- United States

- /

- Banks

- /

- NYSE:BAC

Bank of America (BAC) To Redeem €2 Billion Floating Rate Senior Notes

Reviewed by Simply Wall St

Bank of America (BAC) recently announced the redemption of €2 billion in senior notes, reflecting a careful approach to its debt obligations. Over the last quarter, BAC's shares moved up 15%, a notable change amidst broader market dynamics where indexes, like the Nasdaq, touched record highs. This upward movement gains further context from the company's latest quarterly earnings, which reported increased net interest income and net income, reinforcing investor confidence. Additional weight came from the declaration of increased dividends and a substantial share buyback program, aligning with market optimism and the potential for a Federal Reserve rate cut.

You should learn about the 1 warning sign we've spotted with Bank of America.

Find companies with promising cash flow potential yet trading below their fair value.

Bank of America's recent redemption of €2 billion in senior notes reflects its commitment to managing its debt profile efficiently, which could positively influence its interest expenses and subsequently bolster earnings. The strategic move aligns with the company's ongoing efforts to enhance net interest income through effective asset and interest rate management. This financial prudence is further supported by its strong digital engagement and AI investments, anticipated to drive long-term revenue growth. Over the past five years, Bank of America's total shareholder return, including dividends, was 126.13%, illustrating significant long-term value creation for investors.

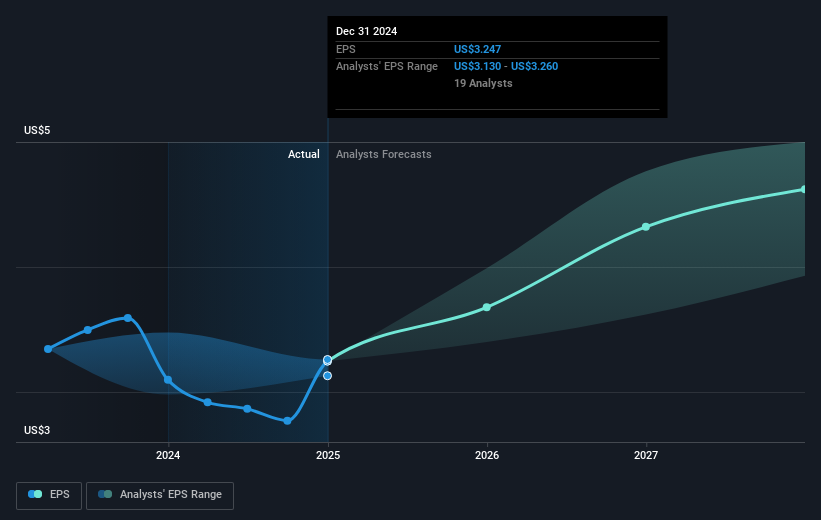

In the short term, Bank of America's stock price has risen by 15% in the last quarter, outperforming the US Market, which returned 19.9% over the past year, but not matching the US Banks industry's 33.6% increase. The current share price of US$50.75, though slightly below the consensus analyst price target of US$53.52, suggests that analysts perceive the stock to be nearing its fair value. This aligns with the market's reaction to the company's future revenue and earnings growth forecasts, including a 32.9 billion earnings projection by 2028, which could require trading at a PE ratio of 13.8x. The anticipated impact of improved digital strategies and credit portfolio diversification may provide further upward momentum to these projections, with potential dividends and share buybacks enhancing shareholder value.

Learn about Bank of America's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of America might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BAC

Bank of America

Through its subsidiaries, provides various financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives