- United States

- /

- Banks

- /

- NYSE:ABCB

Assessing Ameris Bancorp’s Valuation After New $200 Million Share Buyback Extension (NYSE:ABCB)

Reviewed by Simply Wall St

Ameris Bancorp (ABCB) just announced that its board authorized up to $200 million in common stock repurchases and extended the buyback program through October 2026. This signals ongoing confidence in the company’s financial strength.

See our latest analysis for Ameris Bancorp.

Ameris Bancorp’s move to ramp up buybacks and expand its regional footprint has caught investors’ attention, especially as momentum has been building in recent months. The stock’s 18.8% year-to-date share price return and a robust 16.4% total shareholder return over the past year highlight growing confidence in the bank’s long-term prospects.

If you’re curious to see which other fast-growing companies are attracting insider support, this could be a great moment to explore fast growing stocks with high insider ownership.

With shares trading below analyst price targets and fundamentals pointing to steady growth, the key question is whether Ameris Bancorp’s current valuation offers a genuine buying opportunity or if the market is already accounting for potential future gains.

Most Popular Narrative: 6.7% Undervalued

Ameris Bancorp’s last close of $72.48 compares to a most-followed narrative fair value of $77.67, suggesting a modest valuation gap. The financial community’s outlook hinges on both strategic expansion and digital banking investments driving future growth.

“Accelerating digital banking enhancements and emphasis on treasury management are enabling Ameris to acquire and retain more granular, low-cost, noninterest-bearing deposits, supporting net interest margin sustainability and efficiency improvements.”

Ever wondered what earnings growth, deposit strategies, and margin bets underpin this price target? There is one bullish lever analysts are counting on. Don’t miss the key forecast shaping this fair value call.

Result: Fair Value of $77.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, looming competition for deposits and overreliance on Southeastern markets could pressure Ameris Bancorp’s growth story if regional conditions become less favorable.

Find out about the key risks to this Ameris Bancorp narrative.

Another View: Price-To-Earnings Tells a Different Story

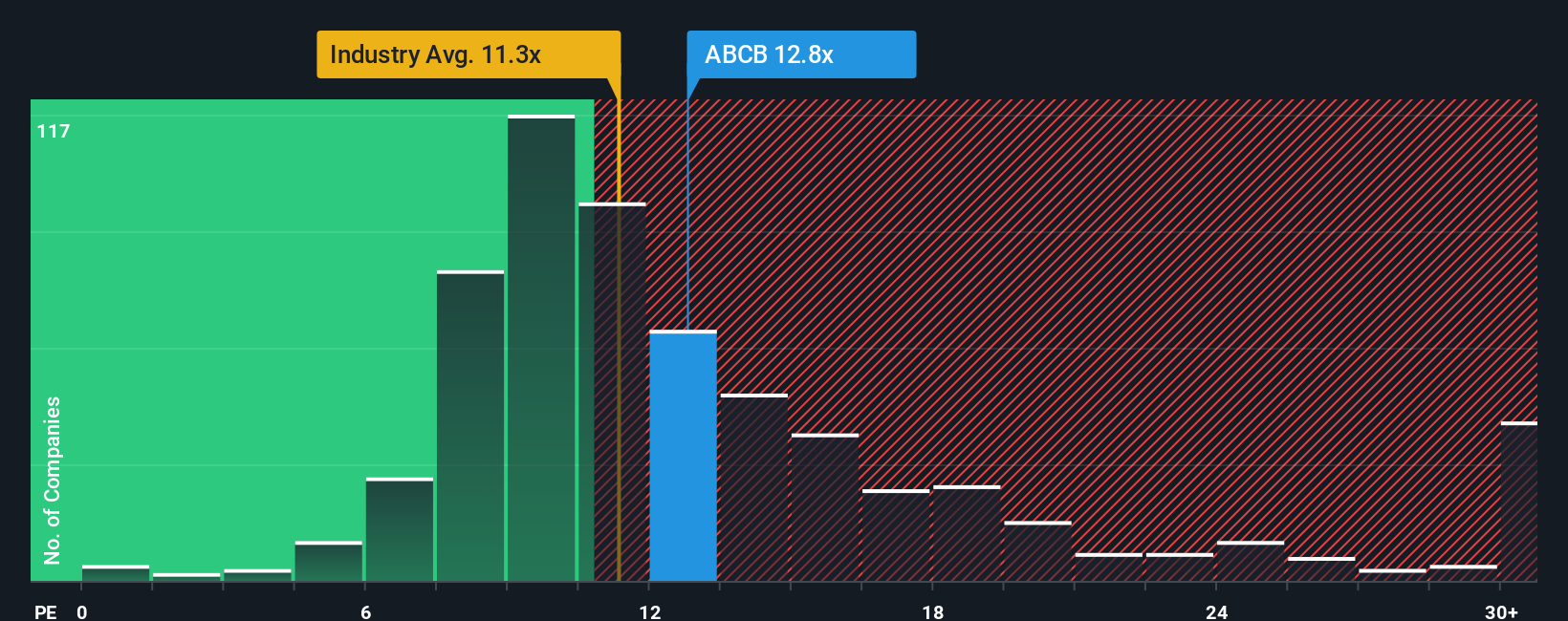

While some see Ameris Bancorp’s shares as undervalued, a glance at its price-to-earnings ratio raises a caution flag. The company trades at 12.7x earnings, which is higher than the US Banks industry average of 11.3x and also above its own fair ratio of 12.1x. This suggests that the market is either expecting higher growth or may have overpriced near-term gains. Which side will prove right over time?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ameris Bancorp Narrative

If you want to dig deeper or have your own take on Ameris Bancorp, you can explore the full data yourself and assemble a custom narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Ameris Bancorp.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. See what other bold moves you could make by checking out handpicked stock ideas built for today’s markets.

- Capture income opportunities quickly with market favorites by reviewing these 17 dividend stocks with yields > 3%, which features strong yields and reliable dividend payments.

- Harness the momentum in healthcare innovation and track future leaders by examining these 33 healthcare AI stocks in the artificial intelligence space.

- Spot undervalued gems before the crowd and position yourself ahead with these 876 undervalued stocks based on cash flows, based on cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABCB

Ameris Bancorp

Operates as the bank holding company for Ameris Bank that provides range of banking services to retail and commercial customers.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives