- United States

- /

- Banks

- /

- NasdaqGS:TOWN

Where Does TowneBank Stand After Recent Regional Bank Selloff?

Reviewed by Simply Wall St

So you are wondering what to do with TowneBank right now? You are definitely not alone. With all the chatter about bank valuations and changing investor sentiment, a closer look at TowneBank’s track record and current price action might help bring some clarity to your decision making. Over the past week, the stock saw a dip of 2.3%, adding to a 4.5% slide in the last month. Still, zoom out a bit and you will notice the year-to-date return sits at 5.7%, while the stock is up a healthy 6.7% over the past year, and an impressive 161.1% in the last five years.

Some of these moves, especially the long-term gains, reflect how investors have grown more optimistic about the company’s underlying strength, even as broader financial markets shifted between risk-on and risk-off modes. Not all news is earth-shattering, of course, but shifts in economic outlook and sector performance can nudge TowneBank’s valuation into new territory. Speaking of valuation, the current value score comes in at 3 out of 6, which means TowneBank scores as undervalued in three of six different checks. Is that enough to call the stock a bargain, or just fairly priced?

Let’s walk through exactly what these valuation checks are, and then go a step further to explore an even better way to get the full picture of what TowneBank is truly worth.

Why TowneBank is lagging behind its peersApproach 1: TowneBank Excess Returns Analysis

The Excess Returns valuation model helps to estimate a stock's true worth by analyzing how much value a company creates for shareholders above the cost of its equity. Instead of just looking at earnings or dividends, this approach focuses on the return generated by invested capital compared to what investors require as compensation for their risk.

For TowneBank, the model shows a Book Value of $30.03 per share and a Stable Earnings Per Share (EPS) of $2.80, reflecting the median return on equity from the past five years. The Cost of Equity stands at $2.23 per share, meaning the company has been generating an Excess Return of $0.57 per share. This leads to an average Return on Equity of 8.5%. Looking ahead, analysts project a Stable Book Value of $32.92 per share based on two weighted future estimates.

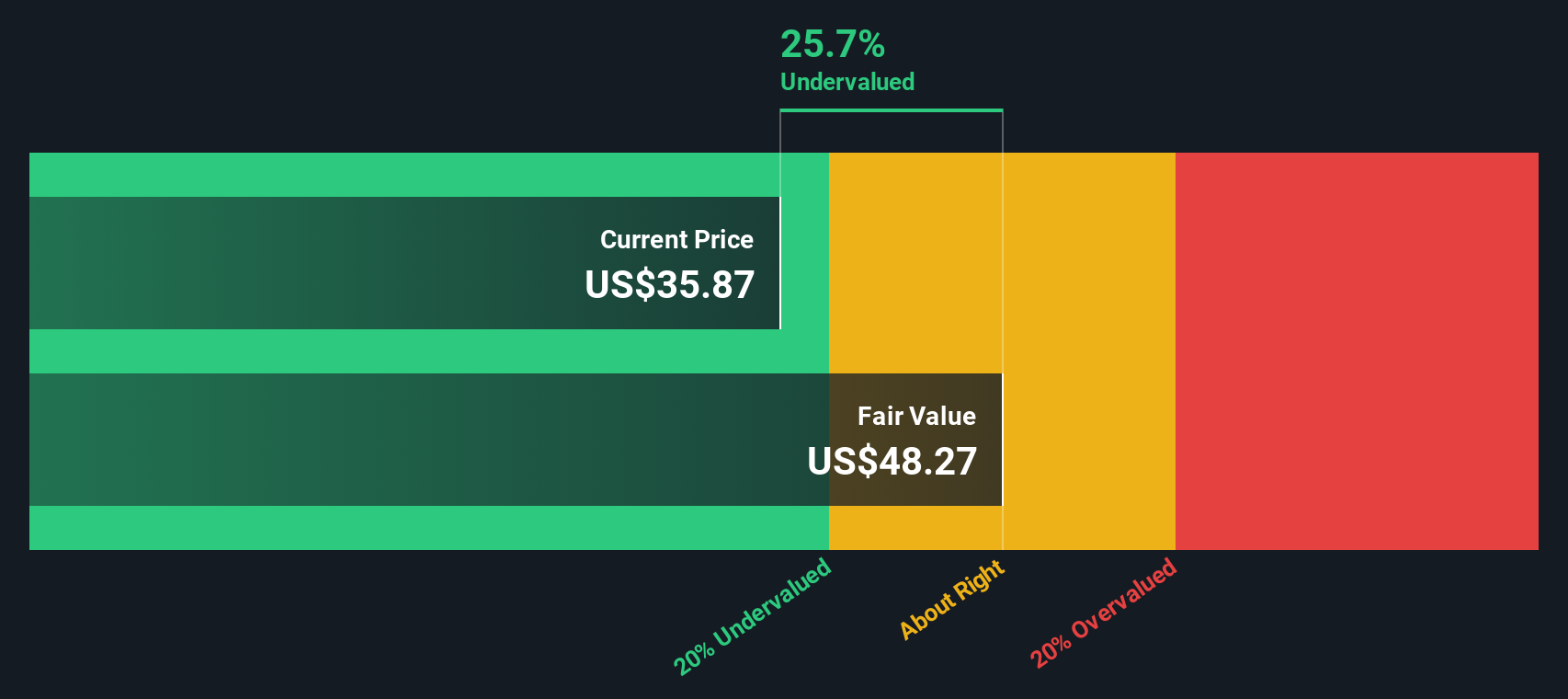

According to this analysis, the intrinsic value of TowneBank stock is estimated to be $48.27. With the share currently trading at a 27.3% discount to this value, the Excess Returns model suggests the stock is significantly undervalued at this time.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for TowneBank.

Approach 2: TowneBank Price vs Earnings

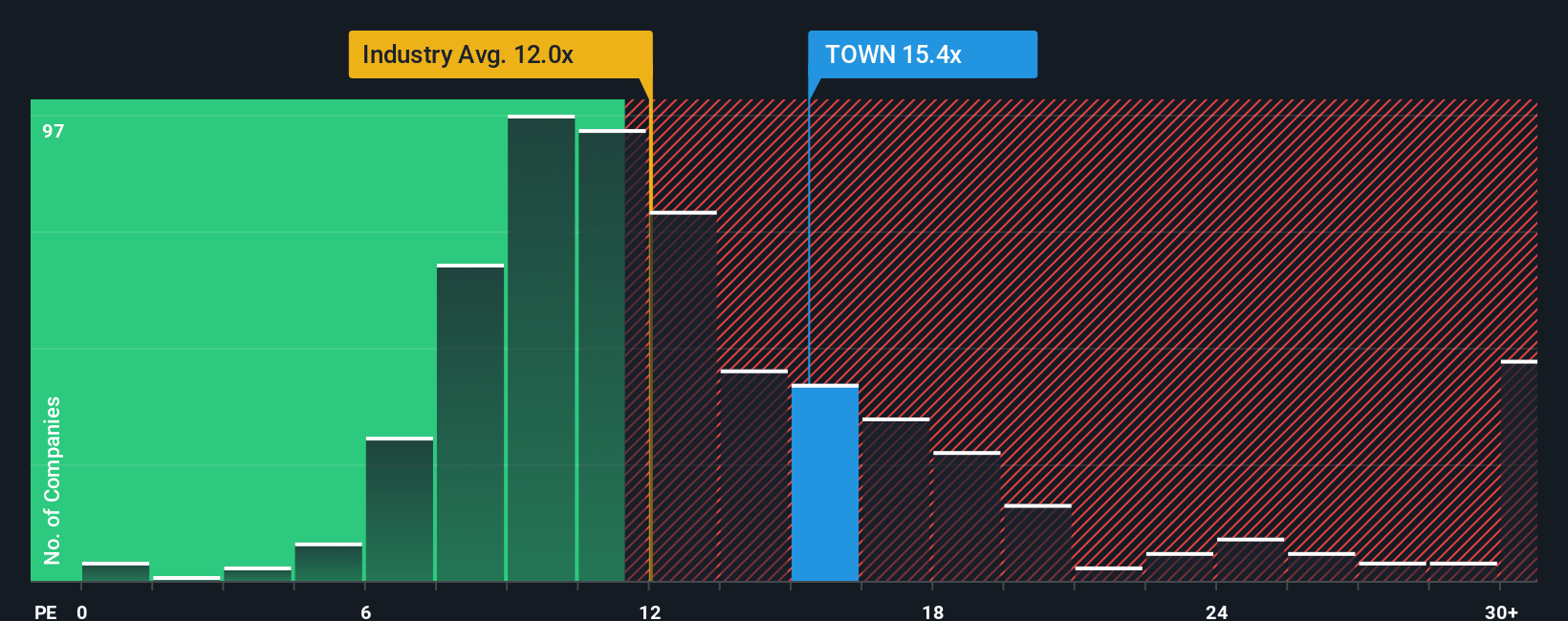

The Price-to-Earnings (PE) ratio is a trusted way to value profitable companies like TowneBank, since it indicates how much investors are willing to pay for each dollar of current earnings. For banks and other established businesses with positive profits, this metric provides a quick snapshot of market sentiment and helps compare value across similar firms.

Growth expectations and risk play a big part in what counts as a “normal” or “fair” PE. Fast-growing or lower-risk companies typically command a higher PE ratio, while slower growth or higher-risk businesses often trade at lower multiples. For TowneBank, the current PE stands at 15.0x, slightly above the industry average of 11.7x and its peer average of 13.0x. At first glance, this might suggest the stock is priced at a premium versus many competitors.

However, Simply Wall St’s proprietary “Fair Ratio” goes deeper than a standard peer or industry comparison. The Fair Ratio, which is 17.9x in TowneBank’s case, reflects expectations tailored to the company’s unique mix of earnings growth, profit margins, industry sector, market capitalization, and risks. Because it accounts for these broader fundamentals, it is often a more reliable measure for long-term investors than just using simple averages.

Given TowneBank’s current PE of 15.0x is below its Fair Ratio of 17.9x, the data points to shares being undervalued from a Price-to-Earnings perspective.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your TowneBank Narrative

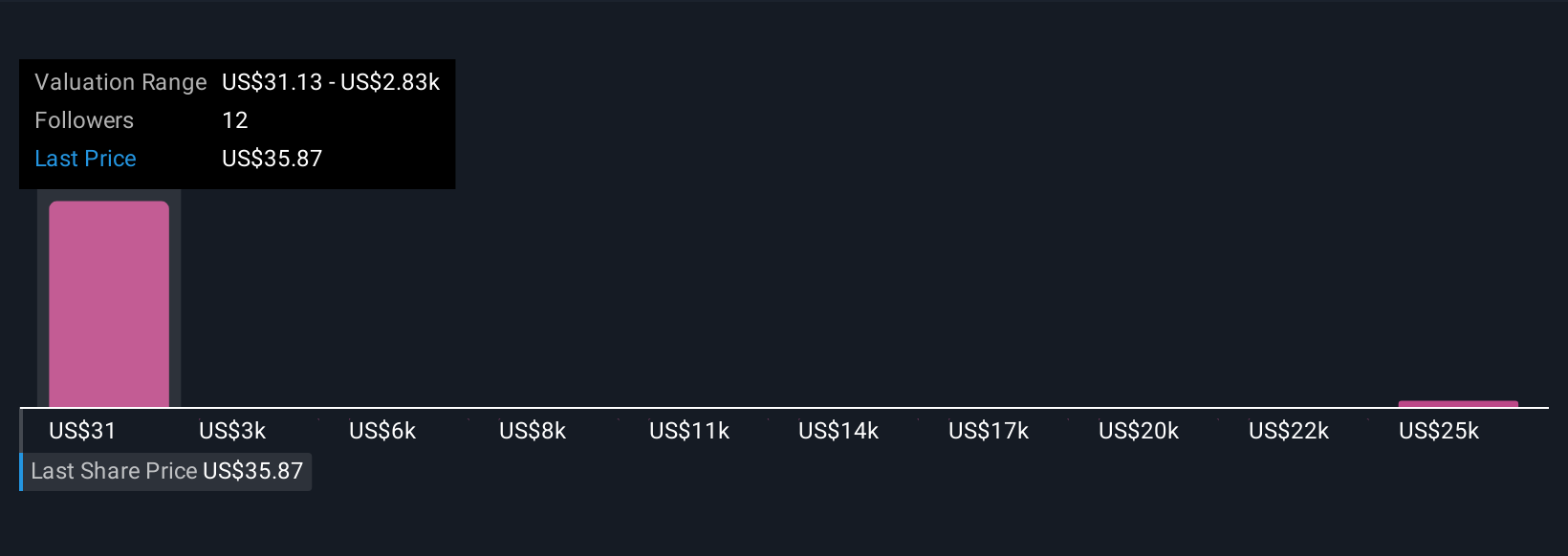

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your own story about a company, combining what you believe about its future, such as expected revenue, profits, or margins, with financial forecasts and price targets. Narratives connect the company’s journey and outlook directly to fair value estimates, helping you see not just what the numbers are, but why they matter in context.

On Simply Wall St’s Community page, Narratives are easy to use and available to millions of investors. This dynamic tool lets you interpret TowneBank through your unique perspective. You can then compare your estimated fair value to the live share price, which can help you decide when to buy, hold, or sell with greater confidence. Best of all, Narratives update automatically as fresh news or results become available, so your view always reflects the latest information.

For example, one investor’s Narrative for TowneBank might be especially optimistic, projecting a much higher fair value, while another’s is cautious, resulting in a lower estimate. This shows how different outlooks lead to unique investment decisions.

Do you think there's more to the story for TowneBank? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TowneBank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TOWN

TowneBank

Provides retail and commercial banking services for individuals, commercial enterprises, and professionals in Virginia and North Carolina.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives