- United States

- /

- Banks

- /

- NasdaqGS:WAFD

WaFd’s (WAFD) Stable Earnings and Share Buybacks Might Change The Case For Investing In WaFd (WAFD)

Reviewed by Simply Wall St

- WaFd, Inc. recently reported its third quarter and nine-month financial results, showing relatively stable net income and earnings per share compared to the previous year, while net charge-offs for the third quarter edged up slightly to US$5.4 million.

- The company also updated its ongoing share buyback program, having repurchased over 1.66 million shares in the most recent quarter, which may signal continued focus on returning value to shareholders.

- We'll explore how WaFd's steady earnings and active share repurchases contribute to the company's investment narrative for stakeholders.

What Is WaFd's Investment Narrative?

Investing in WaFd means believing in steady operational execution, careful capital management, and an ability to weather shifts in the regional banking landscape. The most recent quarterly results highlighted relatively stable earnings per share and net income versus last year, while a modest uptick in net charge-offs and slightly lower net interest income may remind observers of the ongoing pressures facing banks. Still, WaFd's active share repurchase program and reliable dividend show a tangible commitment to shareholder returns, qualities that have long appealed to value-focused investors. The incremental rise in credit losses this quarter is important to watch, but with no sharp deviation from prior periods and only minor share price movement after results, the immediate impact on key short term catalysts like buybacks or dividend policy appears limited. For now, the big questions remain around maintaining asset quality and sustaining profitability amid a still-evolving credit cycle.

Conversely, investors should not overlook the recent rise in net charge-offs.

Exploring Other Perspectives

Build Your Own WaFd Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WaFd research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free WaFd research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WaFd's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

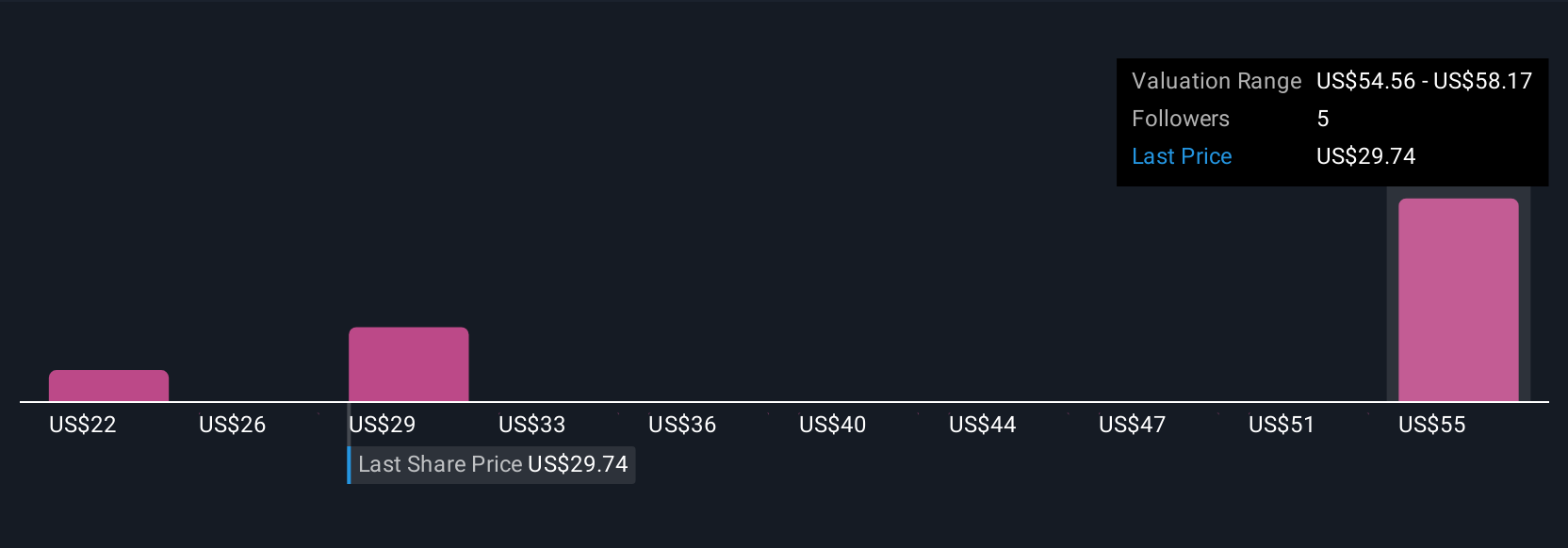

Discover if WaFd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WAFD

WaFd

Operates as the bank holding company for Washington Federal Bank that provides lending, depository, insurance, and other banking services in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives