- United States

- /

- Banks

- /

- NYSE:AUB

Atlantic Union Bankshares (AUB): Exploring Valuation After Recent Strategic Moves and Steady Share Price

Reviewed by Kshitija Bhandaru

See our latest analysis for Atlantic Union Bankshares.

Atlantic Union Bankshares’ share price has remained relatively steady, while its 1-year total shareholder return sits just above break-even and the 3-year figure is much stronger. This pattern suggests investors are weighing recent revenue gains against broader economic risks, and optimism is building for longer-term holders.

If you’re scanning the horizon for your next opportunity, now’s a smart time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading at a notable discount to analyst targets, questions are swirling. Does Atlantic Union Bankshares offer value at today’s price, or has the market already factored in its potential for future growth?

Most Popular Narrative: 13.6% Undervalued

Atlantic Union Bankshares’ narrative fair value of $40.63 is notably above the recent close of $35.12. This difference has fueled speculation that the current price may offer upside potential. It also invites a closer look at why analysts see such potential for a re-rating as the company’s strategy unfolds.

The successful integration of Sandy Spring Bank and the sale of $2 billion in commercial real estate loans have reduced risk concentrations, freed up lending capacity, and expanded the company's customer base in markets with the lowest unemployment nationally. These factors support better credit performance, new fee income, and potential future earnings upside.

Want to know why analysts are forecasting bold growth? The profit engine behind this price target is driven by ambitious expansion plans and streamlined bank operations. What other aggressive projections justify that valuation? Discover the narrative’s detailed numbers and surprising assumptions that could change your view.

Result: Fair Value of $40.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated exposure to Mid-Atlantic markets and challenges from digital competitors could quickly change Atlantic Union Bankshares’ growth outlook and valuation case.

Find out about the key risks to this Atlantic Union Bankshares narrative.

Another View: Market Multiples Suggest a Different Story

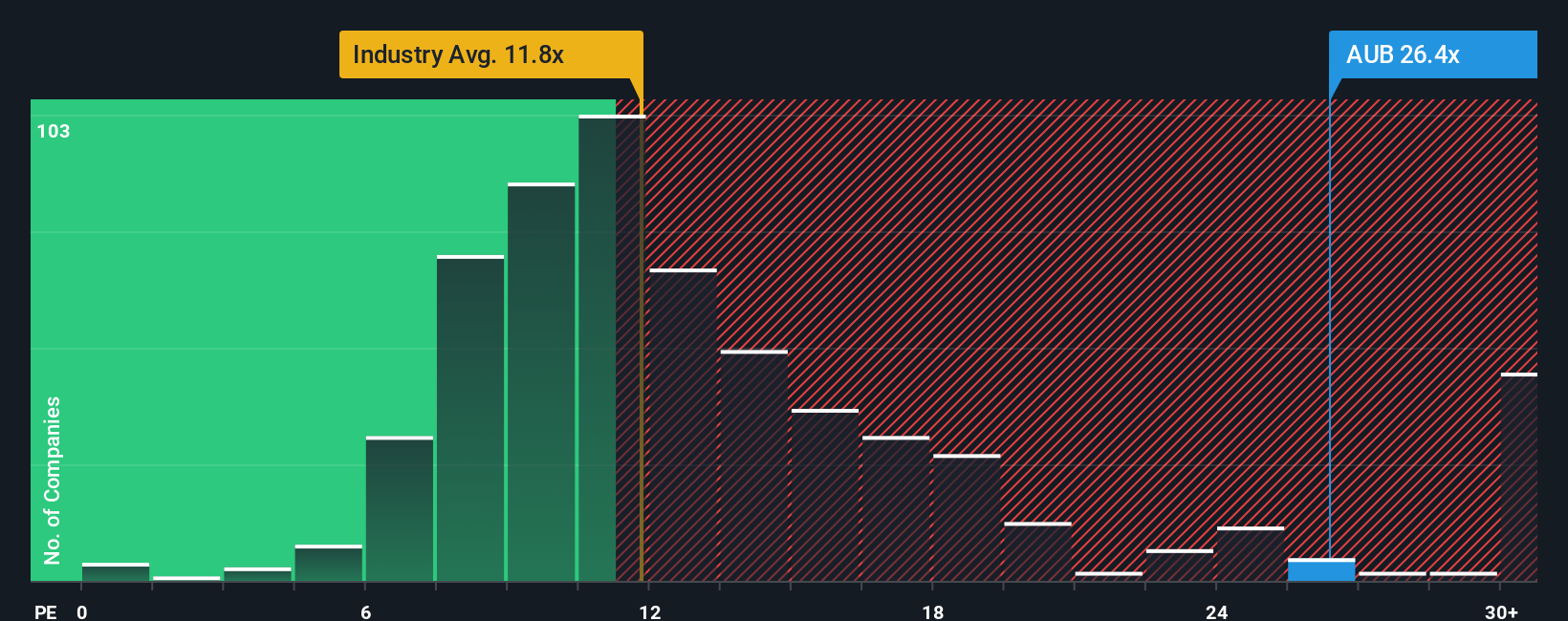

While our fair value model implies Atlantic Union Bankshares is undervalued, looking at its price-to-earnings ratio tells a different story. The company trades at 26.1x earnings, which is well above both the US Banks industry average of 11.8x and its peer average of 15.7x. The fair ratio sits at 21.6x, signaling that valuations could shift if market sentiment changes. Is the premium justified, or are investors paying up for future growth that may not materialize?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Atlantic Union Bankshares Narrative

If you think differently or simply want to dig into the numbers on your own terms, crafting your own perspective takes just a few minutes. Do it your way

A great starting point for your Atlantic Union Bankshares research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Opportunity is everywhere for investors willing to take the next step. Use the Simply Wall Street Screener to pinpoint smart choices tailored to your specific interests and goals.

- Tap into future returns by checking out these 909 undervalued stocks based on cash flows. This screener is packed with stocks currently trading below intrinsic value, offering the potential for strong gains as markets catch up.

- Boost your portfolio’s resilience and cash flow by uncovering reliable picks in these 19 dividend stocks with yields > 3%. Here, companies with yields over 3% can add steady income to your investment mix.

- Stay ahead of the innovation curve by targeting breakthrough companies through these 24 AI penny stocks. You can catch momentum in sectors redefining how we live and invest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AUB

Atlantic Union Bankshares

Operates as the bank holding company for Atlantic Union Bank that provides banking and related financial products and services to consumers and businesses in the United States.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives