- United States

- /

- Software

- /

- NasdaqGS:DDOG

US Exchange: Discover 3 Stocks That May Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

As the U.S. stock market experiences a period of volatility following recent political and economic developments, investors are keenly watching for opportunities amidst fluctuating indices. In this environment, identifying stocks that may be priced below their estimated value can offer potential advantages, particularly when considering factors such as strong fundamentals and resilience to broader market shifts.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (NasdaqGS:UMBF) | $122.86 | $245.13 | 49.9% |

| Afya (NasdaqGS:AFYA) | $16.16 | $32.25 | 49.9% |

| West Bancorporation (NasdaqGS:WTBA) | $23.90 | $46.85 | 49% |

| Better Choice (NYSEAM:BTTR) | $1.80 | $3.52 | 48.9% |

| XPEL (NasdaqCM:XPEL) | $45.46 | $90.91 | 50% |

| Smith Douglas Homes (NYSE:SDHC) | $30.51 | $60.63 | 49.7% |

| Privia Health Group (NasdaqGS:PRVA) | $21.69 | $43.16 | 49.7% |

| Advanced Energy Industries (NasdaqGS:AEIS) | $112.15 | $219.26 | 48.9% |

| South Atlantic Bancshares (OTCPK:SABK) | $15.50 | $30.27 | 48.8% |

| Carter Bankshares (NasdaqGS:CARE) | $19.46 | $38.28 | 49.2% |

Let's take a closer look at a couple of our picks from the screened companies.

Datadog (NasdaqGS:DDOG)

Overview: Datadog, Inc. provides an observability and security platform for cloud applications worldwide, with a market cap of approximately $43.64 billion.

Operations: The company generates revenue from its IT Infrastructure segment, amounting to $2.54 billion.

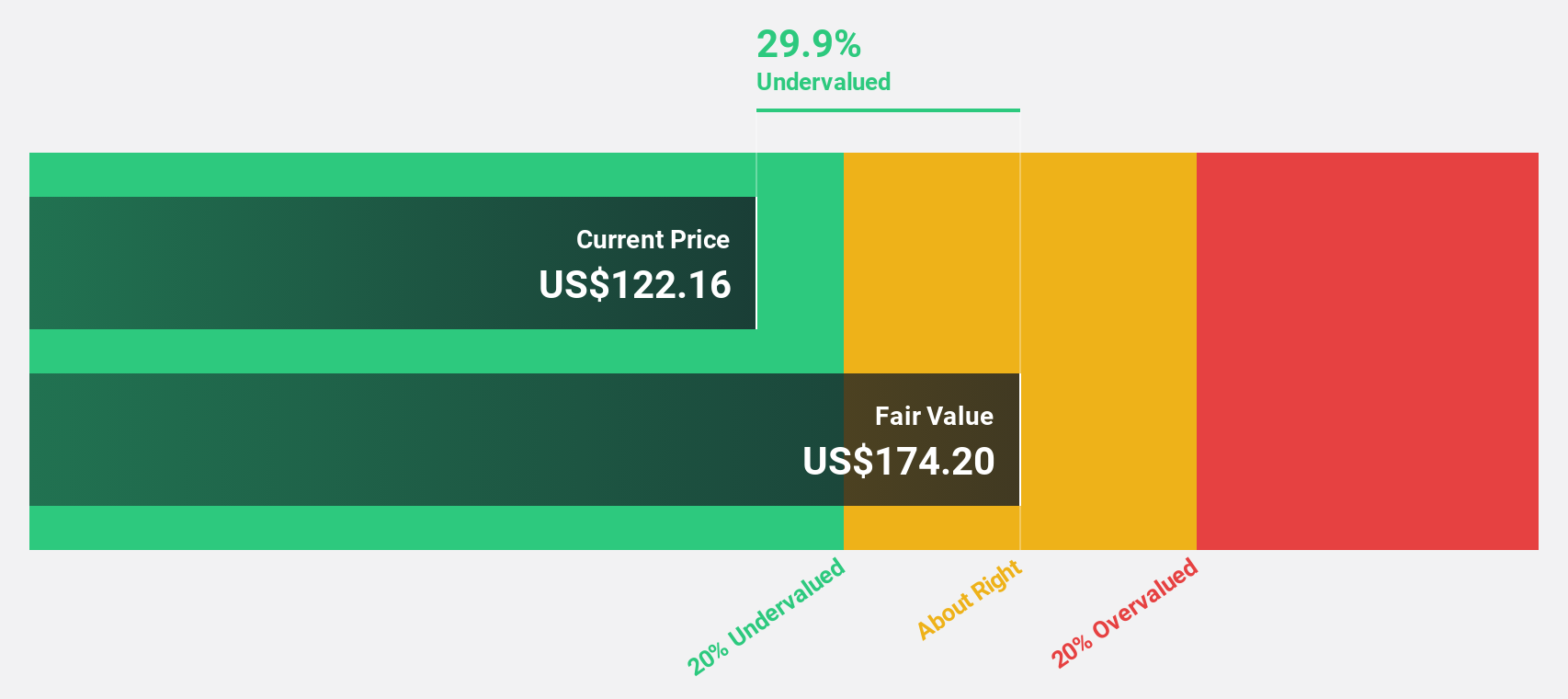

Estimated Discount To Fair Value: 46.1%

Datadog is trading at US$131.43, significantly below its estimated fair value of US$244.02, suggesting it may be undervalued based on cash flows. Despite recent insider selling and shareholder dilution, Datadog's revenue is forecast to grow faster than the US market at 17.9% annually, with earnings expected to increase by 23.6% per year. The recent launch of Kubernetes Active Remediation enhances their product offerings, potentially boosting operational efficiency for clients in complex environments.

- The growth report we've compiled suggests that Datadog's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Datadog.

MercadoLibre (NasdaqGS:MELI)

Overview: MercadoLibre, Inc. operates online commerce platforms in the United States with a market capitalization of approximately $97.89 billion.

Operations: The company generates revenue from its Internet Software & Services segment, totaling $18.49 billion.

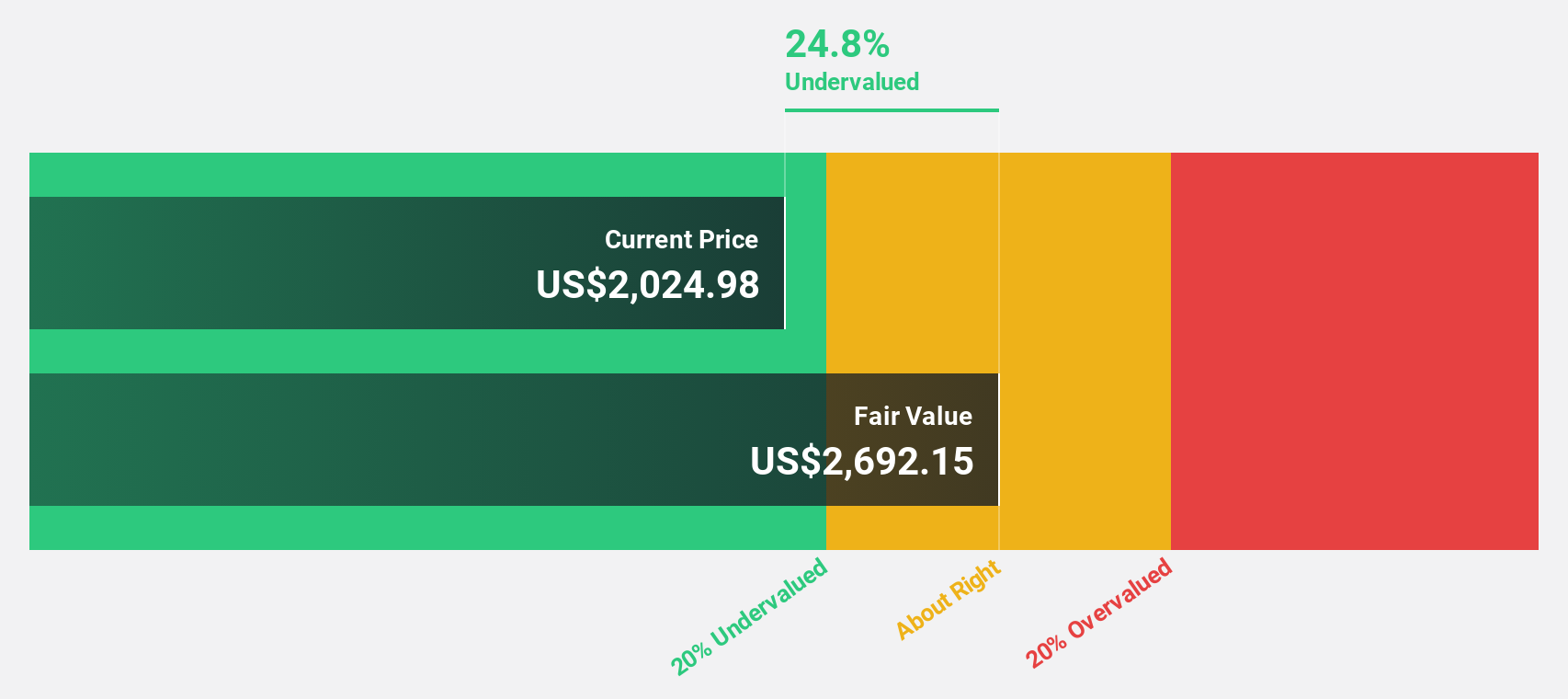

Estimated Discount To Fair Value: 11.5%

MercadoLibre, trading at US$1,876.20, is undervalued relative to its estimated fair value of US$2,119.68. Recent earnings showed significant growth with quarterly revenue reaching US$5.31 billion and net income rising to US$397 million. Despite a moderate valuation gap, the company's robust cash flows and strategic expansions like the Essendant partnership in Latin America position it well for future growth. Analysts anticipate earnings growth outpacing the broader market at 27.9% annually over three years.

- Our comprehensive growth report raises the possibility that MercadoLibre is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of MercadoLibre stock in this financial health report.

Valley National Bancorp (NasdaqGS:VLY)

Overview: Valley National Bancorp is a holding company for Valley National Bank, offering a range of commercial, private banking, retail, insurance, and wealth management services with a market cap of approximately $5.69 billion.

Operations: The company's revenue segments are composed of Consumer Banking at $234.79 million and Commercial Banking at approximately $1.30 billion.

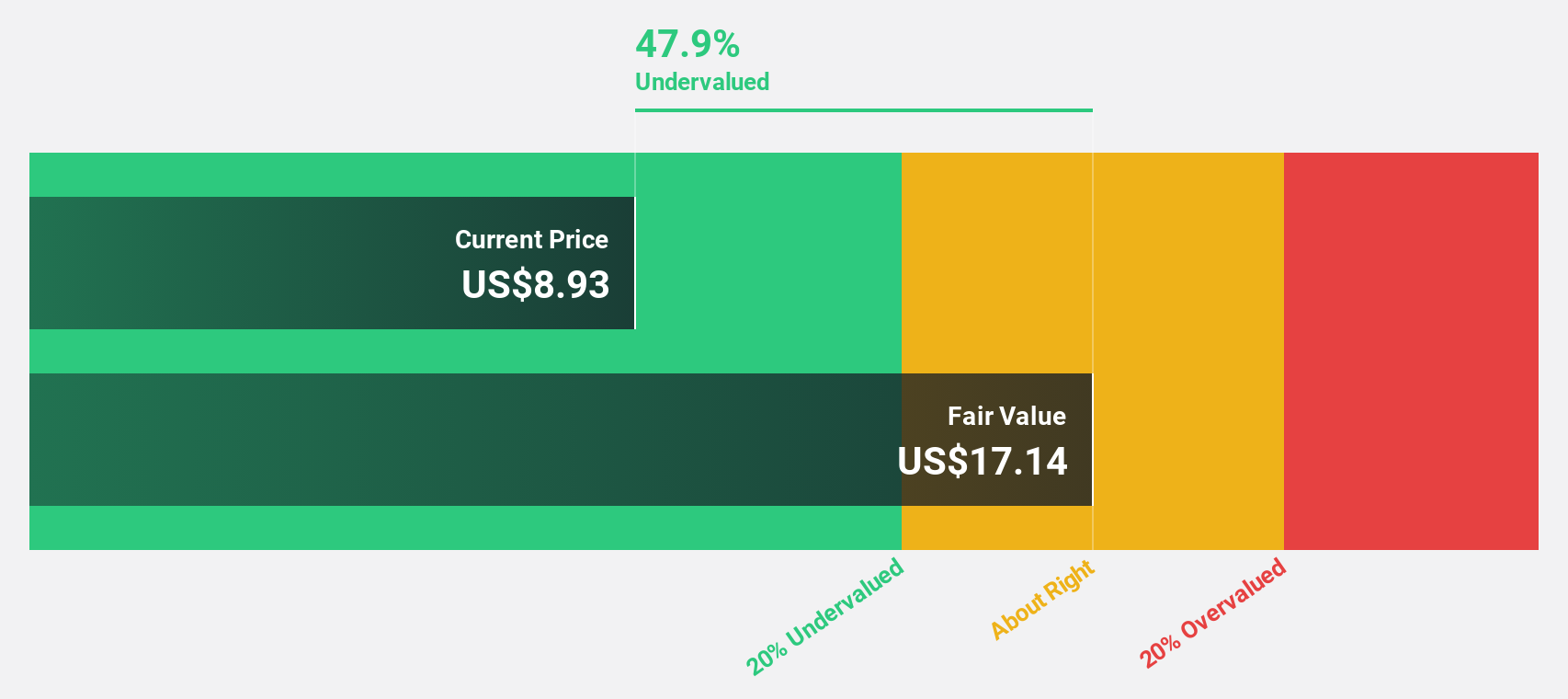

Estimated Discount To Fair Value: 15.2%

Valley National Bancorp's stock is trading at US$10.14, below its estimated fair value of US$11.96, suggesting undervaluation. Despite a recent follow-on equity offering raising nearly $400 million, revenue growth is projected to outpace the US market at 11.4% annually. However, profit margins have declined and net income decreased significantly year-over-year. Earnings are expected to grow substantially by 28.5% annually over the next three years, with a reliable dividend yield of 4.34%.

- According our earnings growth report, there's an indication that Valley National Bancorp might be ready to expand.

- Click to explore a detailed breakdown of our findings in Valley National Bancorp's balance sheet health report.

Taking Advantage

- Discover the full array of 200 Undervalued US Stocks Based On Cash Flows right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DDOG

Datadog

Operates an observability and security platform for cloud applications in North America and internationally.

High growth potential with excellent balance sheet.