Stock Analysis

- United States

- /

- Banks

- /

- NasdaqGS:TRST

What Type Of Shareholders Make Up TrustCo Bank Corp NY's (NASDAQ:TRST) Share Registry?

If you want to know who really controls TrustCo Bank Corp NY (NASDAQ:TRST), then you'll have to look at the makeup of its share registry. Insiders often own a large chunk of younger, smaller, companies while huge companies tend to have institutions as shareholders. Companies that have been privatized tend to have low insider ownership.

TrustCo Bank Corp NY is a smaller company with a market capitalization of US$696m, so it may still be flying under the radar of many institutional investors. Taking a look at our data on the ownership groups (below), it seems that institutions are noticeable on the share registry. Let's take a closer look to see what the different types of shareholders can tell us about TrustCo Bank Corp NY.

See our latest analysis for TrustCo Bank Corp NY

What Does The Institutional Ownership Tell Us About TrustCo Bank Corp NY?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

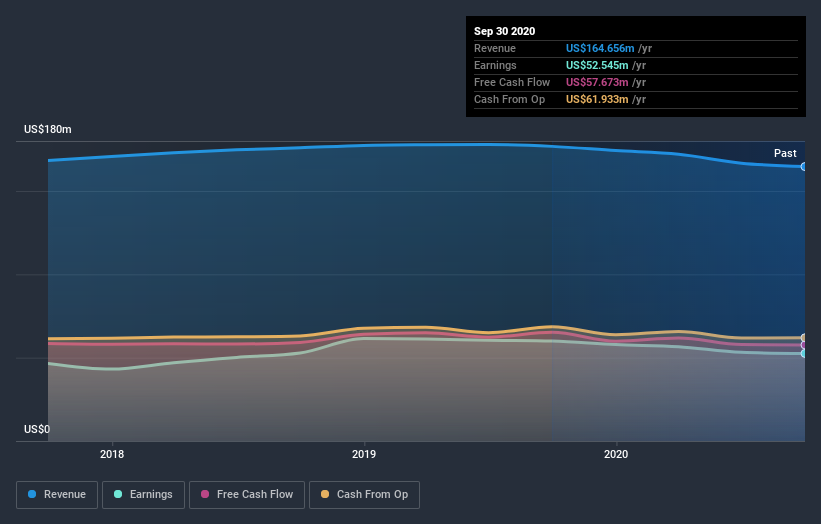

We can see that TrustCo Bank Corp NY does have institutional investors; and they hold a good portion of the company's stock. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see TrustCo Bank Corp NY's historic earnings and revenue below, but keep in mind there's always more to the story.

Investors should note that institutions actually own more than half the company, so they can collectively wield significant power. TrustCo Bank Corp NY is not owned by hedge funds. Looking at our data, we can see that the largest shareholder is BlackRock, Inc. with 15% of shares outstanding. For context, the second largest shareholder holds about 7.0% of the shares outstanding, followed by an ownership of 5.7% by the third-largest shareholder. In addition, we found that Robert McCormick, the CEO has 1.6% of the shares allocated to their name.

After doing some more digging, we found that the top 17 have the combined ownership of 50% in the company, suggesting that no single shareholder has significant control over the company.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of TrustCo Bank Corp NY

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

I can report that insiders do own shares in TrustCo Bank Corp NY. As individuals, the insiders collectively own US$17m worth of the US$696m company. This shows at least some alignment. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public, with a 32% stake in the company, will not easily be ignored. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand TrustCo Bank Corp NY better, we need to consider many other factors. Be aware that TrustCo Bank Corp NY is showing 1 warning sign in our investment analysis , you should know about...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

When trading TrustCo Bank Corp NY or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether TrustCo Bank Corp NY is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:TRST

TrustCo Bank Corp NY

Operates as the holding company for Trustco Bank, a federal savings bank that provides personal and business banking services to individuals and businesses.

Flawless balance sheet established dividend payer.