- United States

- /

- Banks

- /

- NYSE:CBU

Has Market Volatility Created an Opportunity in Community Financial System After Regulatory Headlines?

Reviewed by Bailey Pemberton

- Wondering if Community Financial System could be a hidden gem or just fairly priced? You're not alone, and today we're putting its value under the microscope.

- The stock has seen some turbulence lately, with a dip of 6.4% in the past week and a year-to-date slide of 12.1%. This suggests shifting views on its growth or risk.

- The latest headlines highlight sector-wide regulatory discussions and interest rate speculation, which have weighed on regional banks like Community Financial System. Local merger rumors and credit quality updates have also influenced investor sentiment and contributed to recent price volatility.

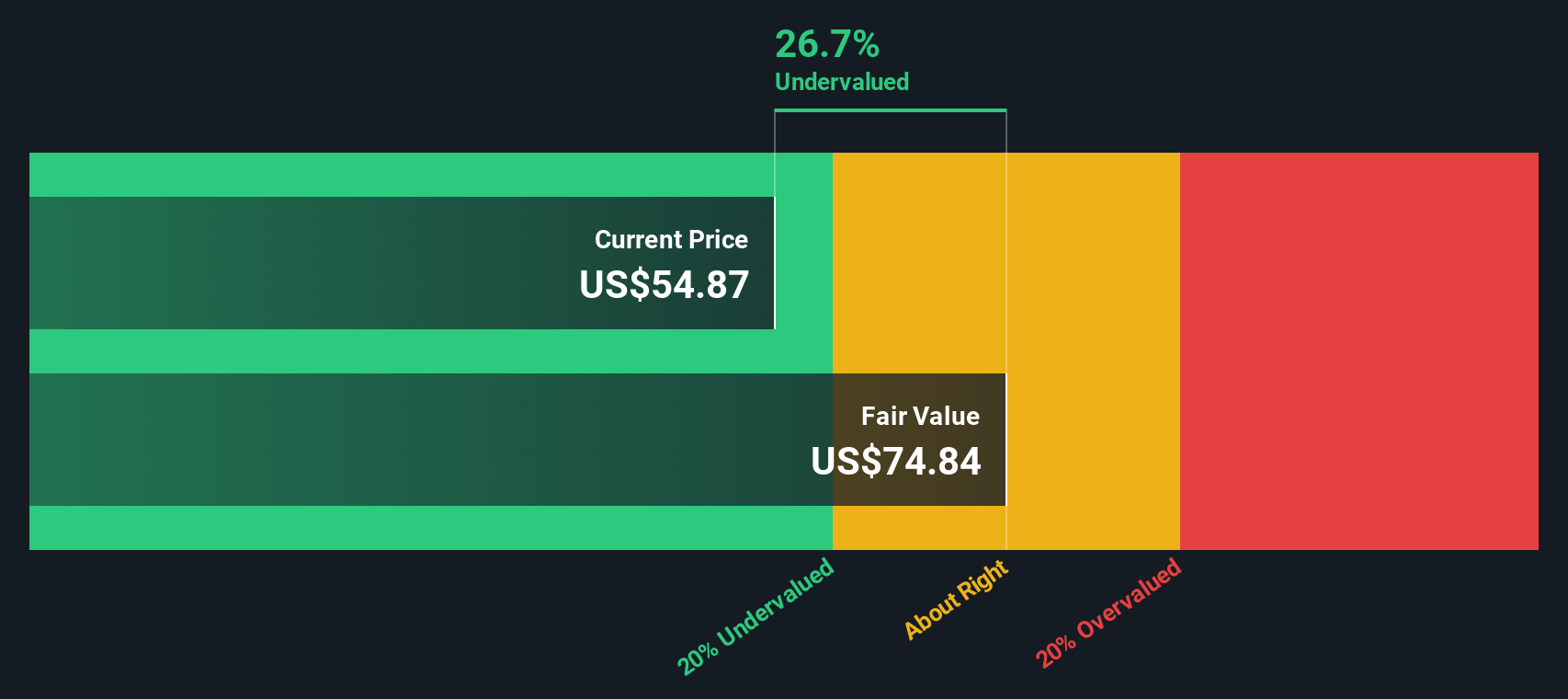

- According to our checks, Community Financial System scores a 4 out of 6 on the value scale. This indicates it is undervalued in several key areas. We will break down what this means using a range of methods, and share a smarter, more holistic way to judge value at the end of the article.

Approach 1: Community Financial System Excess Returns Analysis

The Excess Returns model evaluates a company by considering its ability to earn returns above the required cost of equity. This essentially measures how much additional value the business creates for its shareholders with each dollar of equity invested. This model is especially useful for banks and financial institutions like Community Financial System, where traditional cash flow models may not fully capture performance drivers.

For Community Financial System, key inputs paint a positive picture:

- Book Value: $36.82 per share

- Stable Earnings Per Share (EPS): $4.13 per share (based on the median Return on Equity from the past five years)

- Cost of Equity: $2.87 per share

- Excess Return: $1.26 per share

- Average Return on Equity: 10.00%

- Stable Book Value: $41.26 per share (based on future estimates from analysts)

The Excess Returns assessment calculates an intrinsic value of $75.22 per share. Compared to the current market price, this signals Community Financial System is trading at a notable discount, about 28.7% below its estimated fair value. This suggests that investors may be underappreciating the company's profitability and its ability to generate higher-than-required equity returns.

Result: UNDERVALUED

Our Excess Returns analysis suggests Community Financial System is undervalued by 28.7%. Track this in your watchlist or portfolio, or discover 906 more undervalued stocks based on cash flows.

Approach 2: Community Financial System Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like Community Financial System, as it provides a straightforward way to assess how much investors are paying for each dollar of earnings. Since banks tend to have consistent earnings, the PE ratio offers a clear lens on value, especially compared to less predictable sectors.

It is important to remember that what counts as a "normal" PE ratio is not set in stone. Higher expectations for growth or lower perceived risk typically justify a higher PE, while slower-growing or riskier businesses often command a lower multiple. In the banking industry, these differences are often reflected in comparisons to industry-wide or peer averages.

Currently, Community Financial System trades at a PE of 13.8x, just below the peer average of 14.5x and higher than the broader banking industry’s average of 11.0x. While those benchmarks are useful, Simply Wall St’s proprietary “Fair Ratio” aims to take the analysis a step further. The Fair Ratio for Community Financial System is 12.7x, calculated based on a mix of its recent growth, profitability, risks, market cap, and broader industry factors, not just simple averages.

The Fair Ratio is a more powerful metric because it tailors the expected multiple to the company’s unique profile, rather than assuming all banks or all peers are truly comparable. This approach puts equal weight on real-world performance, sustainable earnings, and potential headwinds.

With the stock’s current PE only slightly above its Fair Ratio (13.8x vs. 12.7x), Community Financial System appears to be valued about right in the market by this method.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1418 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Community Financial System Narrative

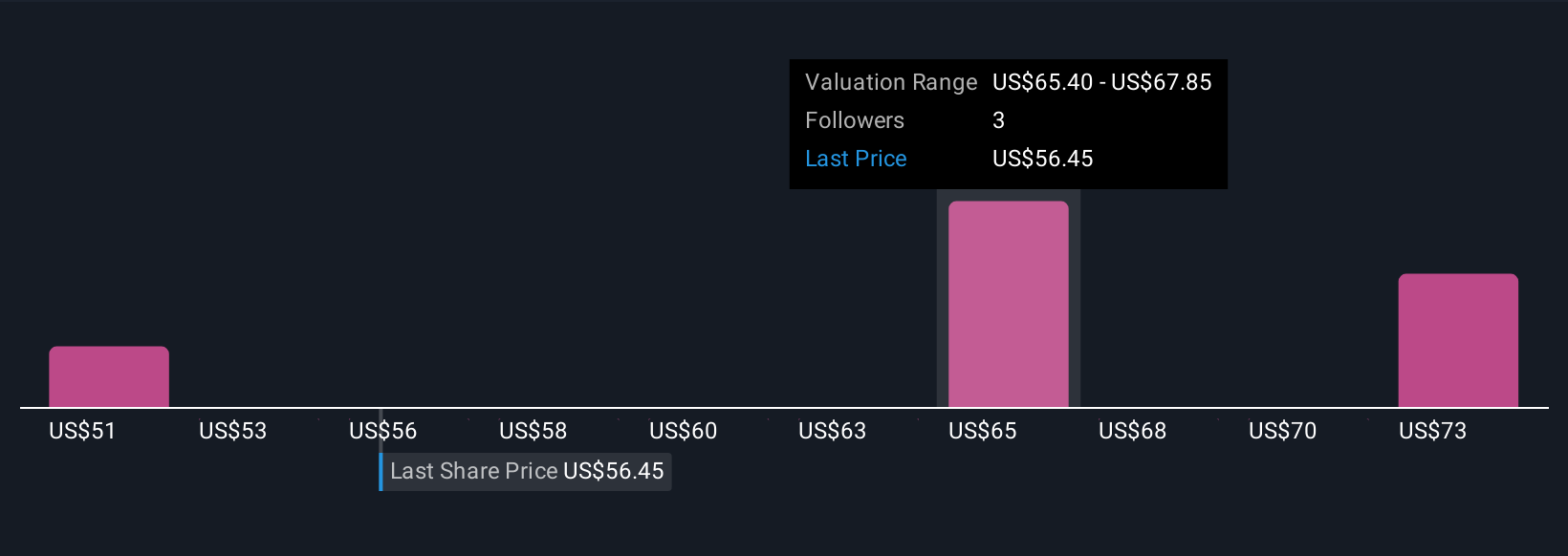

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is more than a number; it is your personal investment story, grounded in your take on a company's future revenue, earnings, profits, and fair value. Narratives connect the dots between what you believe about Community Financial System’s business, your financial forecasts, and the price you think the stock is really worth.

Narratives are simple to create and share using Simply Wall St’s Community page, where millions of investors build and compare their outlooks. With Narratives, you can test your own thesis or explore the perspectives of others, seeing how their stories lead to a different fair value based on varying growth and risk assumptions. They make deciding when to buy or sell easier by lining up each user’s fair value estimate against today’s market price. Best of all, Narratives update automatically when news or earnings are released, so your investment decisions always reflect the latest facts.

For example, a bullish Narrative for Community Financial System expects earnings to reach $328.8 million with a fair value of $67.4, while a more cautious view may see upside capped and current prices as close to fair.

Do you think there's more to the story for Community Financial System? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CBU

Community Financial System

Operates as the bank holding company for Community Bank, N.A.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives