- United States

- /

- Banks

- /

- NasdaqGS:TRST

Should You Be Adding TrustCo Bank Corp NY (NASDAQ:TRST) To Your Watchlist Today?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in TrustCo Bank Corp NY (NASDAQ:TRST). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide TrustCo Bank Corp NY with the means to add long-term value to shareholders.

See our latest analysis for TrustCo Bank Corp NY

How Fast Is TrustCo Bank Corp NY Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. TrustCo Bank Corp NY managed to grow EPS by 9.8% per year, over three years. That's a good rate of growth, if it can be sustained.

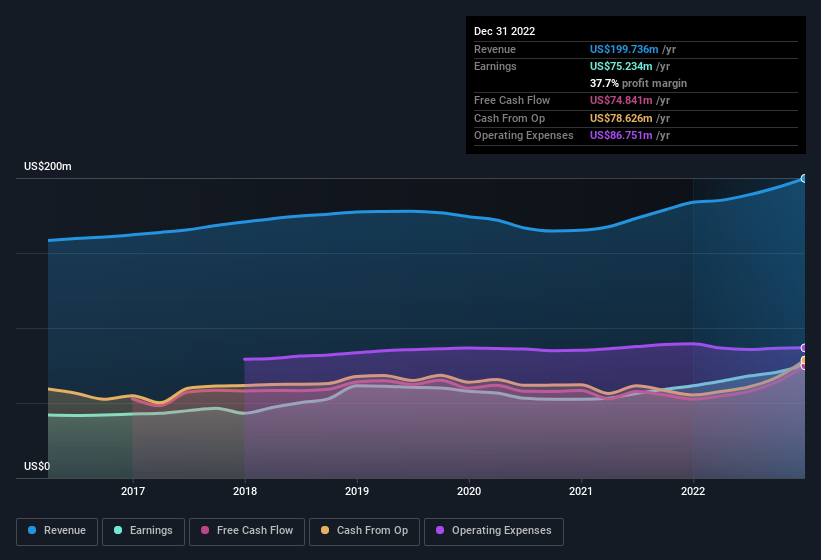

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Our analysis has highlighted that TrustCo Bank Corp NY's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. EBIT margins for TrustCo Bank Corp NY remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 8.7% to US$200m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check TrustCo Bank Corp NY's balance sheet strength, before getting too excited.

Are TrustCo Bank Corp NY Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news is that TrustCo Bank Corp NY insiders spent a whopping US$952k on stock in just one year, without so much as a single sale. The shareholders within the general public should find themselves expectant and certainly hopeful, that this large outlay signals prescient optimism for the business. We also note that it was the General Counsel & Corporate Secretary, Michael Hall, who made the biggest single acquisition, paying US$105k for shares at about US$33.66 each.

On top of the insider buying, it's good to see that TrustCo Bank Corp NY insiders have a valuable investment in the business. To be specific, they have US$19m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. While their ownership only accounts for 3.0%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because on our analysis the CEO, Rob McCormick, is paid less than the median for similar sized companies. The median total compensation for CEOs of companies similar in size to TrustCo Bank Corp NY, with market caps between US$400m and US$1.6b, is around US$3.9m.

TrustCo Bank Corp NY offered total compensation worth US$3.2m to its CEO in the year to December 2021. That is actually below the median for CEO's of similarly sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does TrustCo Bank Corp NY Deserve A Spot On Your Watchlist?

One positive for TrustCo Bank Corp NY is that it is growing EPS. That's nice to see. Better yet, insiders are significant shareholders, and have been buying more shares. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. What about risks? Every company has them, and we've spotted 1 warning sign for TrustCo Bank Corp NY you should know about.

The good news is that TrustCo Bank Corp NY is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if TrustCo Bank Corp NY might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TRST

TrustCo Bank Corp NY

Operates as the holding company for Trustco Bank that provides personal and business banking services to individuals and businesses.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives