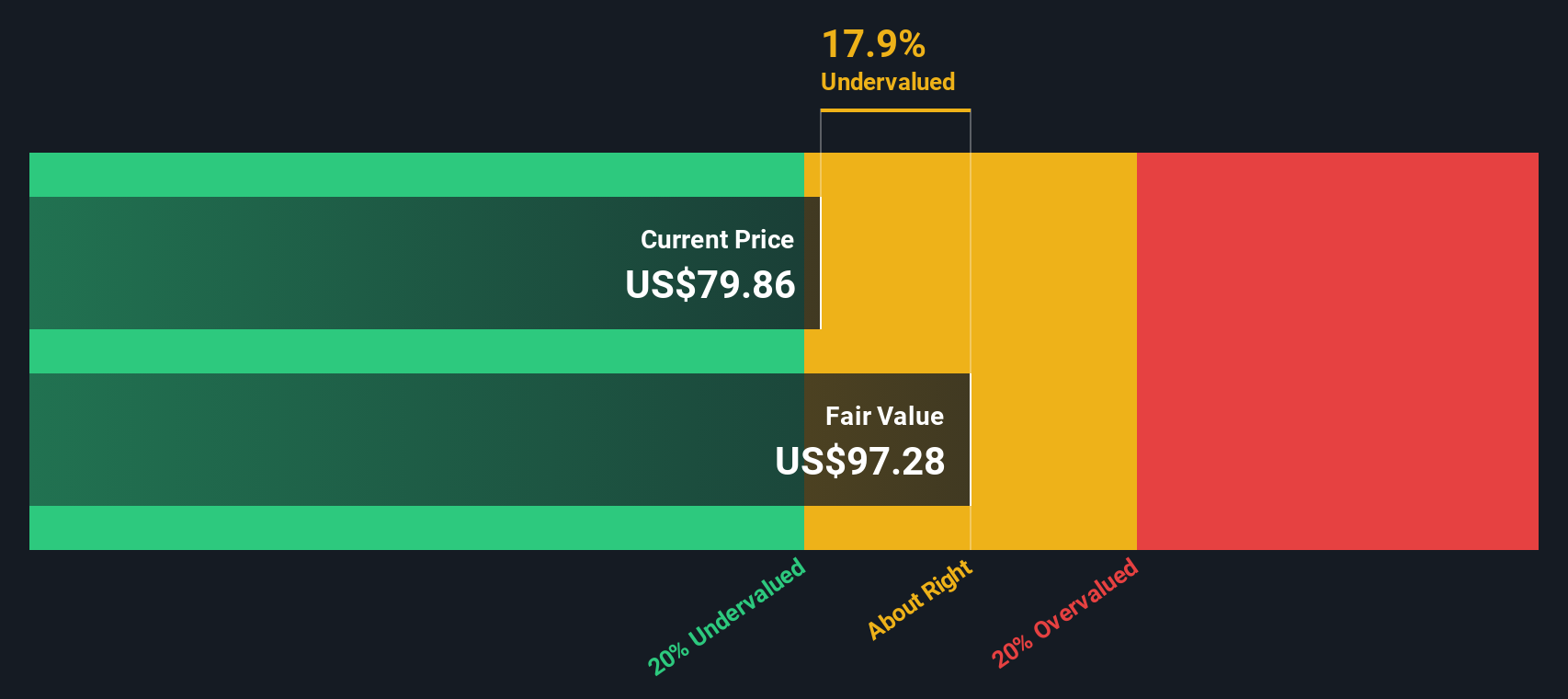

Working through these figures, the Excess Returns model places Comerica’s intrinsic value in close proximity to its current trading price. With the implied discount at just 1.6%, the stock is neither significantly undervalued nor overvalued.

Result: ABOUT RIGHT

Comerica is fairly valued according to our Excess Returns, but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Comerica Price vs Earnings

The price-to-earnings (PE) ratio is the go-to metric for valuing profitable companies like Comerica. It allows investors to gauge how much they are paying for each dollar of current earnings, making it especially useful when profits are stable and predictable. For banks, whose earnings capture much of their performance and risk profile, the PE ratio is a particularly meaningful valuation anchor.

Market participants will often pay a premium PE for companies with stronger growth prospects and lower risk, and are less generous to those with weaker outlooks or higher uncertainty. A “normal” or “fair” PE is therefore a moving target, shaped by expectations for future earnings, the company’s risk, industry trends, and macroeconomic conditions.

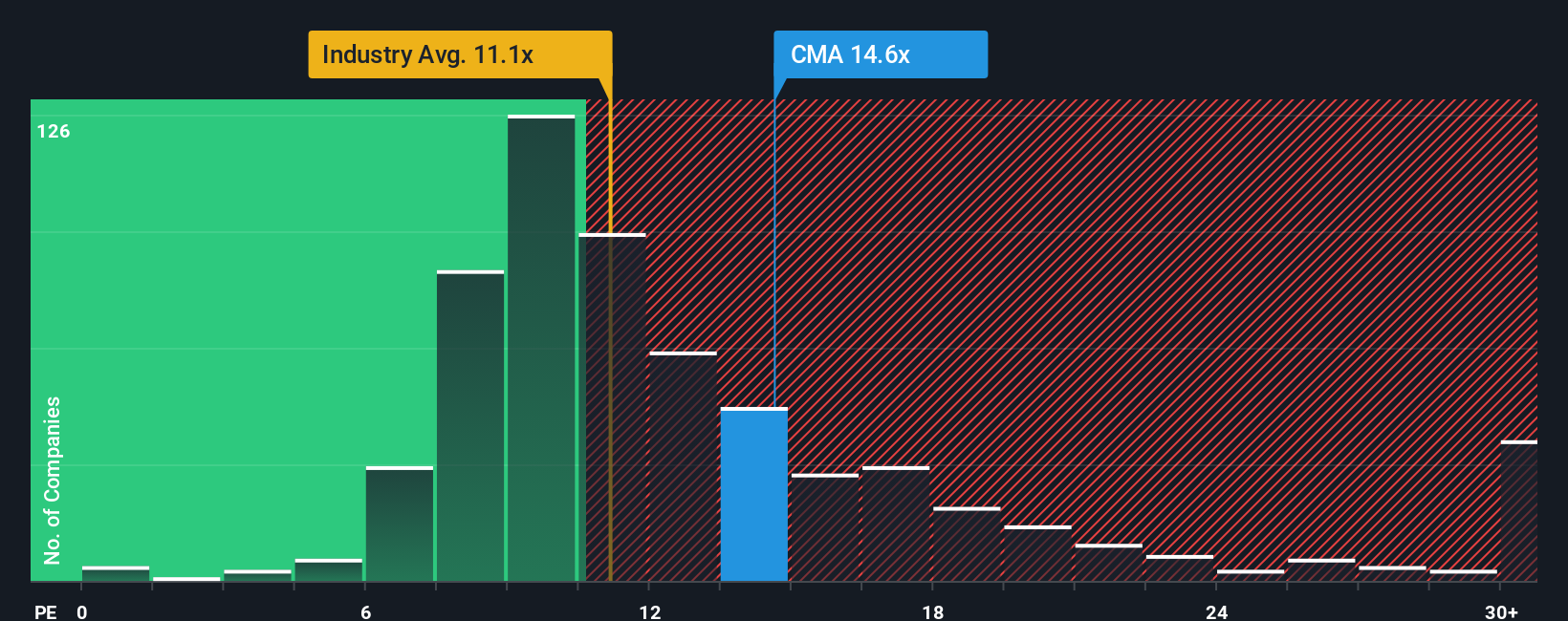

Comerica’s current PE ratio stands at 14.8x. This is above the Banks industry’s typical 11.4x and the peer average of 13.8x. However, on Simply Wall St’s proprietary Fair Ratio—a deeper approach that factors in Comerica’s unique growth prospects, sector exposure, profit margins, and company size—a score of 11.0x is indicated. Unlike basic peer or sector comparisons, the Fair Ratio offers a dynamic, tailored benchmark. By accounting for earnings growth, profitability, industry position, and risk, it offers a sharper lens for assessing value.

Since Comerica’s actual PE (14.8x) is meaningfully above its Fair Ratio (11.0x), this signals that the stock may be trading at a premium to its true value.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1438 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Comerica Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, dynamic tool that lets you define your take on a company's story, what you believe about Comerica’s future, and connect it directly to financial forecasts such as revenue, profit margins, and fair value estimates.

Rather than just looking at numbers in isolation, Narratives let you map out your view of Comerica’s strengths, risks, and growth drivers and instantly see how that perspective translates into an up-to-date, data-driven fair value. Available and easy to use within Simply Wall St’s Community page, Narratives are used by millions of investors to compare what they think should happen with what the market is currently pricing in.

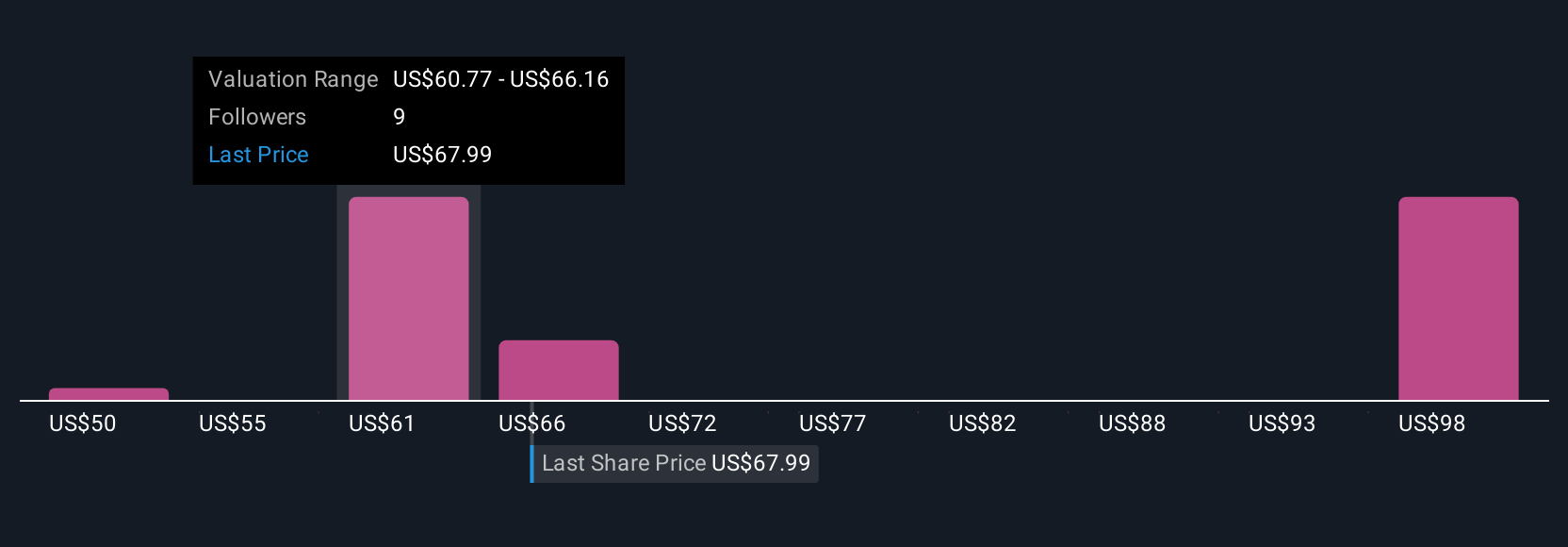

With Narratives, decision making becomes smarter and more accessible. Narratives update automatically as new news or company results are released, so your view always stays relevant. For example, some investors may emphasize Comerica’s merger synergies and bullish growth targets, justifying price targets as high as $81.28, while others focus on sluggish loan growth and sector risks, seeing fair value closer to $56. Narratives help you bridge the gap between story and numbers so you can decide if now is the right time to act.

Do you think there's more to the story for Comerica? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMA

Comerica

Provides financial services in the United States, Canada, and Mexico.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.