- United States

- /

- Banks

- /

- NYSE:AUB

Reassessing Atlantic Union Bankshares (AUB) Valuation After Raymond James’ Downgrade and Earnings Outlook Cut

Reviewed by Simply Wall St

Atlantic Union Bankshares (AUB) just drew fresh scrutiny after Raymond James cut its rating, pointing to softer yields on new loans and weaker Sandy Spring accretion that collectively trim the bank’s earnings outlook.

See our latest analysis for Atlantic Union Bankshares.

The Raymond James downgrade appears to have checked optimism that had been building after the Sandy Spring deal. A 1 month share price return of 4.85% has given way to a weaker year to date share price return of 6.93% and a 1 year total shareholder return of 15.31%.

If this shift in sentiment has you reassessing your watchlist, it could be a smart moment to explore fast growing stocks with high insider ownership as potential fresh ideas beyond regional banks.

With shares now trading at a double digit discount to both intrinsic value estimates and analyst targets after the downgrade, the real question is whether Atlantic Union Bankshares is a mispriced regional compounder or if the market already sees limited upside.

Most Popular Narrative Narrative: 17.2% Undervalued

With Atlantic Union Bankshares last closing at $34.39 versus a narrative fair value near the low $40s, the storyline leans firmly toward mispricing driven by future growth.

The successful integration of Sandy Spring Bank and the sale of $2 billion in commercial real estate loans have reduced risk concentrations, freed up lending capacity, and expanded the company's customer base in markets with the lowest unemployment nationally, supporting better credit performance, new fee income, and future earnings upside.

Want to see how loan growth, widening margins, and surging earnings all get baked into one bold fair value call? The full narrative lays out an aggressive earnings ramp, a sharply higher profitability profile, and a future valuation multiple that might surprise anyone used to traditional bank benchmarks.

Result: Fair Value of $41.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent digital competition or integration missteps on recent acquisitions could erode margins and derail the growth trajectory implied in that fair value.

Find out about the key risks to this Atlantic Union Bankshares narrative.

Another Angle on Valuation

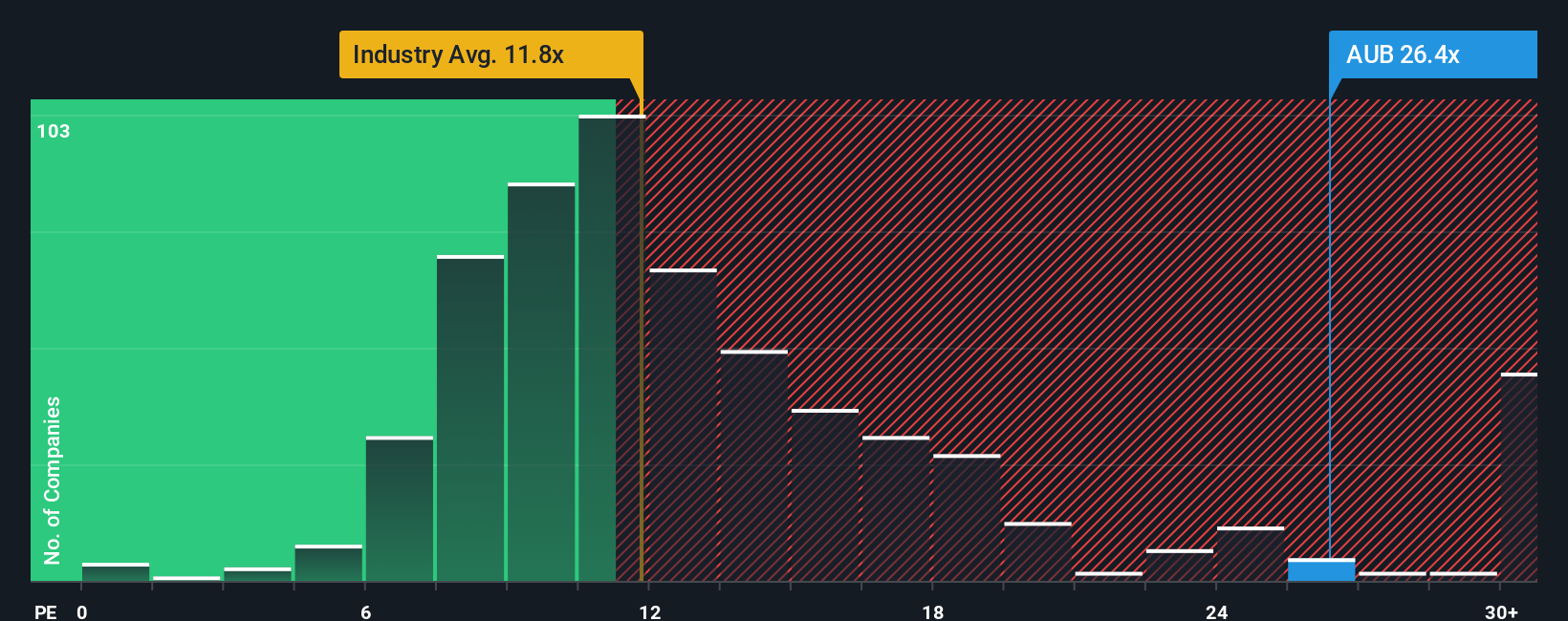

On earnings, Atlantic Union Bankshares looks far less forgiving. Its 23.6x price to earnings ratio sits well above the US Banks industry at 11.7x and even its own 21.6x fair ratio, suggesting limited margin for error if growth or integration stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Atlantic Union Bankshares Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in minutes, starting with Do it your way.

A great starting point for your Atlantic Union Bankshares research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investing opportunities?

Before you log off, line up your next move with fresh, data backed stock ideas on Simply Wall Street that most investors are still overlooking.

- Capitalize on overlooked value by targeting these 906 undervalued stocks based on cash flows that trade below their cash flow potential yet still pass strict fundamental checks.

- Position yourself for structural growth by focusing on these 30 healthcare AI stocks applying intelligent automation to diagnostics, treatments, and patient care.

- Boost your income strategy with these 15 dividend stocks with yields > 3% that pair attractive yields with balance sheets built to support long term payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AUB

Atlantic Union Bankshares

Operates as the bank holding company for Atlantic Union Bank that provides banking and related financial products and services to consumers and businesses in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026