- United States

- /

- Banks

- /

- NYSE:BAP

Credicorp Ltd. Just Missed Revenue By 42%: Here's What Analysts Think Will Happen Next

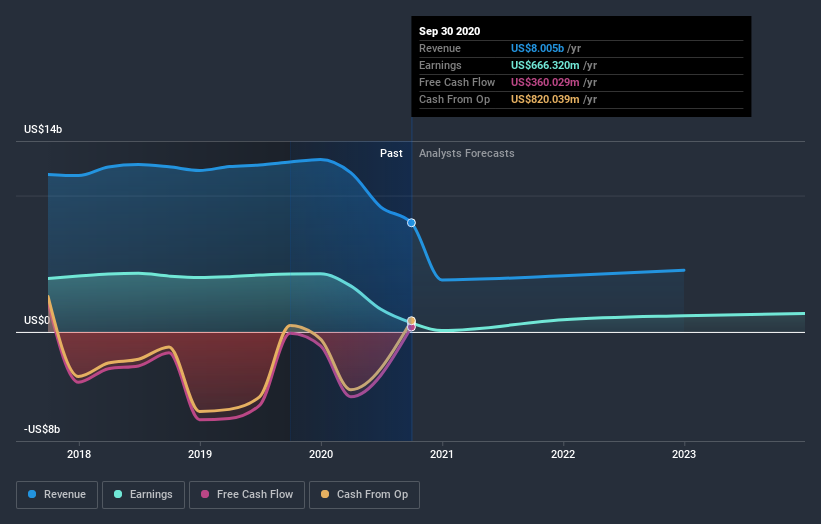

It's been a good week for Credicorp Ltd. (NYSE:BAP) shareholders, because the company has just released its latest annual results, and the shares gained 8.0% to US$166. Credicorp reported a serious revenue miss, with sales of US$8.0b falling a huge 42% short of analyst estimates. The bright side is that statutory earnings per share of US$4.34 were in line with forecasts. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

Check out our latest analysis for Credicorp

Taking into account the latest results, the current consensus, from the ten analysts covering Credicorp, is for revenues of US$4.11b in 2021, which would reflect a substantial 49% reduction in Credicorp's sales over the past 12 months. Per-share earnings are expected to shoot up 34% to US$11.21. Yet prior to the latest earnings, the analysts had been anticipated revenues of US$15.0b and earnings per share (EPS) of US$41.01 in 2021. It looks like sentiment has declined substantially in the aftermath of these results, with a pretty serious reduction to revenue estimates and a pretty serious reduction to earnings per share numbers as well.

Despite the cuts to forecast earnings, there was no real change to the US$174 price target, showing that the analysts don't think the changes have a meaningful impact on its intrinsic value. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values Credicorp at US$200 per share, while the most bearish prices it at US$134. As you can see, analysts are not all in agreement on the stock's future, but the range of estimates is still reasonably narrow, which could suggest that the outcome is not totally unpredictable.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. These estimates imply that sales are expected to slow, with a forecast revenue decline of 49%, a significant reduction from annual growth of 0.5% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 6.9% annually for the foreseeable future. It's pretty clear that Credicorp's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. On the negative side, they also downgraded their revenue estimates, and forecasts imply revenues will perform worse than the wider industry. The consensus price target held steady at US$174, with the latest estimates not enough to have an impact on their price targets.

With that in mind, we wouldn't be too quick to come to a conclusion on Credicorp. Long-term earnings power is much more important than next year's profits. We have forecasts for Credicorp going out to 2022, and you can see them free on our platform here.

Don't forget that there may still be risks. For instance, we've identified 3 warning signs for Credicorp that you should be aware of.

If you decide to trade Credicorp, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:BAP

Credicorp

Provides various financial, insurance, and health services and products primarily in Peru and internationally.

Undervalued established dividend payer.