- United States

- /

- Diversified Financial

- /

- NYSE:AGM

Does Federal Agricultural Mortgage (NYSE:AGM) Deserve A Spot On Your Watchlist?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Federal Agricultural Mortgage (NYSE:AGM). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Federal Agricultural Mortgage

How Fast Is Federal Agricultural Mortgage Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. Federal Agricultural Mortgage managed to grow EPS by 6.0% per year, over three years. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

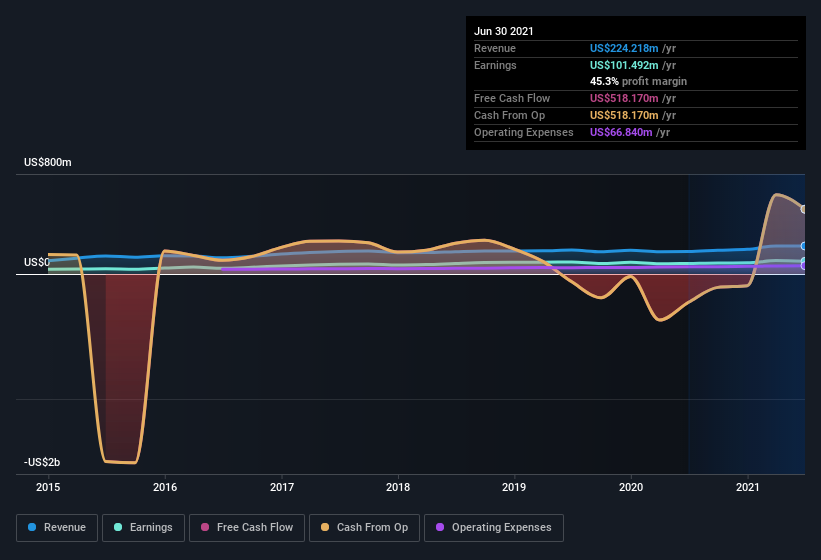

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Federal Agricultural Mortgage's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Federal Agricultural Mortgage maintained stable EBIT margins over the last year, all while growing revenue 25% to US$224m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Federal Agricultural Mortgage Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Insider selling of Federal Agricultural Mortgage shares was insignificant compared to the one buyer, over the last twelve months. Specifically the Independent Director, James Engebretsen, spent US$507k, paying about US$101 per share. To me, that's probably a sign of conviction.

The good news, alongside the insider buying, for Federal Agricultural Mortgage bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold US$21m worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 1.7% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. The cherry on top is that the CEO, Brad Nordholm is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalizations between US$1.0b and US$3.2b, like Federal Agricultural Mortgage, the median CEO pay is around US$3.7m.

Federal Agricultural Mortgage offered total compensation worth US$2.7m to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does Federal Agricultural Mortgage Deserve A Spot On Your Watchlist?

One positive for Federal Agricultural Mortgage is that it is growing EPS. That's nice to see. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for my watchlist - and arguably a research priority. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Federal Agricultural Mortgage is trading on a high P/E or a low P/E, relative to its industry.

The good news is that Federal Agricultural Mortgage is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:AGM

Federal Agricultural Mortgage

Provides a secondary market for various loans made to borrowers in the United States.

Undervalued established dividend payer.