- United States

- /

- Banks

- /

- NasdaqGS:TFSL

Evaluating TFS Financial (TFSL) Valuation Following Strong Earnings and Business Momentum

Reviewed by Simply Wall St

TFS Financial (TFSL) just released its latest earnings report, showing an increase in both net interest income and net income for the quarter and full year. The higher earnings per share indicate ongoing business momentum.

See our latest analysis for TFS Financial.

Following its upbeat earnings report, TFS Financial's share price climbed 2.78% in the latest session, building on a 10.15% return year to date. The company’s one year total shareholder return stands at an impressive 16.76%, reflecting steadily improving investor confidence and long-term momentum.

If you’re interested in broadening your search for reliable performers, it is a great time to discover fast growing stocks with high insider ownership.

Yet with shares hovering just below analyst targets and recent gains reflecting improved fundamentals, investors may wonder whether TFS Financial presents an undervalued opportunity or if the market has already priced in much of the upside.

Price-to-Earnings of 41.9x: Is it justified?

TFS Financial’s latest close of $13.67 translates to a price-to-earnings (P/E) ratio of 41.9x, which is considerably above its peer group and industry averages. This suggests that the market is pricing in significantly higher earnings growth or a premium for perceived resilience.

The price-to-earnings multiple reflects how much investors are willing to pay for each dollar of current earnings. A high P/E might indicate optimism about future profitability, but for a bank like TFS Financial, it also calls for scrutiny since banks typically trade at lower premiums due to their stable, regulated business models.

Notably, TFS Financial’s P/E is much higher than both its peer average of 12.9x and the US Banks industry average of 11x. The implied fair P/E, based on regression estimates, sits at 10.9x. This highlights that the current valuation is well above typical levels the market could revert towards.

Explore the SWS fair ratio for TFS Financial

Result: Price-to-Earnings of 41.9x (OVERVALUED)

However, slower revenue growth and a high valuation could limit further share gains if market sentiment or sector conditions shift unexpectedly.

Find out about the key risks to this TFS Financial narrative.

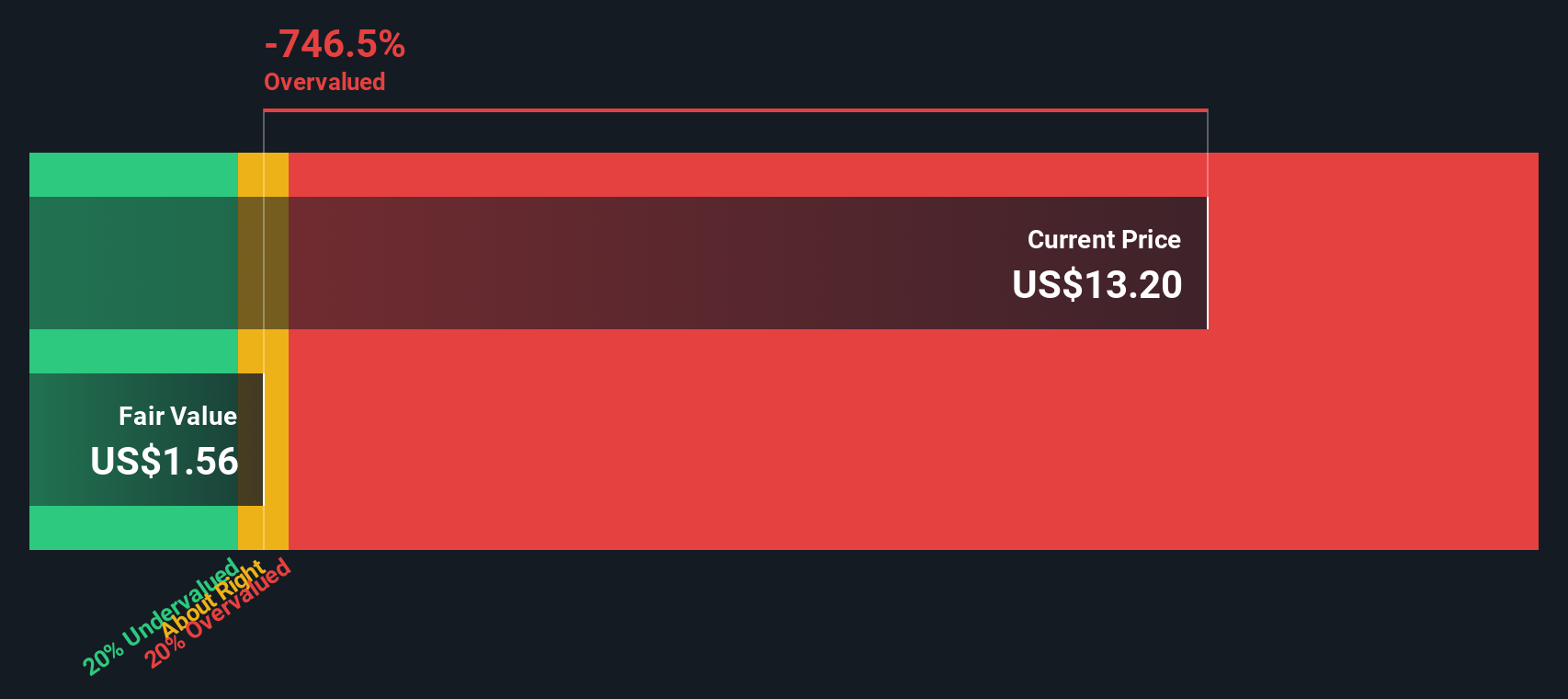

Another View: Discounted Cash Flow Signals Significant Overvaluation

Looking at valuation from a different angle, our SWS DCF model estimates TFS Financial’s fair value at just $1.58 per share. This figure is far below the current share price of $13.67, which indicates the stock trades well above its projected future cash flows.

Does this gap reveal excessive optimism, or is there more to the story that the model does not capture?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TFS Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TFS Financial Narrative

If you want a different perspective or prefer hands-on research, you can easily craft your own analysis in just a few minutes. Do it your way.

A great starting point for your TFS Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Smart Investment Opportunities?

Do not let today’s momentum stop here. Take the next step with Simply Wall Street’s tailored screeners to uncover stocks that might fit your strategy better than ever.

- Boost your income by checking out these 18 dividend stocks with yields > 3%, which offers reliable payouts above 3% for steady compounding potential.

- Pinpoint overlooked gems by reviewing these 840 undervalued stocks based on cash flows, known for their attractive cash flow valuations.

- Capitalize on breakthroughs by considering these 33 healthcare AI stocks, leading innovation at the intersection of artificial intelligence and health care.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TFS Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TFSL

TFS Financial

Through its subsidiaries, provides retail consumer banking services in the United States.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives