- United States

- /

- Banks

- /

- NYSE:C

Citi’s Leadership Shift and Business Integration Could Be a Game Changer for Citigroup (C)

Reviewed by Sasha Jovanovic

- Citigroup recently announced the transition of Mark Mason from Chief Financial Officer to Executive Vice Chair and the integration of its U.S. Retail Bank into the Wealth business, with leadership changes affecting key business segments.

- This broad reorganization seeks to unify management and streamline operations, with the goal of improving Citi’s efficiency and sharpening its competitive focus in the U.S. market.

- We’ll review how Citi’s management transition and consolidation of its retail and wealth businesses could affect the company’s investment outlook.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Citigroup Investment Narrative Recap

To be a Citigroup shareholder, you need to believe the bank’s global transaction platform, digital transformation, and capital return strategy will generate value as Citi adapts to changing client needs and competition. The recent management changes and the integration of U.S. Retail into Wealth may help sharpen execution on these priorities, but are unlikely to materially affect the core short-term catalysts, growing digital payments and expense efficiency, or the major risk of persistent transformation and compliance costs.

Among recent developments, the move to unify Citi’s U.S. retail and wealth management businesses under one experienced leadership team stands out. This consolidation aims to create more synergy across client segments and may help Citi more efficiently prioritize investment, acquisition, and deposit growth efforts, key factors as the company targets better cost control and improved returns.

In contrast, investors should keep in mind the ongoing challenge of regulatory scrutiny and transformation costs...

Read the full narrative on Citigroup (it's free!)

Citigroup's narrative projects $88.8 billion in revenue and $17.2 billion in earnings by 2028. This requires 6.8% yearly revenue growth and a $4.3 billion earnings increase from $12.9 billion today.

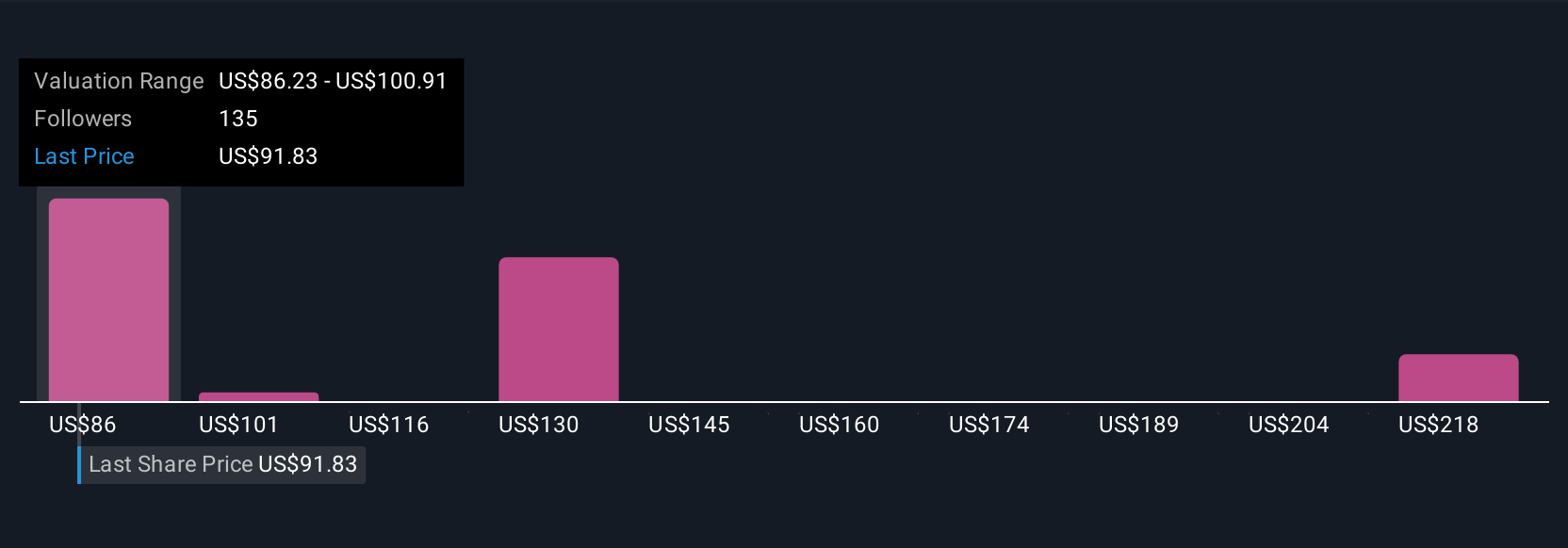

Uncover how Citigroup's forecasts yield a $114.10 fair value, a 11% upside to its current price.

Exploring Other Perspectives

While consensus analysts see steady but modest growth ahead, the more optimistic forecasts called for Citigroup's annual revenue to rise to US$91.3 billion and earnings to hit US$20.0 billion by 2028, largely hinging on success in cost management and digital expansion. These bolder expectations highlight just how much investor opinions on Citi can differ. As recent executive and business reorganizations come into play, it’s worth asking how these views may shift next, explore several alternate perspectives to understand what matters most for your investment approach.

Explore 12 other fair value estimates on Citigroup - why the stock might be worth 26% less than the current price!

Build Your Own Citigroup Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Citigroup research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Citigroup research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Citigroup's overall financial health at a glance.

No Opportunity In Citigroup?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:C

Citigroup

A diversified financial service holding company, provides various financial product and services to consumers, corporations, governments, and institutions.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success