- United States

- /

- Banks

- /

- NasdaqGS:UMBF

UMB Financial (UMBF): Assessing Valuation After Strong Q3 and Heartland Acquisition Integration

Reviewed by Simply Wall St

UMB Financial (UMBF) caught investor attention after delivering strong third-quarter results, largely propelled by the successful integration of Heartland Financial USA, Inc. and steady organic growth. Net income saw a noticeable surge as a result of broad-based revenue gains.

See our latest analysis for UMB Financial.

Over the past year, UMB Financial’s share price has been on a modest ride, starting the year flat but seeing a recent uptick as third-quarter momentum and acquisition synergies sparked renewed investor interest. Although the 1-year total shareholder return still sits at -9.5%, longer-term holders are in firmly positive territory, with three- and five-year total returns of 38.7% and 75.3%, respectively. This suggests that, despite some bumps, the broader trajectory remains constructive for patient investors.

If this mix of resilience and growth has you wondering what else is capturing investor attention, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

Given the recent jump in earnings and the stock still trading at a discount to analyst targets, the key question for investors is whether UMB Financial is undervalued at current levels or if the market is already reflecting future growth prospects.

Most Popular Narrative: 18.6% Undervalued

According to the most popular narrative, UMB Financial’s current price of $112.02 is well below its fair value estimate of $137.69. This suggests significant upside if future growth plays out as expected. This narrative sets the stage for a deep dive into the transformation-driven catalysts that could reshape the company’s margins over the next two years.

The successful integration of the Heartland (HTLF) acquisition, including vendor consolidation and conversion to the UMB platform, is expected to unlock substantial cost savings ($124 million targeted, most of which will be realized by early 2026). This should materially improve operating leverage and expand net margins.

Want to know what drives this aggressive upside? The valuation relies on bold operating margin expansion and revenue growth assumptions built around UMB's integration strategy. Uncover the quantitative leaps that analysts are expecting from these key moves. Find out how much bank profitability might change by 2028 and what that could mean for today’s share price.

Result: Fair Value of $137.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, key risks remain, notably UMB Financial's regional concentration and execution challenges with the Heartland integration. Both of these factors could dampen its growth outlook.

Find out about the key risks to this UMB Financial narrative.

Another View: What Do Market Ratios Tell Us?

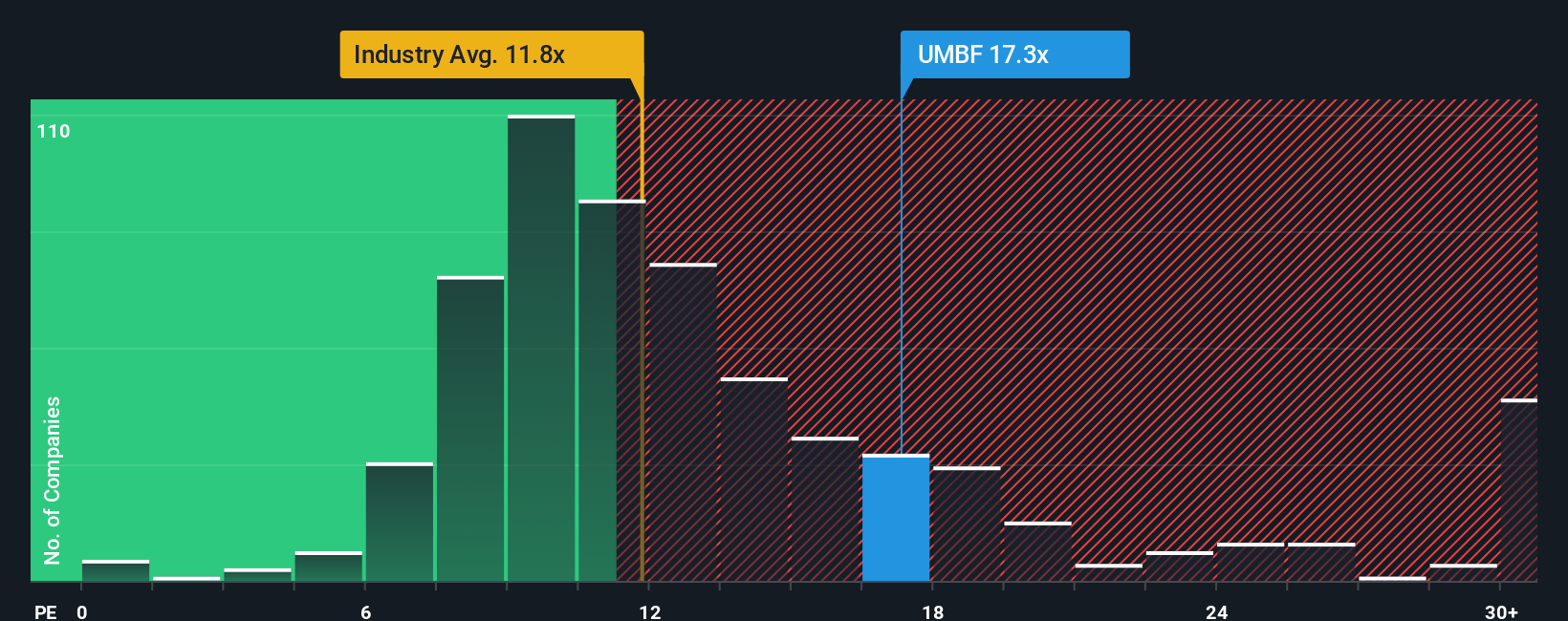

While our first look focused on future cash flows and growth projections, the market is valuing UMB Financial using a ratio of 14.3x. This is higher than the industry average of 11.4x and slightly above the fair ratio of 15.2x that the market could eventually move towards. This may signal a market premium, but is it justified, or does it mean higher risk for investors if expectations slip?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UMB Financial Narrative

Feel free to dig deeper, challenge the numbers, and shape your own perspective. The tools are available for you, and you can develop your own in just minutes. Do it your way

A great starting point for your UMB Financial research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that the best opportunities rarely wait around. Get ahead of the crowd by checking out these alternative angles and make your next move with confidence:

- Tap into stocks with rapid growth backed by solid fundamentals by browsing these 3579 penny stocks with strong financials and uncovering game-changing small caps.

- Unlock the power of artificial intelligence by selecting these 25 AI penny stocks, and see which companies are redefining what’s possible in tech.

- Secure your portfolio with assets offering consistent yields. See which top picks are providing income above 3% via these 15 dividend stocks with yields > 3% now before others catch on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UMBF

UMB Financial

Operates as the bank holding company that provides banking services and asset servicing in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.