- United States

- /

- Banks

- /

- NYSE:CFG

Citizens Financial Group (CFG): Evaluating Valuation Following Strong Earnings and New Share Buyback Announcement

Reviewed by Simply Wall St

Citizens Financial Group (CFG) posted third-quarter earnings that topped expectations, supported by higher net interest and non-interest income. Credit quality also saw improvement, with fewer net charge-offs and non-accrual loans reported.

See our latest analysis for Citizens Financial Group.

Citizens Financial Group’s upbeat earnings and plans to buy back $125 million in shares have put a spotlight on the company, feeding into a steady recovery trend. While the latest price return is a robust 15.67% year-to-date, the 13.71% total shareholder return over twelve months and nearly 40% over three years signal that momentum is building for long-term investors, even as risk perceptions shift with each new quarter.

If strong fundamentals and renewed buyback activity have you looking beyond the banks, consider using this opportunity to discover fast growing stocks with high insider ownership.

The question now is whether Citizens Financial Group’s strong outlook and discounted share price present a compelling entry point, or if the market has already factored in the expected wave of growth.

Most Popular Narrative: 18.4% Undervalued

With Citizens Financial Group closing at $50.43 and the most widely followed narrative setting fair value at $61.83, bulls see pricing upside that could surprise many. The narrative builds on expectations for robust future earnings and structural changes underway at the bank.

The build-out of Citizens' Private Bank and expansion into high-growth markets (New York Metro, Florida, California) is scaling well, with rising deposits, robust loan growth, and an increasing share of fee-based assets under management. This is likely to provide sustainable revenue diversification and accretive impacts to net earnings and ROE over the next several years.

Want to decode what powers such a bullish outlook? There are bold forecasts for future profits, rising margins, and a shrinking PE ratio, all fueling this fair value prediction. Find out exactly what analysts project for Citizens’ growth engine and how it might justify a premium valuation.

Result: Fair Value of $61.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, commercial real estate exposure and the potential for slower digital transformation could pose real challenges to Citizens Financial Group’s positive outlook.

Find out about the key risks to this Citizens Financial Group narrative.

Another View: Are Multiples Sending a Warning?

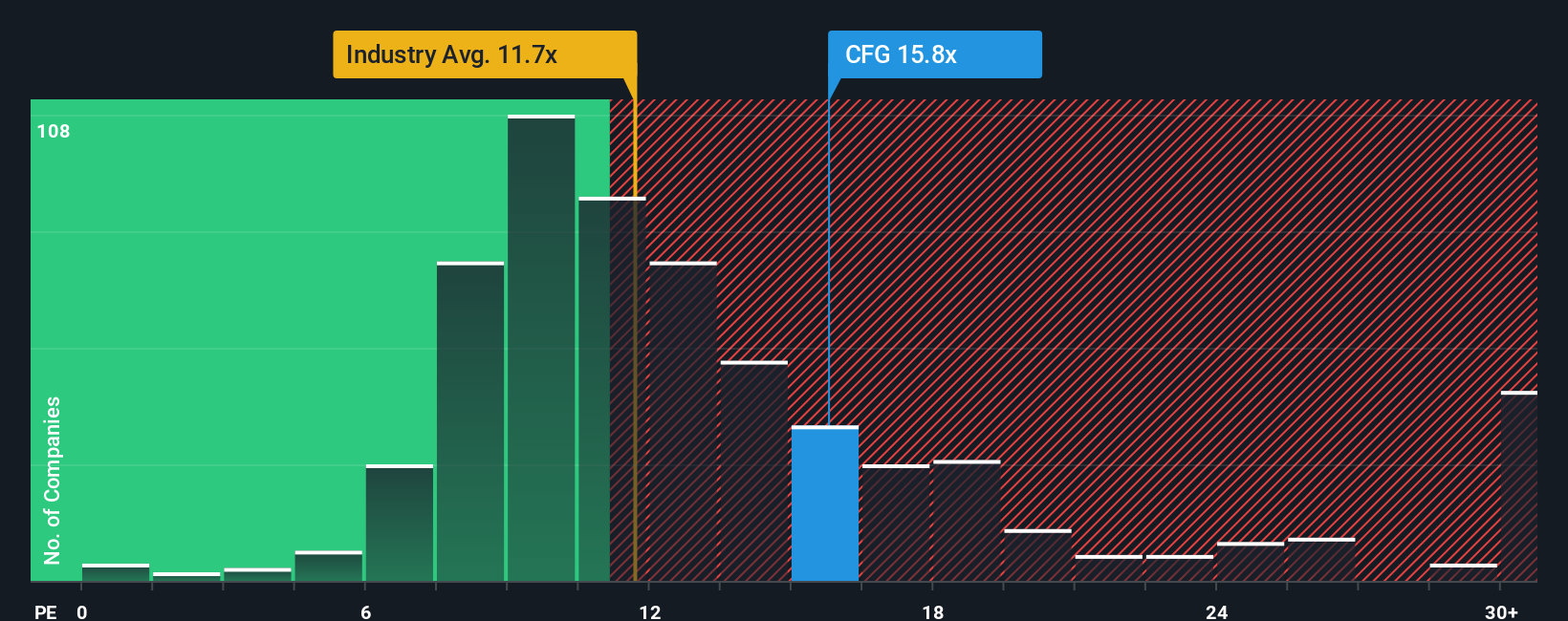

While the fair value narrative points to upside, looking at Citizens Financial Group's price-to-earnings ratio paints a more cautious picture. Trading at 13.8x, it sits above both the US Banks industry average of 10.9x and the peer average, suggesting the stock may be priced for faster growth than the sector overall. Notably, this is still below the fair ratio of 15.7x, which implies a possible value gap if sentiment shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Citizens Financial Group Narrative

If you think the story runs deeper or want to dig into the numbers yourself, crafting your own narrative takes less than three minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Citizens Financial Group.

Looking for More Investment Ideas?

Smart investors never limit themselves to just one stock. Take charge of your portfolio by tapping into new opportunities where future growth, income, or innovation await.

- Maximize your passive income by tracking these 18 dividend stocks with yields > 3% offering high yields and consistent payouts for steady returns.

- Get ahead of the curve with these 27 AI penny stocks that power real-world solutions from automation to predictive analytics.

- Strengthen your portfolio's foundation by targeting these 907 undervalued stocks based on cash flows now priced below their true potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CFG

Citizens Financial Group

Operates as the bank holding company that provides retail and commercial banking products and services to individuals, small businesses, middle-market companies, large corporations, and institutions in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives