- United States

- /

- Banks

- /

- NYSE:CADE

Cadence Bank (CADE): Valuation Insights as Rate Cut Hopes Lift Banking Sector Confidence

Reviewed by Simply Wall St

Recent remarks from New York Federal Reserve President John Williams about possible rate adjustments sent banking stocks higher. Cadence Bank (CADE) saw its shares climb, which points to investor optimism despite ongoing questions around loan quality across the sector.

See our latest analysis for Cadence Bank.

Cadence Bank’s share price is showing renewed momentum, gaining 8.6% over the past month and now up 17.6% year-to-date. That rally was sparked by excitement around possible interest rate cuts and lower short interest. Total shareholder return over the past year was a more modest 5.9%, with longer-term holders enjoying a striking 79% return over five years.

If rate-driven rallies have you curious about what else is catching investors’ attention, now’s a great time to discover fast growing stocks with high insider ownership

With shares trading just below analyst targets and recent momentum fueled by rate cut hopes, is Cadence Bank still undervalued or are investors already factoring in all of its future growth potential?

Most Popular Narrative: 7.2% Undervalued

Cadence Bank’s most-followed valuation narrative sets a fair value of $42.70, which is roughly 7% above the last close of $39.62. The stage is set for a debate: does the bank’s projected growth truly support that premium?

The ongoing expansion in high-growth Sunbelt markets, particularly Texas and Georgia, continues to drive robust organic loan and deposit growth, supported by population inflows and business activity. This should underpin sustained revenue and net interest income expansion.

Do you want to see what ambitious forecasts are powering this price target? Behind the headline, bold growth assumptions and future margins are shaping this fair value. Uncover the surprising financial projections and find out why the valuation could turn heads on Wall Street.

Result: Fair Value of $42.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing economic conditions in Texas or hurdles with recent acquisitions could limit Cadence Bank’s growth. These factors may challenge today’s optimism around the share price.

Find out about the key risks to this Cadence Bank narrative.

Another View: Multiples Say the Shares Look Pricey

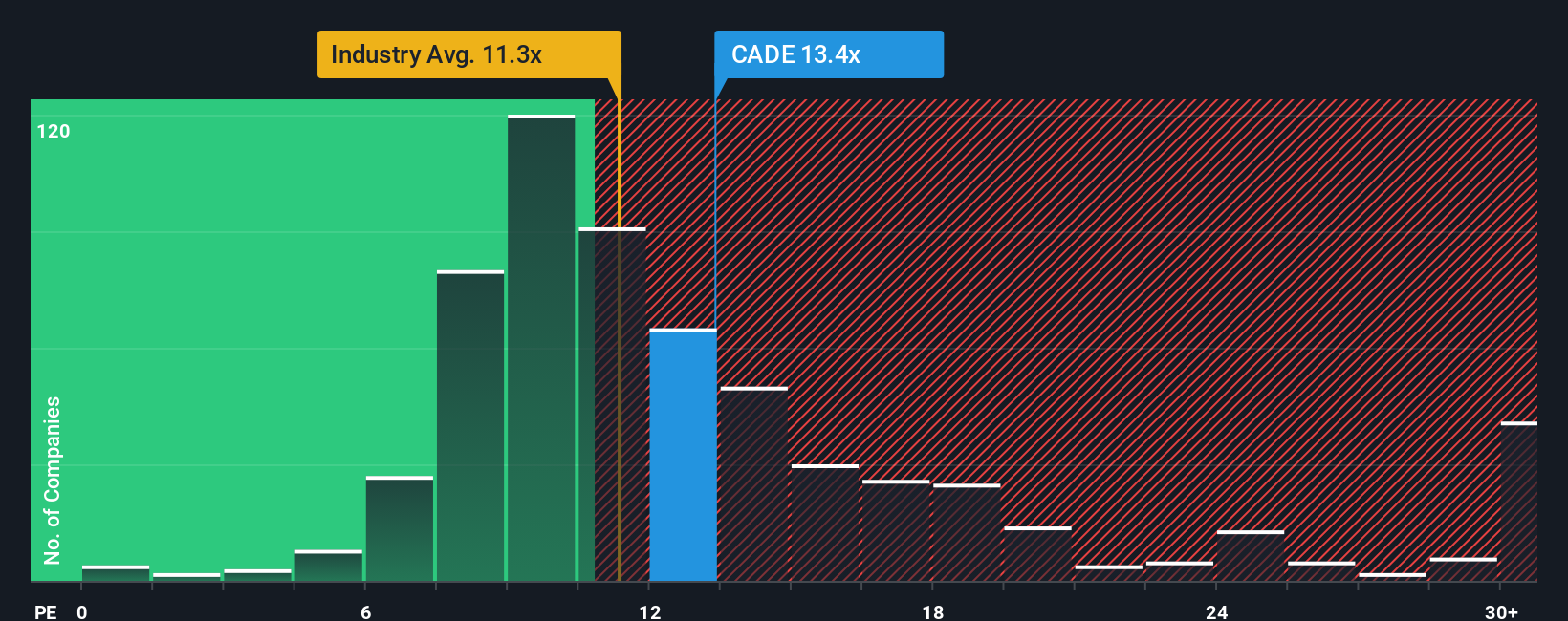

While the main valuation narrative sees Cadence Bank as undervalued, a glance at its price-to-earnings ratio tells a different story. The shares trade at 14.2 times earnings, noticeably higher than the industry average of 11.2 and above the fair ratio of 13.3. This suggests investors are already paying a premium, which could raise the bar for future growth. Could this premium signal opportunity, or does it expose investors to greater downside risk if growth expectations are not met?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cadence Bank Narrative

If you want to dig deeper or see things from a different angle, it only takes a few minutes to shape your own fair value case. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Cadence Bank.

Looking for more investment ideas?

Stop waiting on the sidelines while savvy investors spot the next big opportunity. Use these handpicked screens to supercharge your research and boost your portfolio's potential today.

- Start building wealth with reliable income by checking out these 14 dividend stocks with yields > 3%, which features strong yields from companies powering your dividends above 3%.

- Tap into breakthrough technologies that are poised to change healthcare forever, thanks to these 30 healthcare AI stocks driving innovation across medicine and medical devices.

- Catch high-growth trends before the crowd by targeting these 26 AI penny stocks, which are shaping tomorrow's AI-powered industries right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CADE

Cadence Bank

Provides commercial banking and financial services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success