- United States

- /

- Banks

- /

- NYSE:CBU

Should Community Financial's Santander Branch Acquisition and Deposit Growth Prompt Action From CBU Investors?

Reviewed by Sasha Jovanovic

- Community Financial System, Inc. announced the completed acquisition of seven Santander Bank branches in the Allentown, Pennsylvania area, boosting its footprint in the Greater Lehigh Valley and adding approximately US$553.0 million in customer deposits.

- This move positions Community Bank, N.A. among the region's top five banks and signals a commitment to maintaining customer service continuity by retaining existing staff at the acquired locations.

- We'll explore how the addition of US$553 million in deposits and expanded footprint could reshape Community Financial System's investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Community Financial System Investment Narrative Recap

To be a shareholder in Community Financial System, you have to believe in the firm’s ability to grow its regional banking franchise through branch expansion and deposit growth while managing costs across physical and digital channels. The recent acquisition of Santander Bank’s Allentown branches, adding US$553.0 million in deposits, meaningfully boosts Community Bank’s market presence in the Greater Lehigh Valley and should reinforce its most important near-term catalyst: achieving scale in core deposits. However, this expansion increases execution risk, as integrating new branches while closing others could put pressure on short-term profitability if operating expenses outpace projected synergies.

Among recent developments, the consistent quarterly dividend, most recently at US$0.47 per share with an annualized yield of 3.21%, stands out. This signals the company’s ongoing commitment to rewarding shareholders, but it also comes at a time when noninterest expenses and credit risk may climb due to expansion, adding an extra layer of scrutiny to future earnings stability.

By contrast, even as Community Financial System eyes market share gains, the possibility that heightened competition and expansion costs could squeeze margins is something every investor should be aware of…

Read the full narrative on Community Financial System (it's free!)

Community Financial System's narrative projects $1.0 billion revenue and $328.8 million earnings by 2028. This requires 11.5% yearly revenue growth and a $135.1 million earnings increase from $193.7 million today.

Uncover how Community Financial System's forecasts yield a $67.40 fair value, a 19% upside to its current price.

Exploring Other Perspectives

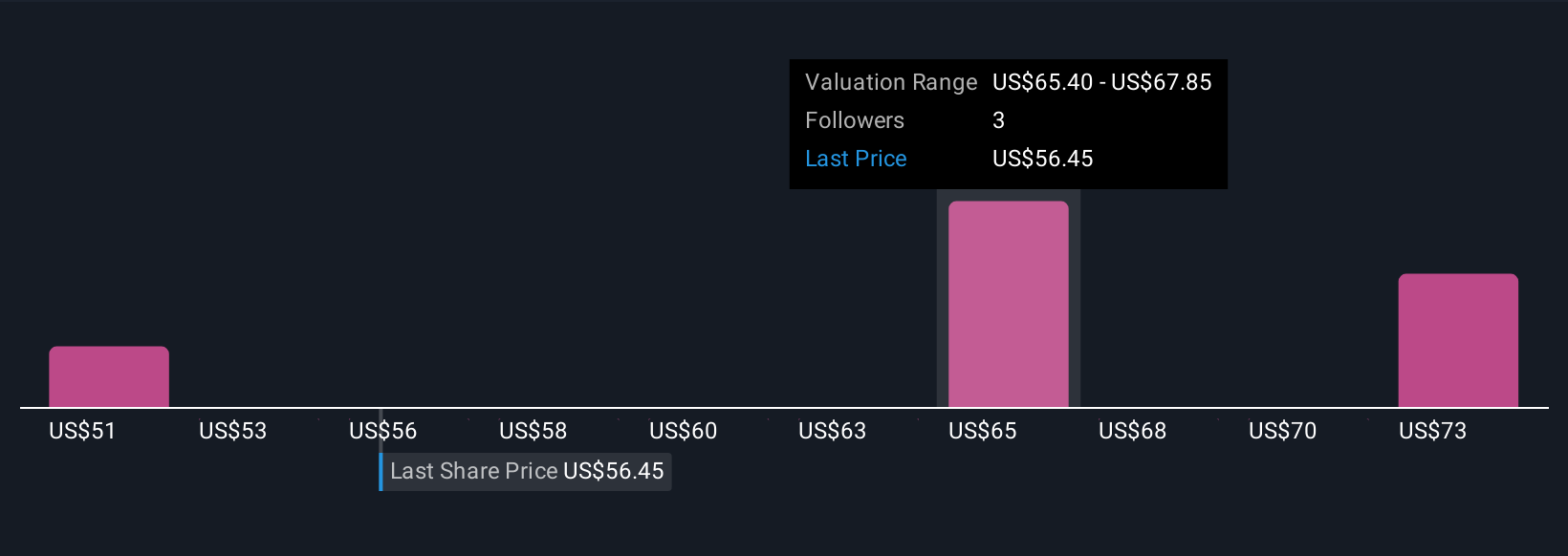

Simply Wall St Community members estimate fair values for Community Financial System stock from US$50.66 to US$75.22, across three analyses. With recent acquisition activity heightening execution risk, you should consider how differing outlooks may reflect broader uncertainty about expense management and near-term earnings.

Explore 3 other fair value estimates on Community Financial System - why the stock might be worth 11% less than the current price!

Build Your Own Community Financial System Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Community Financial System research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Community Financial System research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Community Financial System's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CBU

Community Financial System

Operates as the bank holding company for Community Bank, N.A.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives