- United States

- /

- Diversified Financial

- /

- NasdaqGS:WSBF

Should You Be Adding Waterstone Financial (NASDAQ:WSBF) To Your Watchlist Today?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

So if you're like me, you might be more interested in profitable, growing companies, like Waterstone Financial (NASDAQ:WSBF). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Waterstone Financial

How Fast Is Waterstone Financial Growing Its Earnings Per Share?

Over the last three years, Waterstone Financial has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like a firecracker arcing through the night sky, Waterstone Financial's EPS shot from US$1.38 to US$4.01, over the last year. You don't see 191% year-on-year growth like that, very often. The best case scenario? That the business has hit a true inflection point.

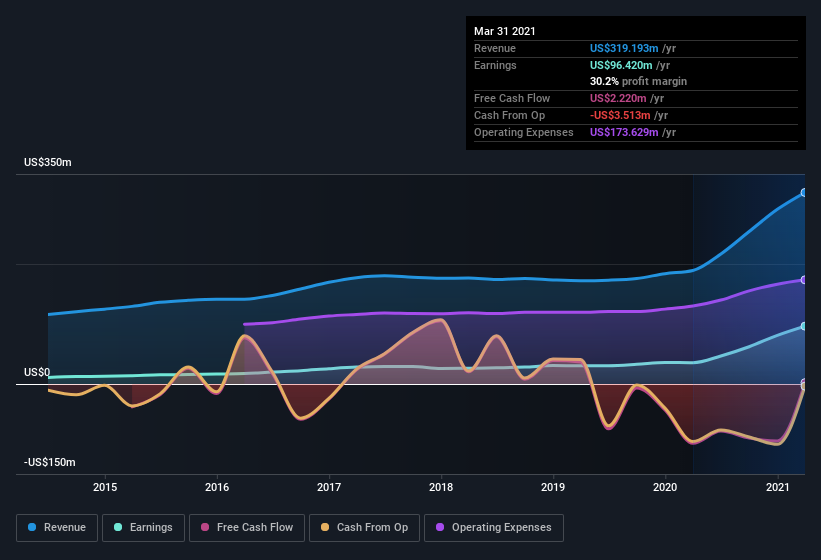

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that Waterstone Financial's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note Waterstone Financial's EBIT margins were flat over the last year, revenue grew by a solid 69% to US$319m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Waterstone Financial Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. So it is good to see that Waterstone Financial insiders have a significant amount of capital invested in the stock. Indeed, they hold US$27m worth of its stock. That's a lot of money, and no small incentive to work hard. That amounts to 5.6% of the company, demonstrating a degree of high-level alignment with shareholders.

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. Well, based on the CEO pay, I'd say they are indeed. For companies with market capitalizations between US$200m and US$800m, like Waterstone Financial, the median CEO pay is around US$1.7m.

Waterstone Financial offered total compensation worth US$1.5m to its CEO in the year to . That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Waterstone Financial Deserve A Spot On Your Watchlist?

Waterstone Financial's earnings have taken off like any random crypto-currency did, back in 2017. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The strong EPS improvement suggests the businesses is humming along. Waterstone Financial certainly ticks a few of my boxes, so I think it's probably well worth further consideration. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Waterstone Financial (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Waterstone Financial, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Waterstone Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:WSBF

Waterstone Financial

Operates as a bank holding company for WaterStone Bank SSB that provides various financial services to customers in southeastern Wisconsin, the United States.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives