- United States

- /

- Banks

- /

- NYSE:BAC

Bank of America (NYSE:BAC) Declares US$1.75 Dividend on Series B Preferred Stock and US$0.26 on Common Stock

Reviewed by Simply Wall St

Bank of America (NYSE:BAC) recently announced dividends on its preferred and common stock, affirming its financial stability and shareholder commitment. Over the last week, Bank of America shares rose 4%, mirroring the broader market's upward trend amid positive earnings reports and anticipations regarding tariff news. The company’s decision to redeem its senior notes may have added weight to its price increase, reflecting proactive debt management. As major indices like the S&P 500 and Nasdaq reported gains, Bank of America's stock movement aligned with overall market optimism, supported by its consistent dividend strategy.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

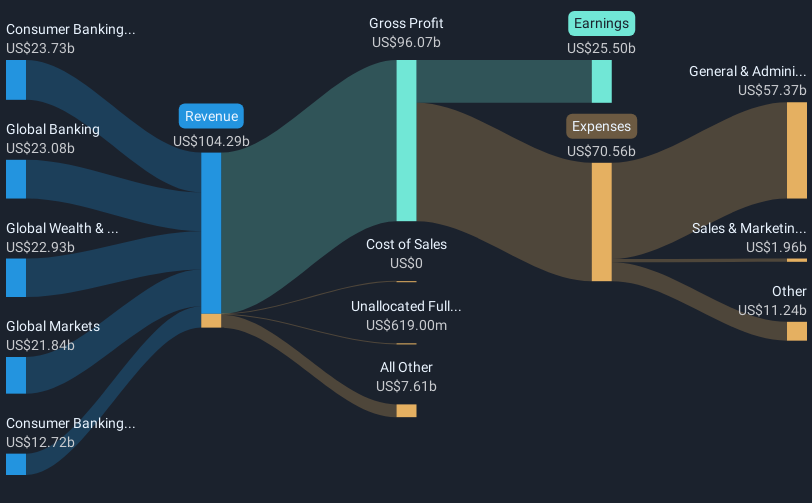

Bank of America's recent announcement regarding dividends on both its preferred and common stock aligns with its commitment to shareholder returns and could bolster investor confidence. This move, combined with the redemption of senior notes, underscores proactive financial management, which might positively influence the company's revenue and earnings forecasts. Investments in digital engagement and AI, along with strategic asset management, are likely to support long-term revenue growth and enhance net interest income, key factors for future profitability.

Over the past five years, Bank of America's total shareholder return, including share price appreciation and dividends, reached 77.07%. This performance provides a longer-term context beyond the recent 4% weekly rise mentioned earlier. However, in the past year, Bank of America underperformed the broader US Banks industry, which returned 11%, and the overall US Market, which gained 5.9%.

The current share price of US$38.32 suggests potential upside towards the consensus price target of US$48.64, indicating that market participants have room for growth in their valuation assumptions. With expectations of revenue reaching US$117.7 billion and earnings potentially climbing to US$31.1 billion by 2028, analysts see room for expansion if the company achieves these targets. Nevertheless, risks such as economic volatility and competitive pressures could affect these projections.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of America might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BAC

Bank of America

Through its subsidiaries, provides various financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives