- United States

- /

- Banks

- /

- NYSE:ABCB

Will Fed Liquidity Hopes and Strong Bank Earnings Shift Ameris Bancorp’s (ABCB) Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier this week, regional banks such as Ameris Bancorp saw increased investor interest after large US banks reported third-quarter earnings that exceeded Wall Street expectations, supported by a rebound in investment banking and strong trading activity.

- Atmosphere across financial markets was further buoyed by Federal Reserve Chair Jerome Powell's comments about a potential end to quantitative tightening, a shift that could boost market liquidity and support the banking sector.

- We'll examine how increased liquidity expectations from the Fed could influence Ameris Bancorp's investment narrative and future market positioning.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Ameris Bancorp Investment Narrative Recap

Shareholders of Ameris Bancorp are generally backing a growth outlook tied to robust loan and deposit expansion in key Southeastern markets, expecting continued benefits from regional economic strength and digital banking enhancements. The recent wave of optimism across financials following strong big bank earnings and potential Fed liquidity support may help counter short-term pressures, but competition for deposits and lending continues to pose a significant risk; this news does not fundamentally shift the most crucial catalysts or risks for Ameris in the near term. Among company updates, Ameris Bancorp recently announced a $0.20 per share quarterly dividend, underscoring ongoing efforts to maintain shareholder returns. While this dividend supports the argument for stability and income, the most important market catalysts remain linked to sustained growth in loans and deposits amid an increasingly competitive banking environment. However, investors should be aware that heightened competition for deposits and loans may still present...

Read the full narrative on Ameris Bancorp (it's free!)

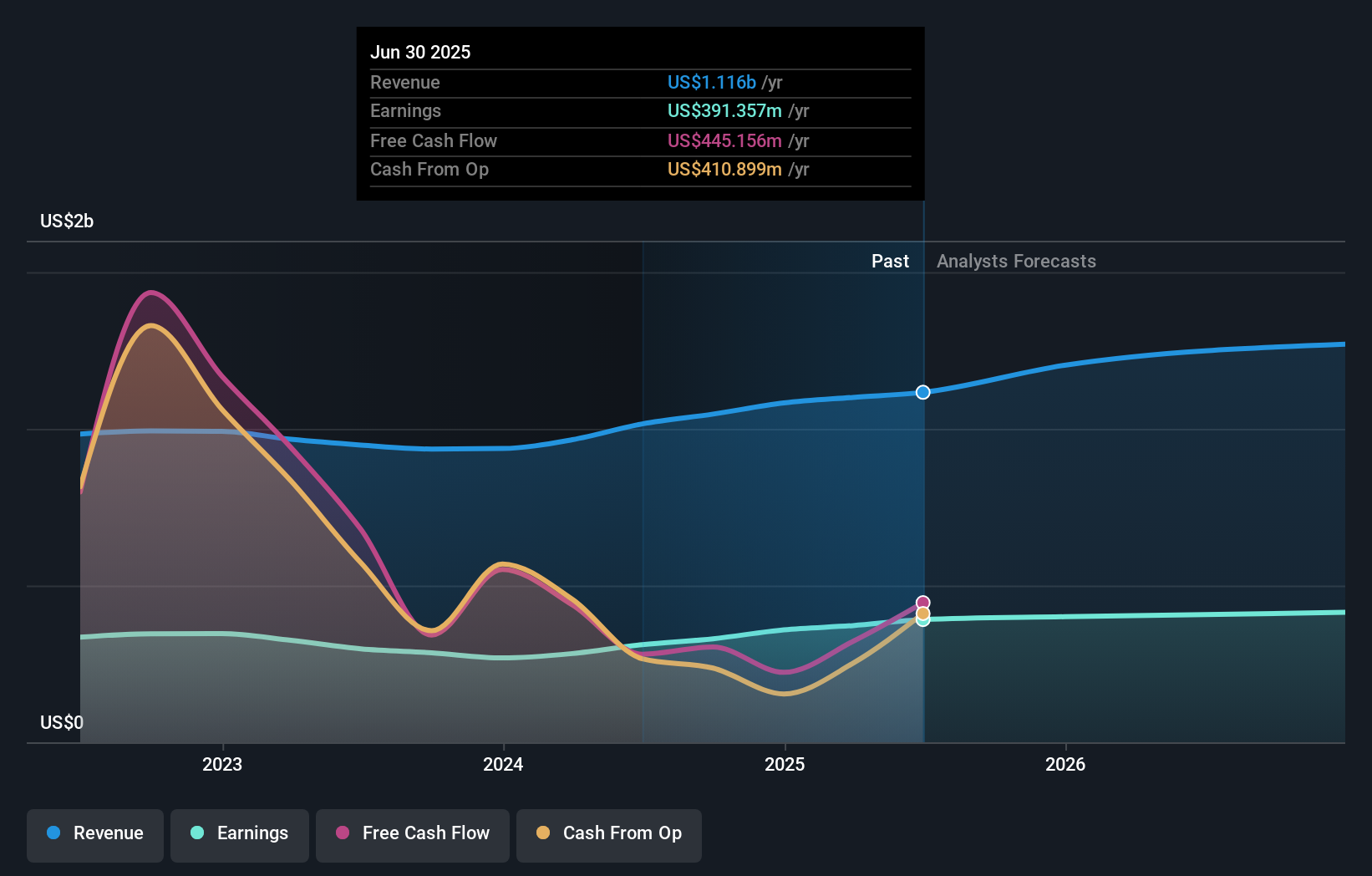

Ameris Bancorp's narrative projects $1.4 billion in revenue and $438.2 million in earnings by 2028. This requires 8.8% yearly revenue growth and a $46.8 million earnings increase from the current $391.4 million.

Uncover how Ameris Bancorp's forecasts yield a $77.67 fair value, a 10% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s sole fair value estimate sits at US$116.31, indicating a much higher valuation than current price targets. With increasing industry-wide deposit competition, shareholder viewpoints may diverge on how Ameris’s future growth could be impacted.

Explore another fair value estimate on Ameris Bancorp - why the stock might be worth as much as 64% more than the current price!

Build Your Own Ameris Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ameris Bancorp research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Ameris Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ameris Bancorp's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABCB

Ameris Bancorp

Operates as the bank holding company for Ameris Bank that provides range of banking services to retail and commercial customers.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives