- United States

- /

- Banks

- /

- NYSE:BOH

Bank of Hawaii (BOH): Assessing Valuation Following New Financial Assistance Initiatives for Federal Workers

Reviewed by Simply Wall St

Bank of Hawaii (BOH) is rolling out new financial assistance programs for federal employees and contractors dealing with income disruptions. These measures include flexible loan options, forbearance on mortgages, extensions on existing loans, and waived fees.

See our latest analysis for Bank of Hawaii.

After a rocky stretch in 2024, Bank of Hawaii's 1-year total shareholder return is down just 1.6 percent, which is a much smaller decline than its year-to-date share price drop of 11.8 percent. News of fresh financial assistance programs could help shift momentum, signaling the bank's commitment to stability and community support even as the stock remains in a broader holding pattern.

If you’re curious where opportunity might be building next, consider expanding your search to discover fast growing stocks with high insider ownership.

But with Bank of Hawaii trading at a notable discount to analyst price targets and showing recent revenue and income growth, investors must ask if the current share price truly reflects its long-term potential or if a compelling buy opportunity is hiding in plain sight.

Most Popular Narrative: 12.3% Undervalued

With Bank of Hawaii’s most widely followed narrative placing fair value above the last close price, there is a clear gap between analyst-driven fundamentals and current market sentiment. This sets the scene for a deeper look into the forces shaping that assessment.

Deepening customer relationships and expansion in wealth management and trust services are leveraging the aging and increasingly affluent population, resulting in steady growth of non-interest (fee) income and greater revenue diversification.

Curious about the factors boosting that valuation? The narrative relies on a rise in profitability driven by demographic trends and new income streams. What is fueling such optimistic projections, and how aggressive are the underlying assumptions? Find out what could truly set Bank of Hawaii apart from its peers by exploring the full story.

Result: Fair Value of $70.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on Hawaii's real estate market and potential shifts in local economic conditions could present challenges to these optimistic expectations for Bank of Hawaii's growth.

Find out about the key risks to this Bank of Hawaii narrative.

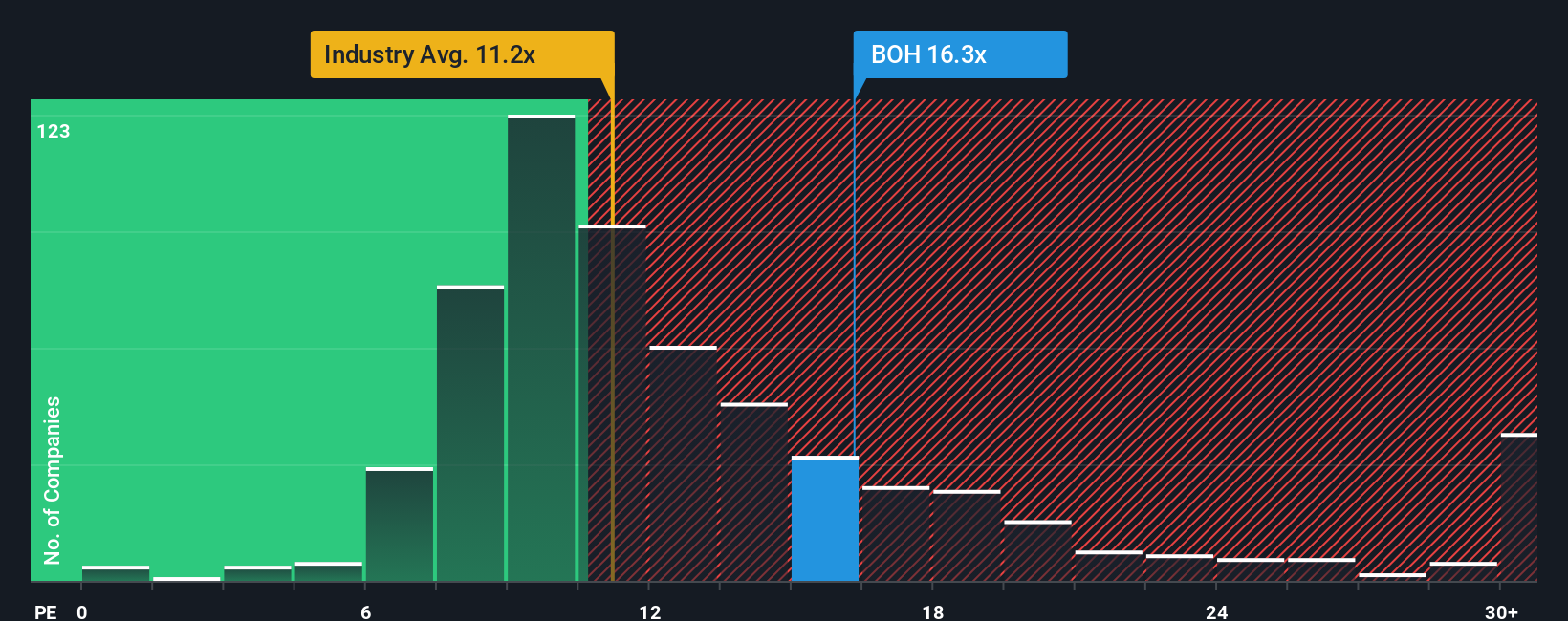

Another View: Looking at Price-to-Earnings

Taking a different angle, Bank of Hawaii currently trades at a price-to-earnings ratio of 16.2 times, which is above the US Banks industry average of 11.3 and its own fair ratio of 13.5. Compared to similar peers, the difference is small, but the higher-than-industry multiple hints at potential overvaluation based on this method. Is the market too optimistic, or does Bank of Hawaii truly warrant this premium given recent growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bank of Hawaii Narrative

If you’re looking for a fresh perspective or want to chart your own course using the underlying data, you can shape your own view in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Bank of Hawaii.

Looking for more investment ideas?

Take your strategy to the next level by searching for stocks with momentum, untapped value, or a specialized growth story using the Simply Wall Street Screener. Opportunities like these rarely last, so set your sights on what could be your next smart move:

- Capitalize on digital disruption by evaluating these 24 AI penny stocks making waves with artificial intelligence across global markets.

- Boost your income and protect your portfolio with these 17 dividend stocks with yields > 3% that deliver reliable yields above 3 percent. This can be ideal for steady long-term growth.

- Supercharge your watchlist with these 872 undervalued stocks based on cash flows that our models suggest may be trading well below their intrinsic worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Hawaii might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BOH

Bank of Hawaii

Operates as the bank holding company for Bank of Hawaii that provides various financial products and services in Hawaii, Guam, and other Pacific Islands.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives