- United States

- /

- Banks

- /

- NasdaqGS:WSBC

WesBanco (WSBC): Evaluating Valuation as Tennessee Expansion Signals New Regional Growth Strategy

Reviewed by Simply Wall St

WesBanco (WSBC) is taking meaningful steps to broaden its reach, announcing plans to open a commercial loan production office in Knoxville and its first retail banking center in Chattanooga. The company’s recent expansion draws attention from investors who track how regional growth strategies impact long-term value.

See our latest analysis for WesBanco.

WesBanco’s move into key Tennessee markets comes amid solid long-term progress, even as share price momentum has faded a bit recently. The past month’s 8.2% decline in share price stands out, but its five-year total shareholder return of nearly 60% reveals the value of its steady expansion. Recent executive promotions, auditor changes, and a completed share buyback contribute to the sense that WesBanco is reshaping its foundation for future growth.

If WesBanco’s regional playbook has you rethinking your own strategy, now might be the perfect time to see what’s possible with fast growing stocks with high insider ownership

But with WesBanco’s five-year growth and substantial expansion moves balanced by recent stock declines, the question remains: Is this the moment to buy into an undervalued bank, or has the market already priced in its future growth?

Most Popular Narrative: 19.6% Undervalued

WesBanco’s most widely followed narrative values the stock at $37.43 per share using a 7.3% discount rate, representing a notable premium over its recent $30.10 close. The narrative hinges on how expansion, digital focus, and disciplined management may transform the company’s earnings profile.

Accelerated investment in digital banking capabilities and treasury management products is boosting fee-based income streams, evidenced by current 40% year-over-year growth in non-interest income. This positions the company to capitalize on customer migration toward digital financial services, which could enhance both revenue mix and net margins.

Curious how high-growth regions, digital migration, and efficiency plays could upend WesBanco’s earnings picture? The narrative’s fair value depends on bold estimates for soaring profits and margin transformation. The precise projections might surprise you. Dive in to see which assumptions drive the bullish price target.

Result: Fair Value of $37.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on commercial real estate and limited geographic reach could slow growth if economic conditions shift or if regional markets underperform.

Find out about the key risks to this WesBanco narrative.

Another View: What Do Market Valuations Say?

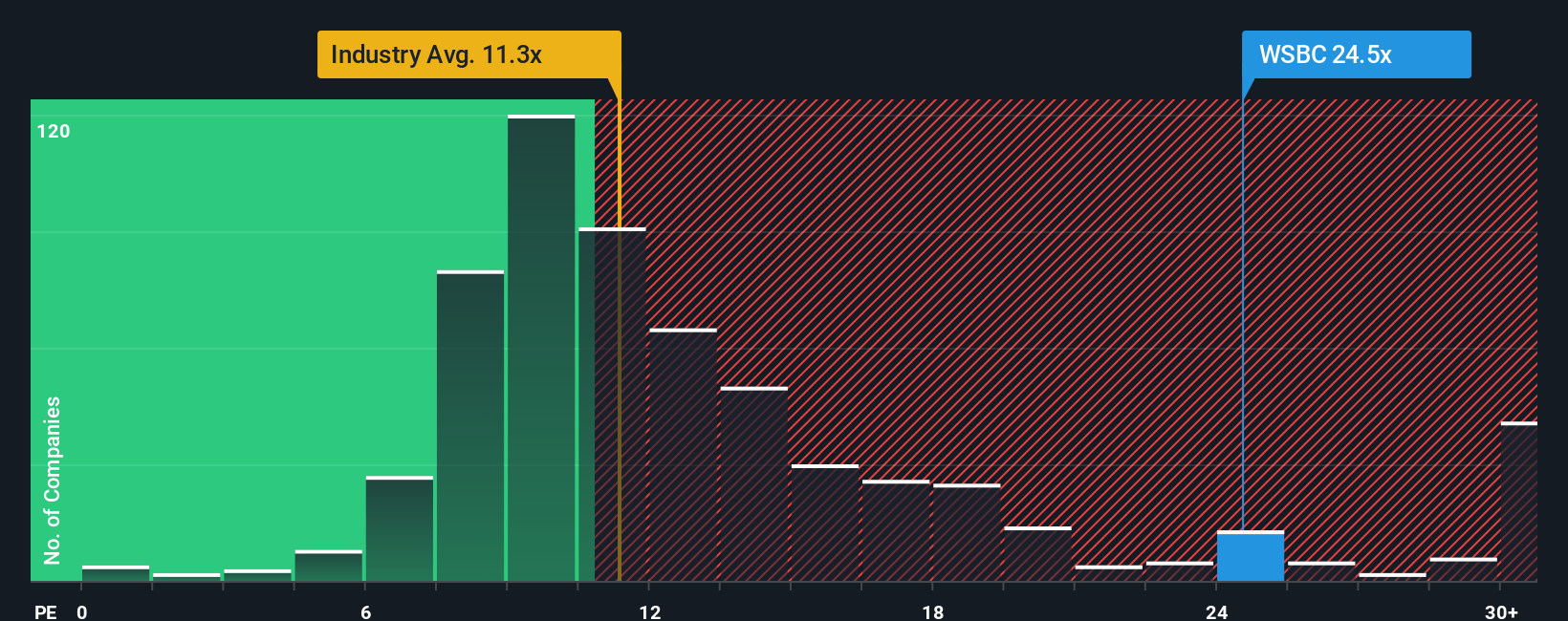

While analyst forecasts see room for upside, the market’s chosen earnings multiple tells a different story. WesBanco trades at 16.9x earnings, noticeably higher than both its peers (14.5x) and the US Banks industry average (11.1x). Yet the fair ratio suggests investors could eventually price the stock at 18.4x instead. Is the current premium a warning sign or a mark of future expectation? The answer may shape the next move in the share price.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own WesBanco Narrative

If the prevailing narrative is not quite convincing, you can dig into the numbers yourself and build an alternative story in just a few minutes. Do it your way

A great starting point for your WesBanco research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Want to give your portfolio a competitive edge? Every great investor knows fresh opportunities are out there. Here’s how to get started with three smart screens that make spotting them simple.

- Capture income potential by checking out these 22 dividend stocks with yields > 3%, packed with reliable stocks offering yields above 3% for steady returns.

- Ride the momentum in artificial intelligence by tapping into these 27 AI penny stocks and see which companies are shaping tomorrow’s breakthroughs.

- Capitalize on undervalued opportunities by using these 840 undervalued stocks based on cash flows, featuring companies trading below their intrinsic value based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WesBanco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WSBC

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives