- United States

- /

- Banks

- /

- NYSE:CFR

How Investors Are Reacting To Cullen/Frost Bankers (CFR) Upward Net Interest Income Guidance for 2025

Reviewed by Sasha Jovanovic

- Cullen/Frost Bankers, Inc. recently reported strong third-quarter results for 2025, highlighted by a rise in net income to US$174.38 million and an upward revision of its full-year net interest income growth guidance to 7–8%.

- This marks a shift in management's outlook, indicating improved performance expectations for the year and potentially stronger underlying business momentum.

- We'll explore how the revised net interest income guidance could influence Cullen/Frost Bankers' investment narrative and long-term outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Cullen/Frost Bankers Investment Narrative Recap

An investor in Cullen/Frost Bankers needs confidence in the long-term growth of the Texas economy and the bank’s ability to drive profitable loan and deposit growth amid regional expansion. The latest upward revision in full-year net interest income guidance provides a modest boost to near-term earnings potential, but does not fundamentally change the most pressing risk: heightened sensitivity to regional economic volatility, which remains an important consideration for shareholders.

Among recent announcements, the decline in quarterly net charge-offs to US$6.59 million compared to the prior year stands out as a positive development. This supports the short-term catalyst of stable credit quality and underwriting discipline, potentially offsetting some concerns about credit risks linked to concentrated regional exposures and economic cyclicality.

However, investors should also be aware that, despite the improved guidance, expense growth linked to ongoing branch expansion and technology upgrades remains elevated and...

Read the full narrative on Cullen/Frost Bankers (it's free!)

Cullen/Frost Bankers is projected to reach $2.4 billion in revenue and $596.4 million in earnings by 2028. This outlook relies on annual revenue growth of 4.6%, but earnings are expected to decrease slightly by $0.3 million from the current $596.7 million.

Uncover how Cullen/Frost Bankers' forecasts yield a $137.47 fair value, a 12% upside to its current price.

Exploring Other Perspectives

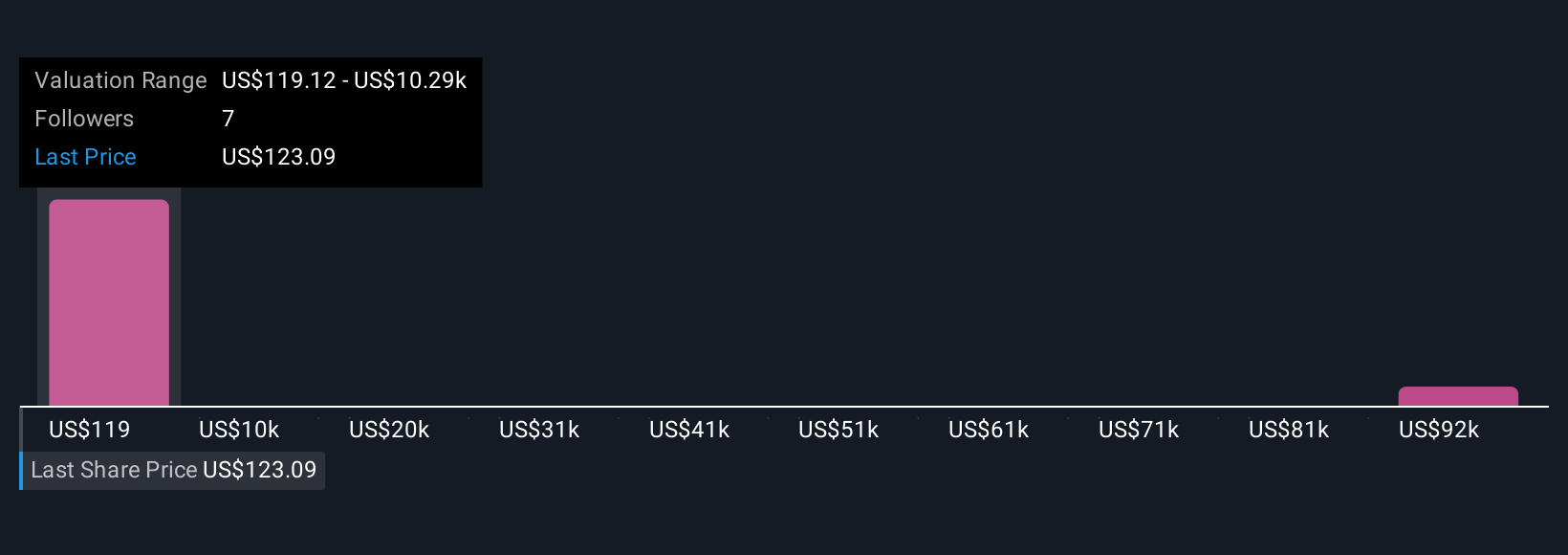

Simply Wall St Community members provided four fair value estimates for Cullen/Frost Bankers ranging from US$119.12 to US$101,835.18. Many see promise in the ongoing credit quality improvement, but a concentrated regional footprint may influence long-term outcomes.

Explore 4 other fair value estimates on Cullen/Frost Bankers - why the stock might be a potential multi-bagger!

Build Your Own Cullen/Frost Bankers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cullen/Frost Bankers research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cullen/Frost Bankers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cullen/Frost Bankers' overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CFR

Cullen/Frost Bankers

Operates as the bank holding company for Frost Bank that provides commercial and consumer banking services in Texas.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives