- United States

- /

- Banks

- /

- NYSE:C

While Citigroup Inc. (NYSE:C) is Cheaper than the Other Banks, Slower than Market Growth may be the Reason

The earnings report comes out today for many large cap banks and financial institutions including: Citigroup ( NYSE:C ), Bank of America ( NYSE:BAC ), Wells Fargo ( NYSE:WFC ), BlackRock ( NYSE:BLK ). By taking a look at their Price to Earnings ratio, we will get insight into their performance.

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 20x, you may consider Citigroup Inc. ( NYSE:C ) as a highly attractive investment with its 9.3x P/E ratio.

We must see if this ratio is low for a reason, compare it to other companies in the related industry and see if there is future potential.

Citigroup could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth.

The P/E is probably low because investors think this poor earnings performance isn't going to get any better, or that their profit is based on a high amount of risk. Specifically (in their Q1 presentation) , Citi's Global Consumer Banking (GCB) consisted of 64% inflows from the USA, and within the developed markets' category, 68% are inflows from "Cards", which means that setting aside the use of credit cards as a preference, a drop in this segment may signal downward consequences in the general purchasing power for consumers.

This and other factors all put pressure on a stock's P/E and should be viewed with caution.

As a first step, in the chart below we compare the P/E from Citi, with that of the banking sector and the US market.

See our latest analysis for Citigroup

NYSE:C Price Based on Past Earnings July 14th 2021

Keen to find out how analysts think Citigroup's future stacks up against the industry? In that case, our free report is a great place to start .

The results paint an encouraging picture for investors, as Citi seems to be trading at 9.3x their current earnings, well below the US market 19.1x and a bit lower than the industry's 11.7x.

To justify this, Citi must have a stable or growing earnings base, and looking at their growth is our next step.

How Is Citigroup's Growth Trending?

Citigroup's P/E ratio would be typical for a company that's expected to deliver little growth or even falling earnings. However, having in mind that Citi has a 23.5% profit margin for the last trailing twelve months in Q1, we can see why investors would be interested in Citi even without the high growth.

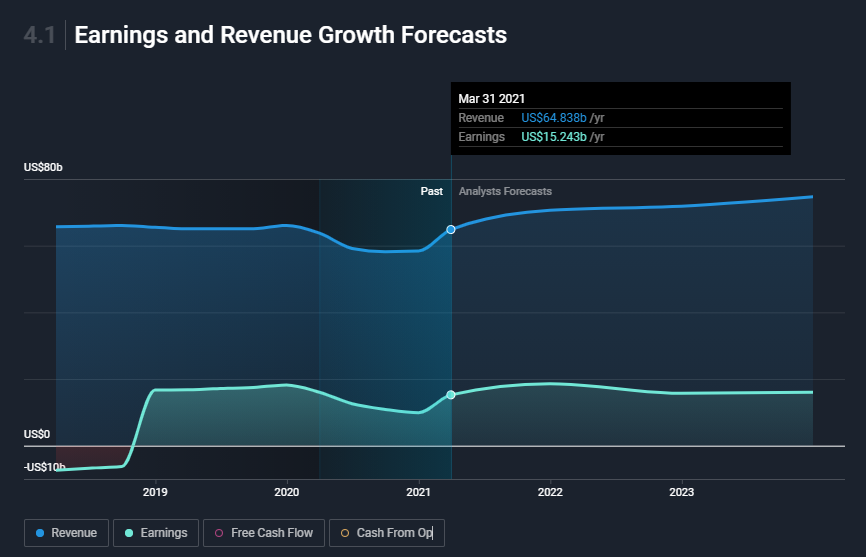

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before.The longer-term trend has been no better, as the company has no earnings growth to show for over the last three years either.Accordingly, revenues were slowly declining from 2015, with a dip and recovery in 2020.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 3.6% each year over the next three years.With the market predicted to deliver 14% growth per year, the company is positioned for a weaker earnings result.

NYSE:C, Past and estimated future revenues and earnings, pre-earnings release 14 July 2021

In light of this, it's understandable that Citigroup's P/E sits below the majority of other companies.It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

Peer Comparison

Sometimes it is good to take a step back from all the positive coverage and look at the big picture.

In order to get a better reference of performance, we selected a sample of large cap financial institutions and looked at how they compare against Citi:

| Company: | Citigroup | Bank of America | Wells Fargo | BlackRock |

| Price to Earnings | 9.3 | 17 | 30 | 26.1 |

| Price to Book | 0.8 | 1.4 | 1.1 | 3.9 |

| Revenue Growth Estimate (annual) | 2.5% | 3.7% | 2.1% | 7% |

From the chart above, it seems that investors are attracted to BlackRock's growth and are willing to pay a higher price for earnings.

Wells Fargo seems like a mixed result where investors are holding at a high P/E - perhaps they are satisfied with their business model or other factors, but the numbers demand further analysis.

Bank of America shows a good mix of growth and price.

Finally, Citi seems to be cheaper both on a P/E and Price to Book basis, compared to its peers. The drawback is a low expected growth. Whatever Citi posts on today's earnings can be encouraging for different types of investors. Contrarians may wish for a negative surprise and wait for a drop post earnings. Long investors might invest at their first opportunity and hope the market picks up.

One more thing worth mentioning again, Citi might have different risks associated with the stock and business model, that is why we strongly encourage you to take a look both at their annual reports and also our risk check . Case in point, we've spotted 2 warning signs for Citigroup you should be aware of, and 1 of them is a bit unpleasant.

Conclusion

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument, but rather to gauge current investor sentiment and future expectations.

For long, value investors the current P/E may be sending an attractive signal that is worth exploring on earnings day, where we expect to see a higher trading volume.

When analyzing Citi, we should not rely on a single metric, but do our best to bring together insight from the past and future performance, profit margins, risk and other factors, when deciding if the stock price is justified.

You might be able to find a better investment than Citigroup. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a P/E below 20x (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:C

Citigroup

A diversified financial service holding company, provides various financial product and services to consumers, corporations, governments, and institutions.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives