- United States

- /

- Banks

- /

- NasdaqGS:WTFC

Here's Why Wintrust Financial (NASDAQ:WTFC) Has Caught The Eye Of Investors

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Wintrust Financial (NASDAQ:WTFC). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

How Quickly Is Wintrust Financial Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. Wintrust Financial managed to grow EPS by 15% per year, over three years. That's a good rate of growth, if it can be sustained.

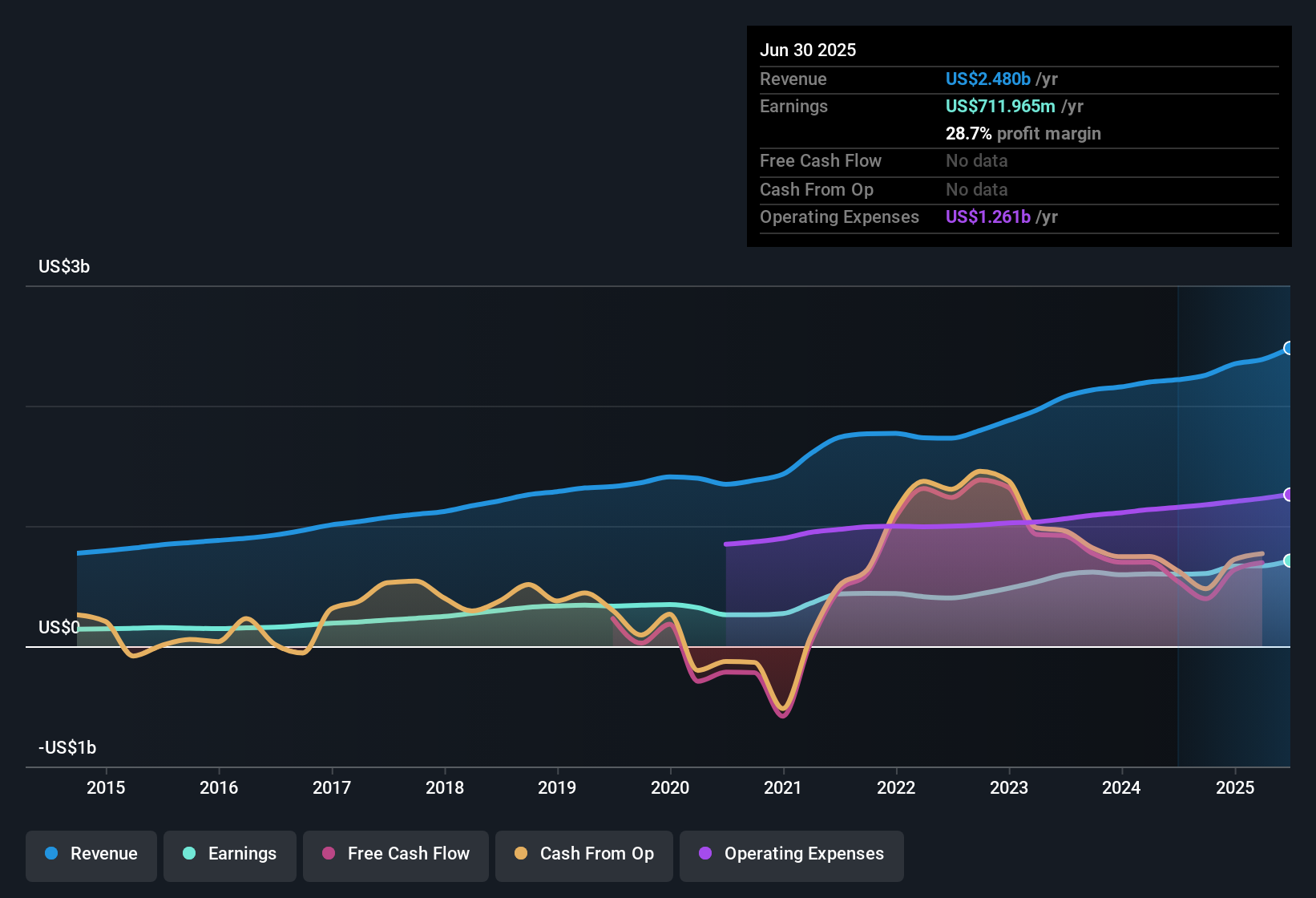

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of Wintrust Financial's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. Wintrust Financial maintained stable EBIT margins over the last year, all while growing revenue 12% to US$2.5b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

See our latest analysis for Wintrust Financial

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Wintrust Financial's future EPS 100% free.

Are Wintrust Financial Insiders Aligned With All Shareholders?

Owing to the size of Wintrust Financial, we wouldn't expect insiders to hold a significant proportion of the company. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. Indeed, they have a considerable amount of wealth invested in it, currently valued at US$122m. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. For companies with market capitalisations between US$4.0b and US$12b, like Wintrust Financial, the median CEO pay is around US$8.8m.

The Wintrust Financial CEO received US$6.1m in compensation for the year ending December 2024. That comes in below the average for similar sized companies and seems pretty reasonable. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add Wintrust Financial To Your Watchlist?

One important encouraging feature of Wintrust Financial is that it is growing profits. The fact that EPS is growing is a genuine positive for Wintrust Financial, but the pleasant picture gets better than that. With a meaningful level of insider ownership, and reasonable CEO pay, a reasonable mind might conclude that this is one stock worth watching. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Wintrust Financial is trading on a high P/E or a low P/E, relative to its industry.

Although Wintrust Financial certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Wintrust Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:WTFC

Wintrust Financial

A financial holding company, provides community-oriented, personal, and commercial banking services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success