- United States

- /

- Banks

- /

- NYSE:ASB

Is Now The Time To Put Associated Banc-Corp (NYSE:ASB) On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Associated Banc-Corp (NYSE:ASB). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Associated Banc-Corp with the means to add long-term value to shareholders.

See our latest analysis for Associated Banc-Corp

How Quickly Is Associated Banc-Corp Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. Associated Banc-Corp managed to grow EPS by 9.3% per year, over three years. That growth rate is fairly good, assuming the company can keep it up.

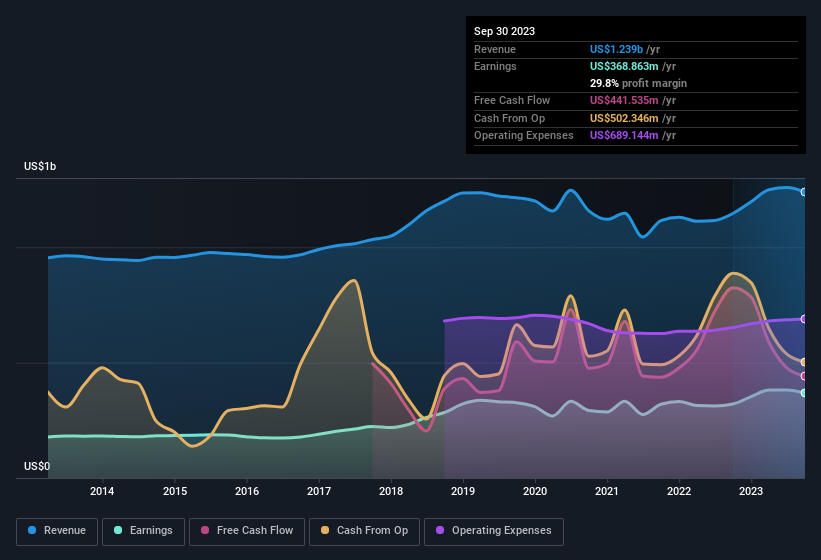

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. It's noted that Associated Banc-Corp's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. While we note Associated Banc-Corp achieved similar EBIT margins to last year, revenue grew by a solid 8.1% to US$1.2b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Associated Banc-Corp.

Are Associated Banc-Corp Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Associated Banc-Corp followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. Indeed, they hold US$23m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. While their ownership only accounts for 0.7%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Does Associated Banc-Corp Deserve A Spot On Your Watchlist?

One important encouraging feature of Associated Banc-Corp is that it is growing profits. To add an extra spark to the fire, significant insider ownership in the company is another highlight. The combination definitely favoured by investors so consider keeping the company on a watchlist. Now, you could try to make up your mind on Associated Banc-Corp by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

Although Associated Banc-Corp certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ASB

Associated Banc-Corp

A bank holding company, provides various banking and nonbanking products and services to individuals and businesses in Wisconsin, Illinois, Missouri, and Minnesota.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026