- United States

- /

- Banks

- /

- NasdaqGS:UBSI

How UBSI’s Profit Growth and Rising Credit Losses Could Shape United Bankshares’ Investment Outlook

Reviewed by Sasha Jovanovic

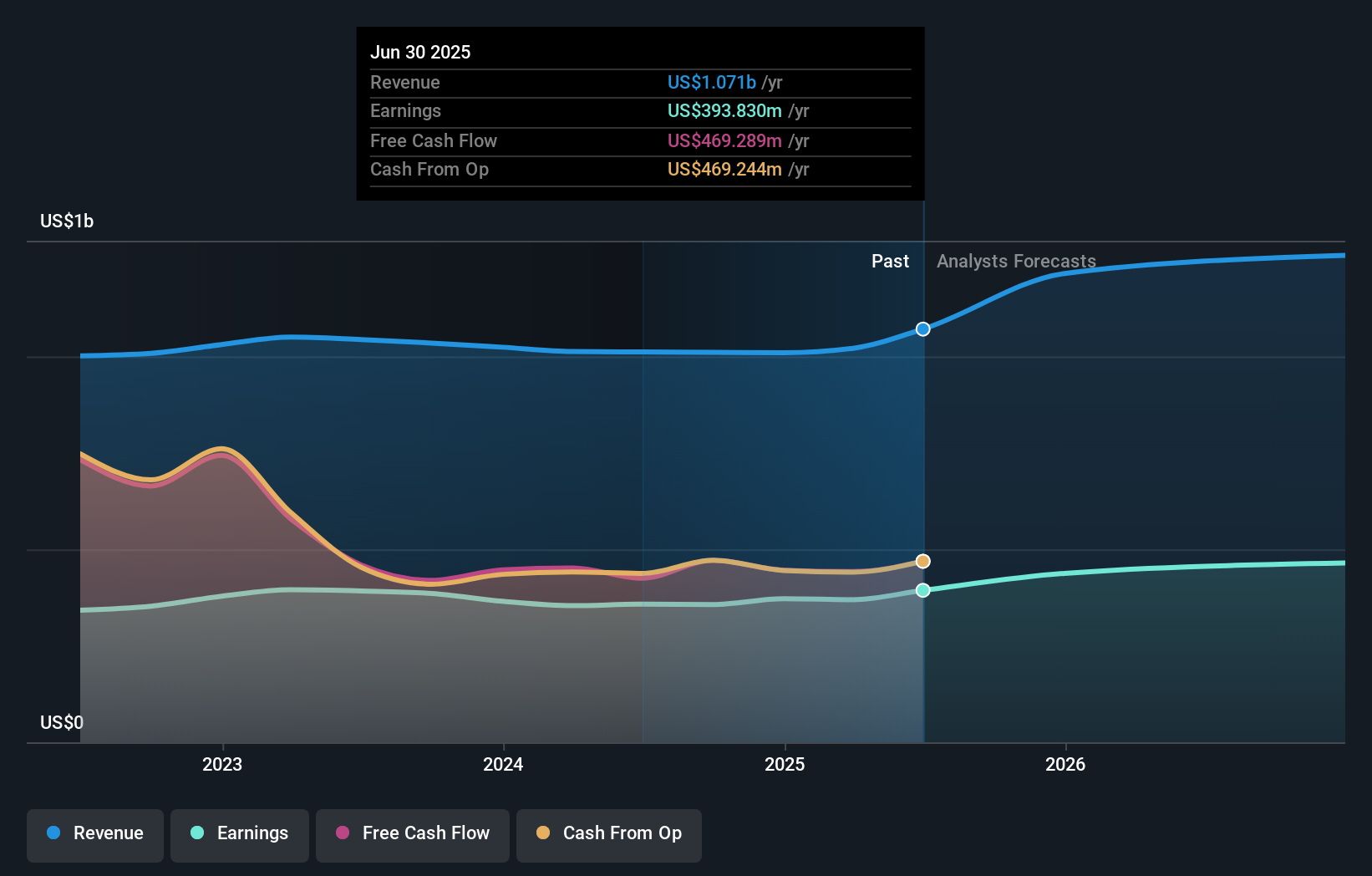

- United Bankshares, Inc. recently reported its third-quarter 2025 results, announcing an increase in net interest income to US$280.12 million and net income to US$130.75 million year-over-year, alongside share repurchase updates and higher net charge-offs.

- While the company achieved substantial profit growth and continued capital returns through buybacks, it also saw a marked rise in credit losses compared to prior quarters.

- We'll explore how the combination of stronger earnings and rising net charge-offs reshapes United Bankshares' investment outlook.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is United Bankshares' Investment Narrative?

For investors considering United Bankshares, the core belief centers on the company's established track record of profit growth, robust dividends, and active capital returns via share buybacks. However, this quarter's sharp increase in net charge-offs to US$20.0 million marks a significant shift in short-term risk, especially as these credit losses have accelerated quickly from prior quarters. While net income and interest income have both climbed strongly year-over-year, the trend in credit quality now raises questions about the sustainability of this growth and the resilience of the loan book in evolving market conditions. The ongoing buyback and consistently rising dividend still appeal, but the higher credit losses could weigh on sentiment and potentially reframe near-term expectations. Recent price moves suggest the market has begun to reassess these emerging risks in light of the new figures. But with rising credit losses, there’s a critical shift in risk you should be aware of.

Despite retreating, United Bankshares' shares might still be trading 41% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 3 other fair value estimates on United Bankshares - why the stock might be worth just $34.72!

Build Your Own United Bankshares Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Bankshares research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free United Bankshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Bankshares' overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UBSI

United Bankshares

Through its subsidiaries, provides commercial and retail banking products and services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives