- United States

- /

- Banks

- /

- NYSE:BAC

Bank of America (NYSE:BAC) Looks Undervalued at the Start of a Rate Hike Cycle

Bank of America Corporation (NYSE: BAC) posted another positive earnings report, slightly surprising on the upside.

While inflation pressures the broad economy, it forces monetary tightening, providing a tailwind for financial institutions since it boosts their net interest income.

See our latest analysis for Bank of America

Q1 2022 Earnings Results

- Total revenue: US$23.2b (+1.7% Y/Y)

- Net income: US$0.8 per share (beat by US$0.05)

- Total loan balances excluding PPP: US$974b

Performance by divisions

- Consumer Banking: US$8.8b (+9% Y/Y)

- Global Wealth and Investment Management: US$5.5b (+10% Y/Y)

- Global Banking: US$5.2b (+12% Y/Y)

- Global Markets: US$5.3b (-15% Y/Y)

What Does This Mean for Investors?

Bank of America exceeding analyst expectations isn't huge news. In the recent past, the last time that didn't happen was in April 2020, after a pandemic-related market crash.

CEO Brian Moynihan noted that the bank grew revenue while reducing costs. Furthermore, he stated that the deposits and loans grew, along with solid investment flows and trading profits. These are commendable results during the quarter with a significant geopolitical conflict. But, we have to zoom in on the net interest income growth.

By definition, net interest income growth is the difference between revenues generated by interest-bearing assets and the cost of servicing liabilities. In Bank of America's case, these assets can be loans (personal or commercial) or mortgages, while liabilities will primarily be deposits.

In Q1, net interest income grew by 13%, and per Mr.Moynihan, it could increase significantly from here – boosting the bank's returns.

Meanwhile, St.Louis Fed President James Bullard, one of the stronger proponents of higher-than-regular (25bps) interest rate hikes, said he wouldn't rule out a 75 basis-point increase. Mr.Bullard added that the fed funds rate should go up to 3.5% at a minimum by the end of this year. While banks react to rate hikes by increasing the yield from deposits, higher interest rates certainly give them a better bottom line, providing a bigger leeway to run their operations.

What is BAC stock worth at the moment?

At a price-to-earnings (P/E) ratio of 10.58x, Bank of America trades slightly above the sector, which averages at 10.1x. While these valuations seem low, we must remember that the financial industry didn't fare well in the prolonged low-interest-rate environment.

To calculate the bank's intrinsic value, we look at the dividends per share (DPS) approach. We use the Gordon Growth Model, which assumes dividends will grow into perpetuity at a rate that can be sustained. The dividend is expected to grow at an annual growth rate equal to the 5-year average of the 10-year government bond yield of 1.9%.

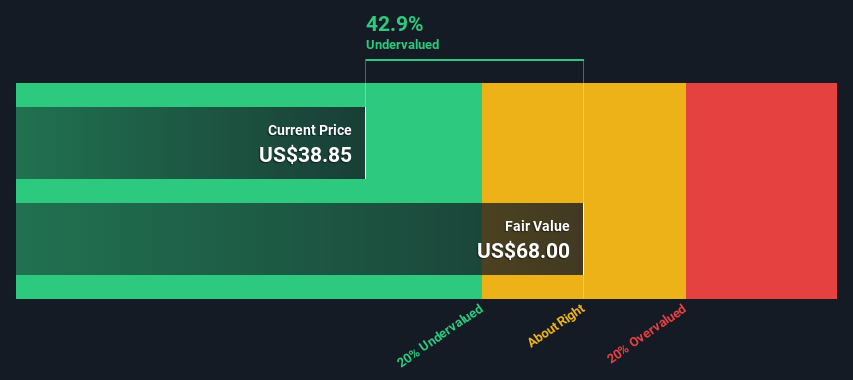

We then discount this figure to today's value at the cost of equity of 6.7%. Compared to the current share price of US$38.9, the company appears relatively undervalued at a 43% discount to where the stock price trades currently. Remember, though, that this is just an approximate valuation.

Value Per Share = Expected Dividend Per Share / (Discount Rate - Perpetual Growth Rate)

= US$1.0 / (6.7% – 1.9%)

= US$68.0

Looking Ahead:

The latest developments indicate that the Bank of America has positive catalysts going into the rate hike cycle. While the stock trades in line with the rest of the sector, our valuation seems optimistic given the general market sentiment.

While important, the DCF calculation shouldn't be the only metric you look at when researching a company since the DCF model is not a perfect stock valuation tool. Thus, there are other considerations to make.

For Bank of America, we've put together three pertinent factors you should look at:

- Risks: Case in point, we've spotted 2 warning signs for Bank of America you should be aware of.

- Management: Have insiders been ramping up their shares to take advantage of the market's sentiment for BAC's future outlook? Check out our management and board analysis with insights on CEO compensation and governance factors.

- Other Solid Businesses: Low debt, high returns on equity, and good past performance are fundamental to a strong business. Why not explore our interactive list of stocks with solid business fundamentals to see if there are other companies you may not have considered!

PS. The Simply Wall St app conducts a discounted cash flow valuation for every stock on the NYSE every day. If you want to find the calculation for other stocks, just search here.

Valuation is complex, but we're here to simplify it.

Discover if Bank of America might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:BAC

Bank of America

Through its subsidiaries, provides various financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives