- United States

- /

- Banks

- /

- NYSE:AMTB

Top US Growth Companies With High Insider Ownership For September 2024

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of mixed performance and cautious optimism amid Federal Reserve rate decisions, investors are increasingly seeking companies with solid growth prospects and strong insider ownership. High insider ownership often signals confidence from those closest to the company, making these stocks particularly attractive in uncertain economic climates.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 32.3% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.0% |

| Hims & Hers Health (NYSE:HIMS) | 13.8% | 40.7% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.0% | 95% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

Here's a peek at a few of the choices from the screener.

California BanCorp (NasdaqCM:BCAL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: California BanCorp, with a market cap of $471.77M, operates as the holding company for Bank of Southern California, N.A., providing various banking services.

Operations: California BanCorp's revenue from commercial banking amounts to $87.33 million.

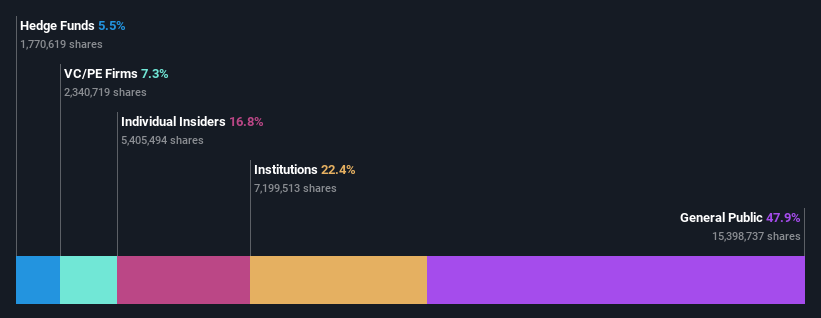

Insider Ownership: 16.8%

Return On Equity Forecast: N/A (2027 estimate)

California BanCorp, a growth company with high insider ownership, is forecast to achieve significant revenue and earnings growth, with earnings expected to grow 113.3% annually. Despite trading at 23.6% below its estimated fair value and analysts predicting a 25.9% price rise, the company has seen substantial shareholder dilution over the past year and no recent insider buying. Recent executive changes include Michele Wirfel's promotion to COO following a merger with Bank of Southern California in July 2024.

- Delve into the full analysis future growth report here for a deeper understanding of California BanCorp.

- According our valuation report, there's an indication that California BanCorp's share price might be on the cheaper side.

Frontier Group Holdings (NasdaqGS:ULCC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Frontier Group Holdings, Inc. provides low-fare passenger airline services to leisure travelers in the United States and Latin America, with a market cap of $1.09 billion.

Operations: Frontier Group Holdings generates $3.61 billion in revenue by offering air transportation services to passengers.

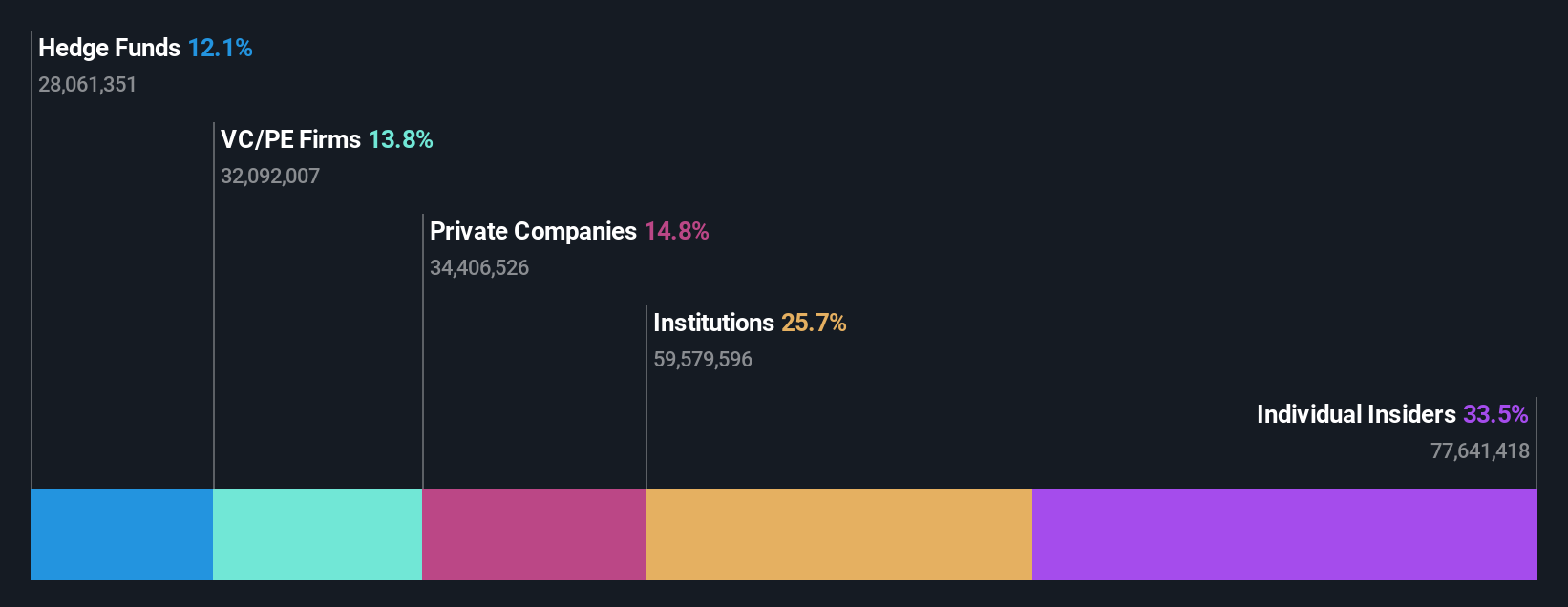

Insider Ownership: 34.7%

Return On Equity Forecast: 31% (2027 estimate)

Frontier Group Holdings is demonstrating moderate revenue growth, with second-quarter 2024 revenue at US$973 million, slightly up from US$967 million a year ago. However, net income dropped to US$31 million from US$71 million. The company forecasts annual revenue growth of 12.1%, outpacing the overall market's 8.7%. Despite no recent insider trading activity, Frontier remains attractive due to its expected profitability within three years and high forecasted return on equity of 31.1%.

- Take a closer look at Frontier Group Holdings' potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Frontier Group Holdings' share price might be too pessimistic.

Amerant Bancorp (NYSE:AMTB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Amerant Bancorp Inc., with a market cap of $860.59 million, operates as the bank holding company for Amerant Bank, N.A.

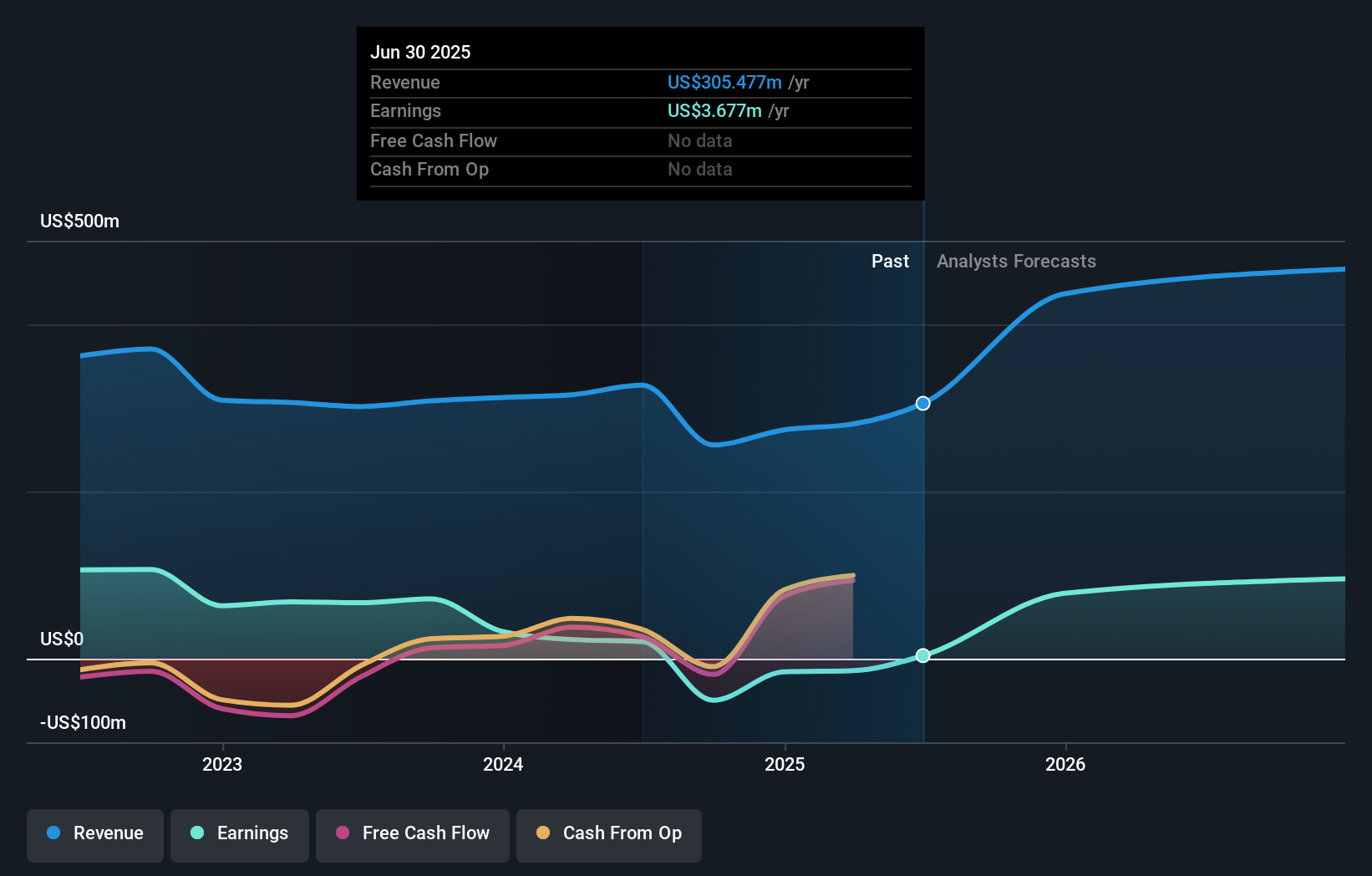

Operations: Amerant Bancorp Inc. generates $327.31 million in revenue from its banking segment.

Insider Ownership: 9.9%

Return On Equity Forecast: N/A (2027 estimate)

Amerant Bancorp recently completed a $150.1 million follow-on equity offering, which may impact shareholder value due to dilution. Despite this, the company has high insider ownership and is forecasted to achieve significant annual earnings growth of 87.5% over the next three years, outpacing the US market's 15.2%. However, its profit margins have declined from 22.2% to 6.3%, and it faces challenges with unstable dividends and low allowance for bad loans at 94%.

- Click here and access our complete growth analysis report to understand the dynamics of Amerant Bancorp.

- In light of our recent valuation report, it seems possible that Amerant Bancorp is trading beyond its estimated value.

Taking Advantage

- Explore the 184 names from our Fast Growing US Companies With High Insider Ownership screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMTB

Amerant Bancorp

Operates as the bank holding company for Amerant Bank, N.A.

Excellent balance sheet with reasonable growth potential.