- United States

- /

- Banks

- /

- NasdaqGS:TFSL

TFS Financial (TFSL) Net Margin Tops 26.5%, Reinforcing Steady-Income Narrative Despite Valuation Concerns

Reviewed by Simply Wall St

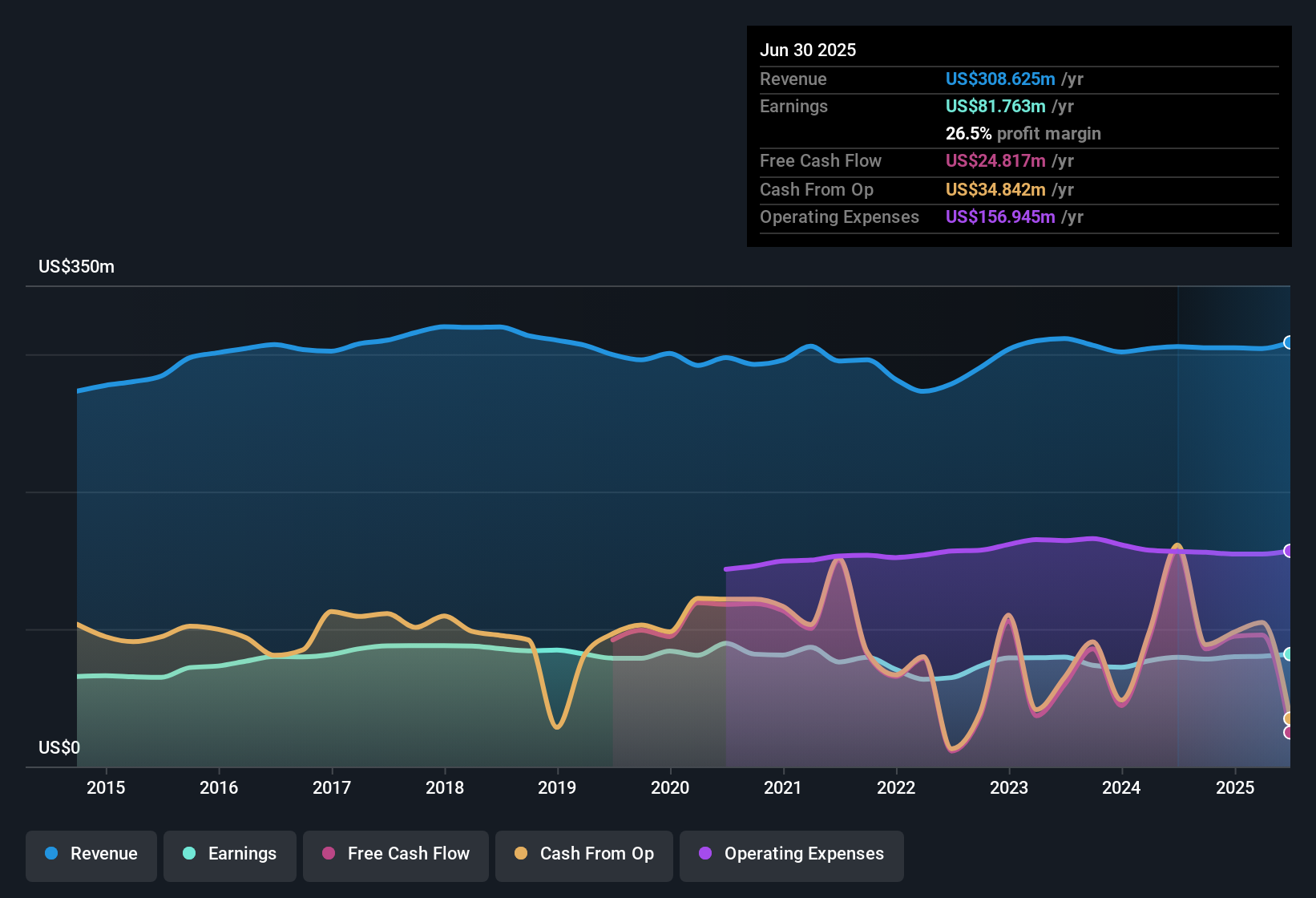

TFS Financial (TFSL) posted a net profit margin of 26.5%, edging above last year's 26% and highlighting consistent profitability. Earnings grew 2.9% over the past year, outpacing the company's five-year annual average of 0.4%. With profit margins remaining stable and growth present, investors are likely weighing these positives against ongoing questions about high valuation and the sustainability of current dividends.

See our full analysis for TFS Financial.Next, we will see how this latest performance stacks up against the market’s key narratives and expectations for TFS Financial. Some familiar stories could be reinforced by the data, while others may be in for a challenge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Dividend Yield Backed by Steady Profit Margins

- The net profit margin sits at 26.5%, matching last year’s strong performance and suggesting that the company continues to convert a healthy portion of its revenue into profit, even in a choppy sector cycle.

- Stable margin quality aligns closely with ongoing “income play” commentary, as many investors see dependable earnings as a robust backdrop for recurring dividends.

- While there is consistent profit generation, bulls who hope this translates directly into higher dividends may be disappointed, especially as risks around payout sustainability are flagged in recent filings.

- Claims that the stable net margin alone justifies the stock’s premium are set against management’s conservative posture and the absence of aggressive investment for new growth drivers.

Modest 2.9% Growth Outpaces Historical Average

- Earnings grew at 2.9% over the last year, exceeding the company’s own five-year average annualized growth rate of 0.4%. This marks a notable step up but remains muted relative to fast-growing peers.

- Some optimism about the company’s resilience and reliability is warranted, as recent figures show a small acceleration in growth.

- However, the prevailing analysis points out that while any improvement above trend is encouraging, this modest pace is unlikely to unlock significant price upside, especially since the company’s business model remains conservative and sector tailwinds are limited.

- The pattern of slow, steady gains appears to reinforce TFSL’s reputation as a defensive holding rather than a high-growth play.

Shares Trade at 45x Earnings, Over Triple Peer Average

- TFS Financial’s price-to-earnings ratio is 45.3x, a stark premium compared to the US Banks industry average of 11.2x and peer average of 13.5x.

- This valuation gap creates a key source of tension for value-oriented investors, as the current share price ($13.30) sits dramatically above the DCF fair value of $1.58. This raises questions about the stock’s sustainable upside in relation to both its fundamentals and sector benchmarks.

- Supporters of the company’s defensive profile might view the premium valuation as a reflection of its steady margins and prudent strategy, particularly during times of market volatility.

- Conversely, the prevailing view is that unless profitability or dividend sustainability can meaningfully accelerate, current multiples leave little room for price appreciation and may expose holders to downside if sector sentiment shifts.

See our latest analysis for TFS Financial.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on TFS Financial's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

TFS Financial’s high valuation far exceeds its modest growth and leaves little room for price gains unless profitability or dividends accelerate significantly.

To find companies that offer more attractive fundamentals at fairer prices, compare with these 832 undervalued stocks based on cash flows to spot stronger opportunities today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TFS Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TFSL

TFS Financial

Through its subsidiaries, provides retail consumer banking services in the United States.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives