- United States

- /

- Banks

- /

- NasdaqGS:WSBC

Valuing WesBanco (WSBC) After Q3 Earnings Beat and Operational Gains

Reviewed by Simply Wall St

WesBanco (WSBC) delivered an impressive set of Q3 results, highlighted by a 68% year-over-year jump in net income and strong revenue growth. Investors took notice as profitability outpaced several expectations.

See our latest analysis for WesBanco.

WesBanco’s upbeat Q3 hasn’t gone unnoticed by investors; after the earnings release, the share price ticked noticeably higher, closing at $31.31 with a 2% pop on the day. While short-term share price movements have been mixed, the real story is in the 8% total return over the past year, hinting at improving momentum as operational changes begin to pay off.

If the bank’s momentum has you curious about broader opportunities, now’s a perfect moment to branch out and discover fast growing stocks with high insider ownership

But after such a strong performance, is WesBanco still flying under the radar? Or have investors already priced in the next leg of growth, making this a tougher call for new buyers?

Most Popular Narrative: 16.3% Undervalued

The latest, most widely followed narrative for WesBanco places its fair value at $37.43. With the last close at $31.31, the market is pricing in a notably lower figure, sparking discussion about whether investors are underestimating key drivers for future growth.

Accelerated investment in digital banking capabilities and treasury management products is boosting fee-based income streams, evidenced by current 40% year-over-year growth in non-interest income. This positions the company to capitalize on customer migration toward digital financial services, likely enhancing both revenue mix and net margins.

Curious how this narrative defends such a bold valuation gap? There is a quantitative engine at work, such as revenue surges and margin upgrades, baked into these projections. Only the full narrative unveils the pivotal financial levers powering that enticing target.

Result: Fair Value of $37.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on commercial real estate growth and limited geographic diversification could challenge WesBanco’s ability to deliver on these bullish projections.

Find out about the key risks to this WesBanco narrative.

Another View: What Do Earnings Ratios Say?

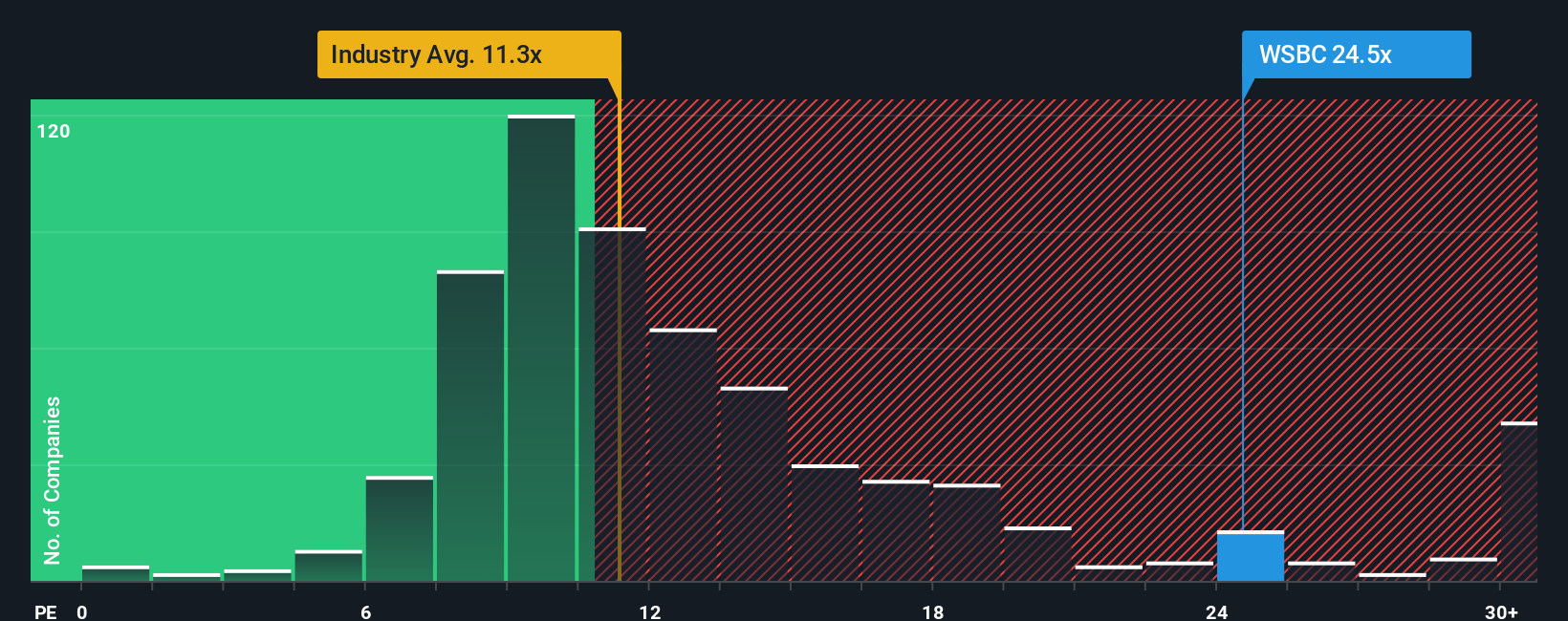

Looking at valuation through the lens of earnings, WesBanco trades at 17.5 times earnings, noticeably above the US Banks industry average of 11.2 and peer average of 14.2. While the current share price is below the consensus target, this higher ratio signals the market is already pricing in some optimism, especially since the fair ratio is estimated at 20.8. Is this a premium worth paying, or does it suggest investors should tread carefully?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own WesBanco Narrative

If this analysis doesn’t quite fit your outlook, or you would rather dig into the numbers yourself, you can put together a fresh angle in minutes. Do it your way

A great starting point for your WesBanco research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Move ahead of the crowd and take charge of your portfolio with expertly pre-screened stock picks. Miss this, and you might overlook tomorrow’s game-changers.

- Boost your income potential by uncovering companies that consistently deliver these 17 dividend stocks with yields > 3% with yields above 3%.

- Catch the next tech disruptors by reviewing these 27 AI penny stocks as they push boundaries in artificial intelligence.

- Get ahead with value opportunities by spotting these 876 undervalued stocks based on cash flows that are underappreciated by the market today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WesBanco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WSBC

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives