- United States

- /

- Banks

- /

- NYSE:BOH

Is Rising Regional Bank Loan Stress Reshaping the Investment Case for Bank of Hawaii (BOH)?

Reviewed by Sasha Jovanovic

- Recent disclosures from Zions Bancorp and Western Alliance Bancorp about loan charge-offs and collateral issues have sparked concerns around deteriorating loan quality in the regional banking sector.

- These developments have intensified discussions among investors about heightened risks associated with commercial real estate lending and the potential for increased loan losses at other regional banks, including Bank of Hawaii.

- We'll now assess how these elevated concerns around regional bank loan quality could reshape Bank of Hawaii's investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Bank of Hawaii Investment Narrative Recap

Being a shareholder in Bank of Hawaii requires confidence in the resilience of Hawaii’s local economy, stable real estate values, and the bank’s ability to manage risk in a concentrated market. Recent headlines about charge-offs and asset quality at other regional banks have raised short-term caution industry-wide, putting extra focus on Bank of Hawaii’s real estate-linked loan book, though at present, reported credit metrics suggest the impact is not material for the bank.

Against this backdrop, Bank of Hawaii’s Q2 2025 announcement stands out: the bank reported $2.6 million in net loan and lease charge-offs, actually down from the prior quarter, providing near-term reassurance about asset quality. However, with sector concerns shifting, this remains a closely watched area as loan performance across regional peers comes under greater scrutiny.

In contrast, investors should be aware that Bank of Hawaii’s high geographic and property market concentration exposes it to local downturns or sudden shifts...

Read the full narrative on Bank of Hawaii (it's free!)

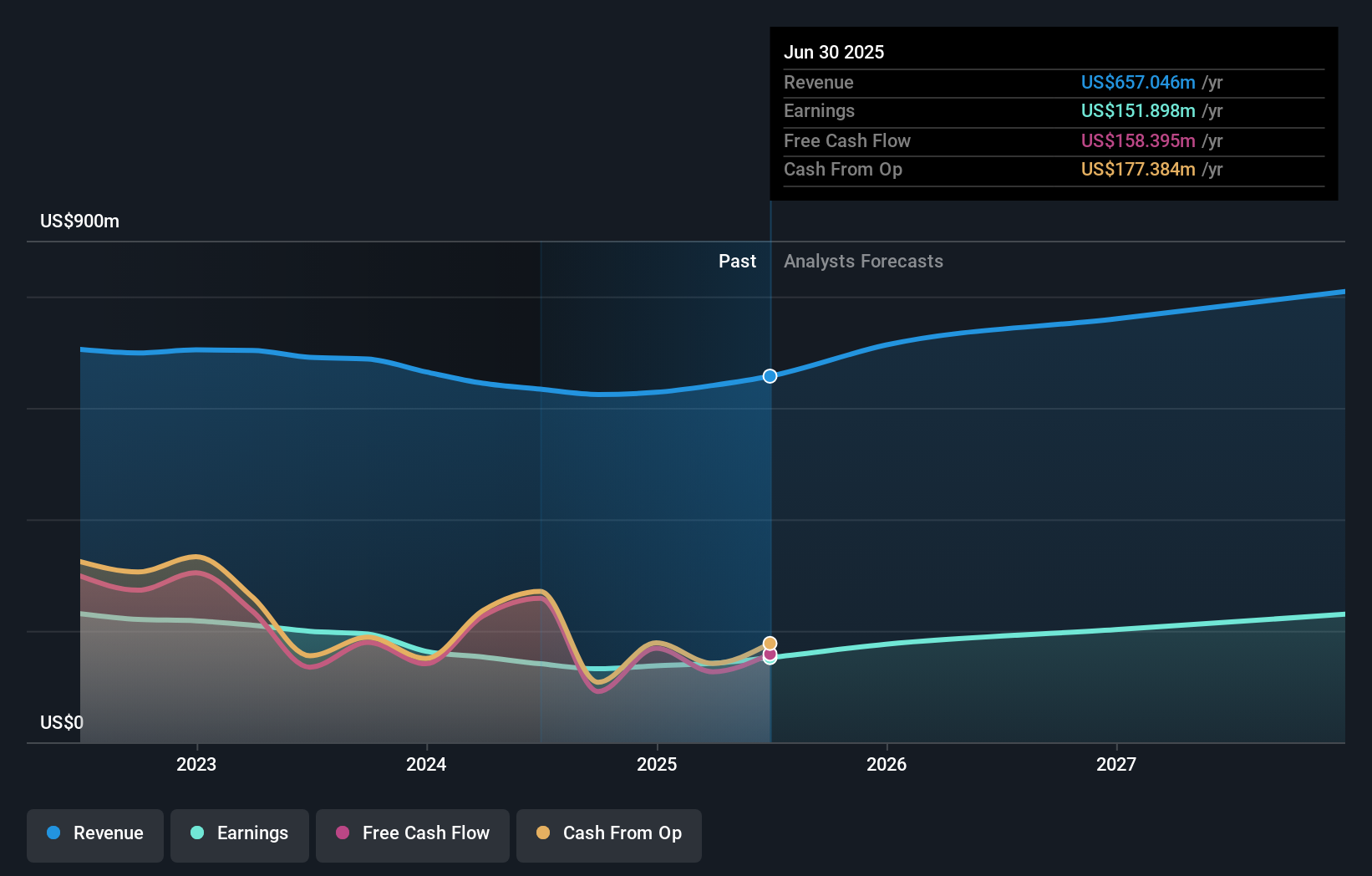

Bank of Hawaii's narrative projects $850.6 million revenue and $251.7 million earnings by 2028. This requires 9.0% yearly revenue growth and a $99.8 million earnings increase from $151.9 million.

Uncover how Bank of Hawaii's forecasts yield a $70.50 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Private investors in the Simply Wall St Community offered BOH fair value estimates from US$70.50 to US$106,031.19, based on two distinct forecasts. While such wide-ranging views exist, ongoing attention to the bank’s exposure to Hawaii’s property market could sway opinions even further.

Explore 2 other fair value estimates on Bank of Hawaii - why the stock might be a potential multi-bagger!

Build Your Own Bank of Hawaii Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bank of Hawaii research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Bank of Hawaii research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bank of Hawaii's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Hawaii might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BOH

Bank of Hawaii

Operates as the bank holding company for Bank of Hawaii that provides various financial products and services in Hawaii, Guam, and other Pacific Islands.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives