- United States

- /

- Banks

- /

- NasdaqGS:UMBF

Is UMB Financial Now an Opportunity After Recent 4% Price Dip?

Reviewed by Bailey Pemberton

If you hold UMB Financial stock or are eyeing it for your portfolio, you’re probably weighing up your next move. Is now the right time to buy more, hold steady, or cash in some gains? With its price closing at $111.40, UMB Financial has caught the attention of both long-term investors and short-term traders alike. Over the last year, the stock climbed 6.0%, and its performance over the past five years is even more impressive, doubling at 107.3%. That kind of growth doesn’t go unnoticed.

However, it’s not all a smooth ride. In just the past week, UMB Financial dipped by 4.2%, and it’s down 6.8% over the last month. Some of this short-term turbulence matches a broader shift in investor sentiment across the mid-cap financials landscape as recent headlines have raised questions about regulatory trends and shifting market expectations for banks. While no major news has flashed the red lights for UMB specifically, the sector’s evolving risk profile is clearly top of mind for many investors.

But here’s the real kicker if you’re focused on value: a quick look at UMB Financial’s value score, based on a six-point checklist of common undervaluation signals, lands it at an impressive 4. For context, each box ticked means the company appears undervalued by a different traditional yardstick, and UMB clears four out of six. That’s a sign there could be more under the hood than recent price moves suggest.

So how does UMB actually measure up on each of those valuation fronts, and is there a smarter way to look at its true worth? That’s exactly what we’ll unpack in the sections ahead.

Why UMB Financial is lagging behind its peers

Approach 1: UMB Financial Excess Returns Analysis

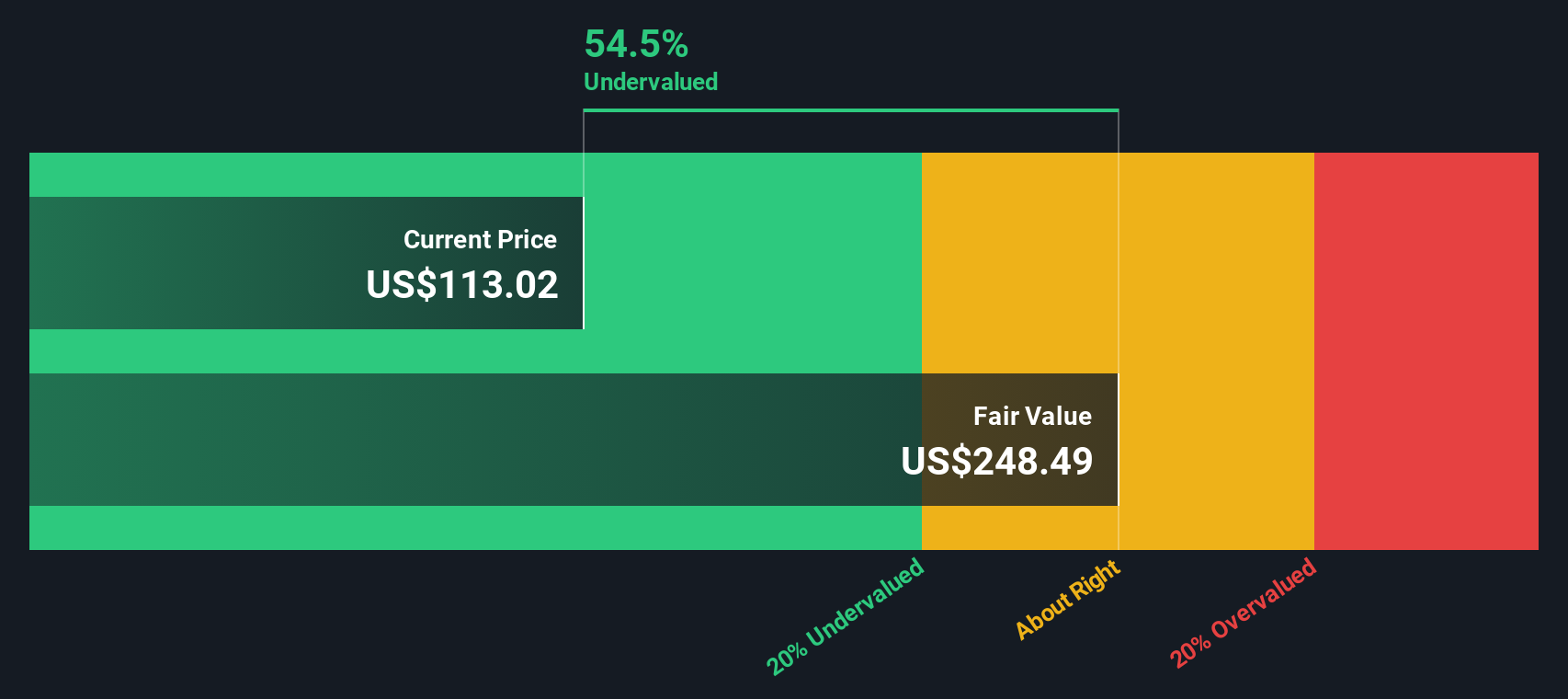

The Excess Returns valuation approach assesses how effectively a company generates profit above its cost of equity, focusing on return on invested capital and sustainable growth rather than just headline earnings. This method highlights the value creation of UMB Financial's core banking operations.

Based on current estimates from nine analysts, UMB Financial carries a book value of $90.63 per share and is projected to deliver a stable earnings per share of $12.52, reflecting an average return on equity of 11.97%. With a calculated cost of equity at $7.18 per share, the resulting excess return is $5.34 per share. This indicates that UMB is expected to consistently generate meaningful value above what investors require as compensation for risk. The stable book value, projected to reach $104.58 per share in future periods, highlights continued capital growth over time.

In summary, this model produces an intrinsic value estimate of $245.55 per share. Compared to the latest closing price of $111.40, that suggests the stock is trading at a substantial 54.6% discount to intrinsic value. According to this model, the market may be overlooking UMB Financial’s value potential.

Result: UNDERVALUED

Our Excess Returns analysis suggests UMB Financial is undervalued by 54.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

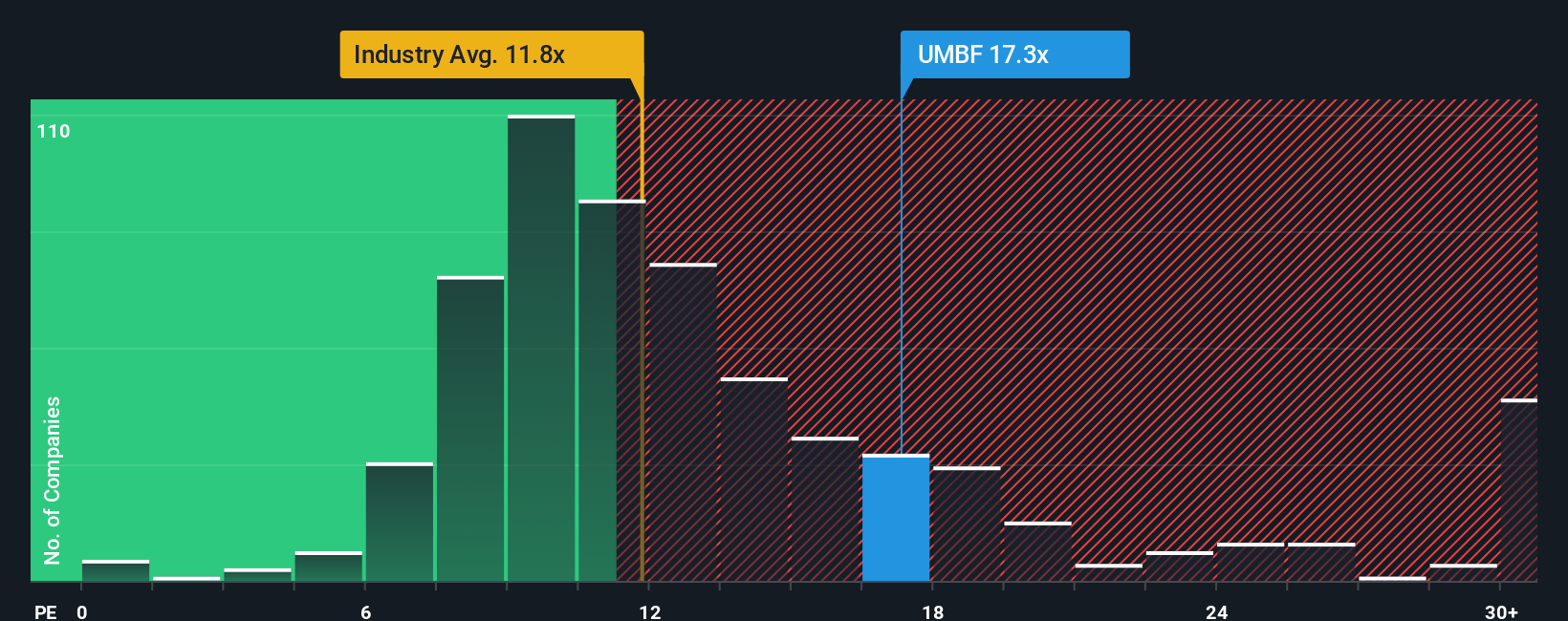

Approach 2: UMB Financial Price vs Earnings

The price-to-earnings (PE) ratio is a go-to valuation tool for established, profitable companies like UMB Financial, as it tells investors how much they’re paying for each dollar of earnings. A stock’s PE ratio helps indicate whether it’s priced richly or cheaply relative to what it earns. This ratio can provide a clear lens for evaluating if future earnings growth is already included in today’s price.

Importantly, a “normal” or fair PE ratio is shaped by factors such as growth expectations, profitability, and risk. Companies with higher expected earnings growth and lower risk usually warrant higher PE ratios, while more mature or risk-prone companies usually deserve lower multiples.

UMB Financial currently trades at a PE ratio of 16.1x, which is noticeably higher than the Banks industry average of 11.2x and also above the average of its closest peers at 12.4x. However, looking only at these benchmarks can be misleading if the company’s growth prospects, margins, or risk profile are different from its peers. This is why Simply Wall St’s “Fair Ratio” at 17.0x for UMB Financial becomes relevant. Unlike simple peer or industry averages, this proprietary metric considers not just the company’s sector but also its earnings growth outlook, profitability, risks, and market cap, providing a more tailored target PE.

With the stock’s current PE (16.1x) slightly below its Fair Ratio (17.0x), UMB Financial appears modestly undervalued by this approach, suggesting there may be more upside left for patient investors.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

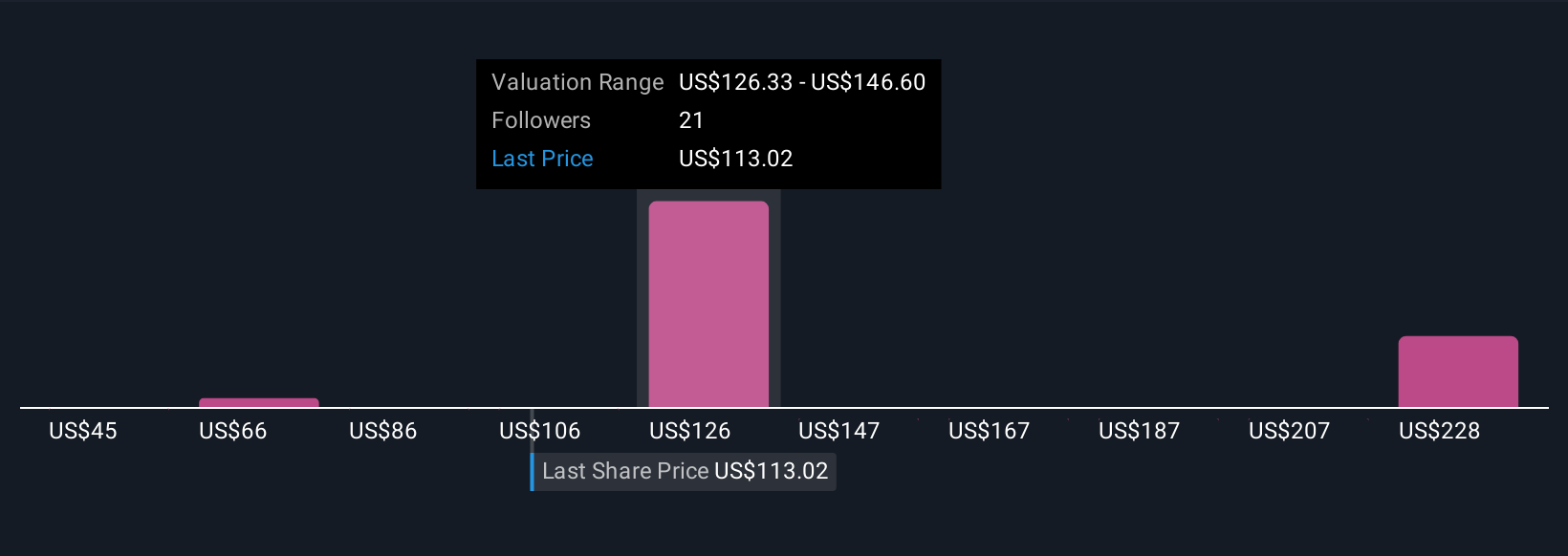

Upgrade Your Decision Making: Choose your UMB Financial Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives, a smarter and more dynamic tool for investors. A Narrative is simply your story behind the numbers: it is how you bring together your own perspective on UMB Financial’s future with estimates for revenue, earnings, margins, and ultimately, what you believe to be a fair value. Narratives link the company’s real-world story and outlook to a financial forecast, connecting business drivers to valuation in a way that is both clear and actionable.

On Simply Wall St’s Community page, millions of investors can easily create and share Narratives, making this powerful approach accessible to everyone. With Narratives, you can see in real time how your assumptions (and those of the community) line up against the current share price, helping you decide when to buy, hold, or sell. Plus, Narratives are kept dynamic, automatically updating as new information, like earnings or breaking news, becomes available and ensuring your investment thesis stays relevant.

For UMB Financial, for example, one Narrative might see cost-saving integrations and Midwest expansion pushing fair value as high as $150 per share. Another, more cautious perspective might set it at just $120, highlighting the value of comparing differing views based on real business data.

Do you think there's more to the story for UMB Financial? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UMBF

UMB Financial

Operates as the bank holding company that provides banking services and asset servicing in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives