- United States

- /

- Banks

- /

- NasdaqGS:UMBF

A Fresh Look at UMB Financial (UMBF) Valuation After Strong Earnings and Surpassing Analyst Forecasts

Reviewed by Kshitija Bhandaru

UMB Financial (UMBF) just delivered a second quarter that has the market taking notice. The company’s revenue soared past Wall Street expectations by 8.6%, with CEO Mariner Kemper crediting the growth on both sides of the balance sheet, healthier asset quality, and better operating leverage. Investors responded quickly, pushing the stock up 8.2% since the announcement. This is clear evidence that these results are being welcomed as more than just another quarterly update.

This solid quarter slots into a year where UMB Financial’s momentum has generally been on the upswing. Over the last twelve months, shares have returned 16%. While the stock saw minor declines in the past month, it is up a strong 13% for the past three months and has gained 68% year-to-date. Longer-term investors have done even better, with the five-year total return topping 153%. The latest earnings beat adds to a narrative of consistent growth, even as the broader financial sector has faced turbulence.

After this remarkable acceleration, the question for investors is front and center. Is there real value left to capture in UMB Financial, or has the market already priced in the company’s next phase of growth?

Most Popular Narrative: 10.2% Undervalued

The consensus narrative suggests UMB Financial is trading at a notable discount to its fair value, supporting a positive outlook on current and future performance.

“The successful integration of the Heartland (HTLF) acquisition, including vendor consolidation and conversion to the UMB platform, is expected to unlock substantial cost savings ($124 million targeted, most of which will be realized by early 2026). This should materially improve operating leverage and expand net margins.”

Curious why analysts see double-digit upside ahead? The calculations behind this valuation rest on bold projections for future earnings power and profit margins. Wondering what surprising assumptions set this fair value apart from what the market thinks? Explore the full story and the hidden numbers driving analyst optimism, but prepare for some eye-opening expectations.

Result: Fair Value of $133 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, integration risks and a slowdown in the Midwest economy could challenge UMB Financial’s growth projections and potentially disrupt momentum for future quarters.

Find out about the key risks to this UMB Financial narrative.Another View: What Does the Market Multiple Say?

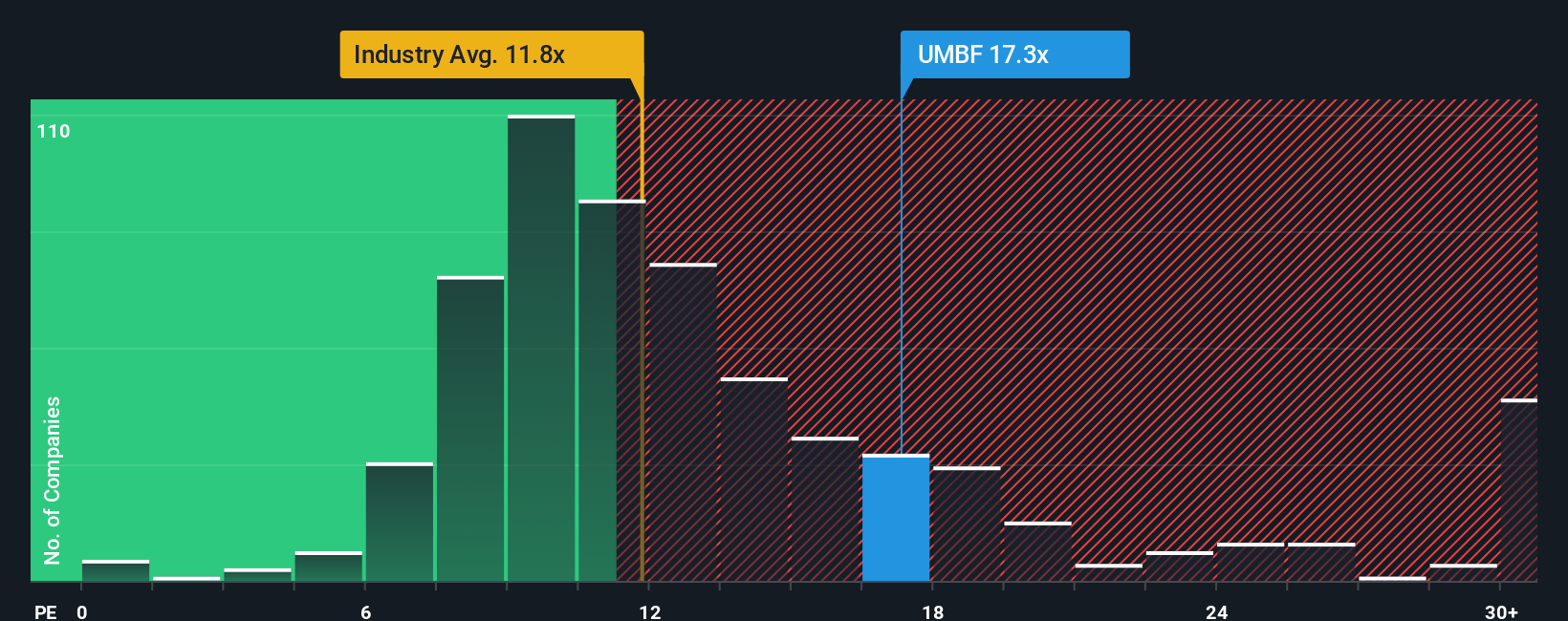

Looking at valuation the way most on Wall Street do, UMB Financial trades at a higher price-to-earnings ratio than the average US bank. Does this suggest expectations are running ahead of reality, or is there more to the story?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding UMB Financial to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own UMB Financial Narrative

If you see things differently or want to dig into the details yourself, you can craft your own narrative with just a few clicks. Do it your way.

A great starting point for your UMB Financial research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Make your next investing move count by uncovering unique stock opportunities tailored to today’s market. Miss this and you could overlook the next breakout winner.

- Tap into emerging tech trends and spot tomorrow’s winners early with AI penny stocks, working at the forefront of artificial intelligence innovation.

- Secure consistent income streams as you browse dividend stocks with yields > 3%, featuring companies rewarding shareholders with attractive yield potential.

- Break into undervalued opportunities and find stocks trading below fair value through the lens of undervalued stocks based on cash flows for your next great bargain.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UMBF

UMB Financial

Operates as the bank holding company that provides banking services and asset servicing in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives