- United States

- /

- Banks

- /

- NYSE:CMA

Comerica (CMA): Weighing Valuation After Operational Progress Drives Shareholder Momentum and Sunbelt Growth

Reviewed by Kshitija Bhandaru

Comerica (CMA) is drawing attention for its consistent operational progress, particularly as it continues to increase loan origination and grow deposits in Sunbelt markets. The bank’s investments in technology and efficiency are quietly fueling this growth.

See our latest analysis for Comerica.

Comerica’s impressive 25% total shareholder return over the past year signals that momentum is building, supported by recent contributions to support women-owned businesses and expanding digital capabilities. Stable sector conditions and operational wins continue to feed into long-term growth expectations.

If Comerica’s progress has you curious about where momentum could go next, this is a great time to explore fast growing stocks with high insider ownership.

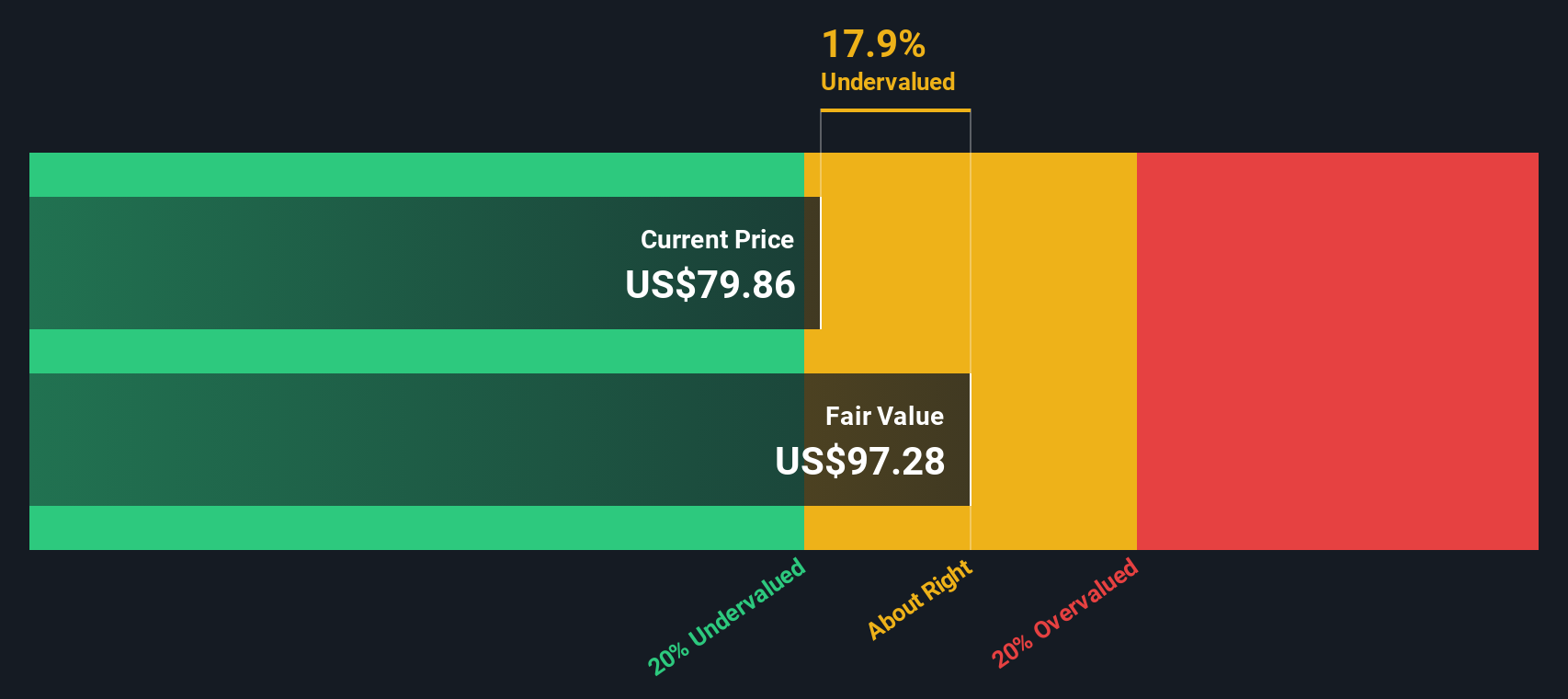

With the bank posting strong results and a positive long-term growth outlook, the key question becomes whether Comerica is undervalued at current levels or if the recent rally has already accounted for all of its future potential.

Most Popular Narrative: 2% Overvalued

Comerica's most widely followed narrative suggests the fair value is just below its recent closing price, hinting at only a modest disconnect between market views and narrative assumptions about performance. Let's look at one of the key drivers shaping this view.

Comerica's significant presence in economically vibrant Sunbelt and growth markets is fueling robust loan origination and stable deposit growth as local businesses and demographic shifts drive increased financial services demand. This supports long-term revenue expansion. Strategic investments in digital capabilities (such as new real-time payment solutions and embedded finance products) are enabling Comerica to enhance operational efficiency, reduce costs, and access new customer segments. This positions the bank to improve net margins over time.

Want to uncover the ambitious forecasts behind these numbers? The narrative is built on bold revenue growth assumptions, shrinking profit margins, and a future earnings multiple that raises eyebrows. The real surprise? One underlying forecast pushes Comerica's valuation beyond industry averages. Find out which.

Result: Fair Value of $69 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing competitive pressures and Comerica's rising expense base could challenge the growth story and potentially derail long-term earnings expectations.

Find out about the key risks to this Comerica narrative.

Another View: Discounted Cash Flow Model

Taking a different approach, our SWS DCF model finds Comerica’s current share price is about 25% below its estimated fair value. This suggests that if you focus on long-term cash flows, investors may actually be underappreciating the bank’s earnings potential. Which lens tells the fuller story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Comerica for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Comerica Narrative

If you want to challenge these conclusions or prefer charting your own course, it takes just a few minutes to build your perspective. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Comerica.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Broaden your edge by targeting unique growth trends, untapped themes, and income prospects before the crowd catches on.

- Ride the AI revolution by targeting the best tech upstarts among these 24 AI penny stocks, shaping tomorrow’s digital landscape and automation breakthroughs.

- Boost your income potential by focusing on these 19 dividend stocks with yields > 3% that offer reliably high yields and steady payouts for peace of mind in volatile markets.

- Capitalize on emerging trends with these 886 undervalued stocks based on cash flows. Find shares the market has overlooked, primed for a potential price surge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMA

Comerica

Provides financial services in the United States, Canada, and Mexico.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives